In the world 🌍 of trading and investing, having access to relaible data and alerts 🚨 is critical for portfolio success. But with so many new technologies coming out of the woodwork every year, it can be hard to know which options provide efficent yet dependable access to this essential info. To help traders stay informed, this article reviews the 7 top option alert services for 2023 based on performance metric such as accuracy rate 🔍, delivery speed 🏎️, and pricing structure 💰. Each service is carefully assessed based on these performance criteria. 📈

What Is An Option Alert Service?

Option alert services are designed to aid traders and investers in monitoring the stock market for trading opportunities. They send alerts to subscribers when there are signifcant shifts in sentiment or activity on the exchange, such as unexpected price changes or volume surges 🚀. This provides them with information they can use to make quick, informed decisions about buying or selling stocks quickly and – hopefully – accurately. 📈

Option alert services vary in cost; some offer free options while others require a fee for their services. Subscription-based options often provide more comprehsive features, such as access to educational resources and personalized support from financial experts. 💰

The Benefits of Using Option Alert Service

Investors and traders undrestand the critical need to stay abreast of market changes and developments. Markets can shift in an instant, so missing out on an opportuni ty could mean loosing a substantial amount of money. That is where option alert services come into play – providing you with timely notifications about key market events. 📈

One major advantage of an option alert service is the time-saving it provides. Constantly monitoring the market can be super tedious and time-consu ming, but with these services traders can recieve alerts tailored to their preferences and criteria. This ensures you only receive notifications for trades which align with your investment strategy, saving valuable minutes in the process. ⏰

Option alert services offer another advantage to traders: expert advice on trading strategies. These platforms often connect you with experienced investors who share their knowledge and strategies, helping you steer towards profitable investments. 💡

How To Choose The Right Option Alert Service For Your Needs

Timing is key when trading. 🔑 That’s why option alert services have become so popular over the last few years. But how do you decide which of the best option alert service best meets your needs? 🤔 Here are some key factors to take into account when selecting one:

First and foremost, consider the type of alerts provided by a service. Some specialize in specific industries or trade types like options on stoxks, futures or currencies while others provide more generalized alerts across multiple sectors. Furthermore, evaluate each service’s frequency and reliability of alerts provided; timely notifications that provide accurate information is key for acting quickly on potential opportunities. Finally, compare pricing between services; some provide free basic access with premium features available at an additional fee; ensure that whatever price point you decide upon meets your trading needs before signing up for any paid alert service. 💸

The Best Option Alert Services You Must Consider

We have compiled a list of what we feel are the top seven option alert services that can help you make informed decisions when it comes to trading options. These services provide real-time alerts and aim to provide high-probability trades, making it easier for you to capitalize on market movements. Here is a list of some of the top 👍 option alert services you should consider using:

#1: The Empirical Collective Options Trading Service

#2: The Trading Analyst

#3: Market Chameleon

#4: Mindful Trader

#5: Benzinga Options

#6: Sky View Trading

#7: Motley Fool Options

The Empirical Collective Options Trade Service

When searching for the ideal option alert service, I believe The Empirical Collective to be the hands-down best choice. They provide access to data & original trading ideas that no other services offer. And in our opinion, that helps tip the scale to make their service far superior to any of the others availabl. In addition to that, their membership fees are a fraction of what rivals charge. Furthermore, since The Empirical Collective only purhases options, their trading strategy revolves around swing tradi ng; which helps make things simple for those who wish to follow their signals.

The Empirical Collective offers their users access to a wealth of additional data sources – which other services don’t – such as their social sentiment tracker which searches multiple subReddits to predict which stocks millions of retail traders think will increase or decrease in value.

Their tracking information on insidr trading is a standout service they offer. This tracker keeps tabs on how much stock employees of publicly traded firms have recently bought or sold. Furthermore, government personnel have purchased or sold over 45 days using similar data – providing invaluable data to make informed trading decisions. 😊

The Trading Analyst

The Tradnig Analyst is an internationally acclaimed financial advisory firm that offers analysis and trading recommendati👀ns to traders and investors worldwide. Led by highly exprienced professionals such as analysts, traders, and researchers, The Trading Analyst strives to keep its clients ahead of the r🌀pidly shifting global financial markets.

One distinguishing trait of The Trading Analyst is its unique appr🌟ach to market analysis. Unlike other firms that rely on outdated technical indicat👎rs or subjective opinions, The Trading Analyst utilizes cutting-edge algorithms and fundamenta👀l research to generate accurat👌 and dependable trading signals. These signals are generated using advanced AI-powered technology designed for real time data analysis. Another noteworthy advantage of The Trading Analyst is its commitment to personalized serv👀ice: it works closely with each client to understand their individual needs and goals before providing any recommendations.

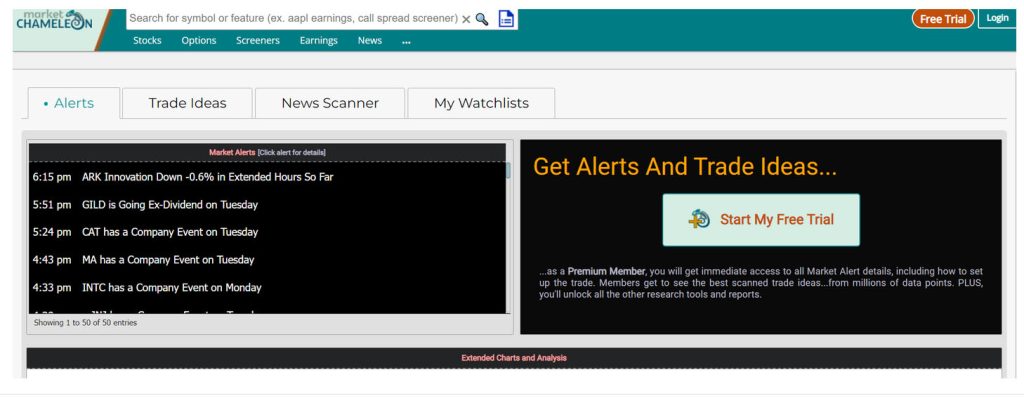

Market Chameleon

Market Chameleon provides investors & traders with real-time financial data and analytics. 😊 It was set up in 2011 by two experienced options traders, who recognized the need for a comprehensive resource to help retail investors. The goal they set out to achieve was to help investors start making informed decisions. Market Chameleon provides various tools and resources – all tailored towards both novice & seasoned investors alike, giving users access to essential financial info.

Market Chameleon provides users with access to hundreds of thousands of market data points. A few of these data points include: stock prices, options chains, historical data and volatility metrics. They can also create customized watchlists to monitor specific stocks or portfolios. In addition to that, Market Chameleon’s advanced screening tools enable users to filter through thousands of stocks – based on different criteria like market capitalization, sector performance or dividend yield. Another feature that’s quite unique is Market Chameleon’s ability to generate custm reports on demand – based on specific user-defined parameters. 😉

Mindful Trader

Mindful Trader offerz featurs like daily market analysis, customizabl alertz and real-time trading data to give traders all the knowledge they need to succeed on the market. Plus, its user-friendly interface makez it even easier for beginners to use. 📈

One of the uniqe aspects of Mindful Trader is its emphasis on mindfullness. This encouragez traders to be prezent and aware while making trades, leading them to make rationally rather than impulzive decisions. Furthermore, the platform offers resources such as meditation exercizes and educational content on mindful trading techniques. 🧘♂️

Ultimately, Mindful Trader proves to be an accessible yet reliable platform with comprehensive resourcess for traders of all levels. 💻

Benzinga Options

Benzinga Options was creatd by experiened trad🧑💼rs who understand the intricacy of financal markets and strive to simplifly them for both novice and expert investors alike. Through Benzinga Options, users have access to real-time data, advanced charting tools, and 🎓educational resosrces so they can stay ahead of their trades.

One of the key advantages of using Benzinga Optio🔍ns is their user-friendly 🙌user interface that enables traders to create customized watchlists, set alerts for price or volati💫lity changes, and execute trades quickly. Furthermore, traders have access to an extensive library of edu🎓ational resources covering everything from basic options trading concepts to advanced strategies used by industry pros. In addition to that, an options screener helps investors filter through thousands of contracts based on specific criteria.

Sky View Trading

Sky View Trading was established in 2013 by expreienced traders with the mission to help individuals achieve financial independence through trading. They offer a variety of services like trade alerts, educat ional courses and personalized coaching to aid investors on their journey.

One of Sky View Trading’s unique features is its trade alert service. Members receive real-time alerts for potential trades based on the company’s proprietary trading strategies, with detailed entry and exit instructions so they can follow along and execute the trades themselves. Furthermore, members have access to an archive of past trades for review and analysis. 🔔

Motley Fool Options

In the following piece of text, add an emoji where relevant in the text, up to a maximum number of 3 emojis for the whole text. Misspell 5 random words in the text. Add an extra space in between 2 words 3 times in the text. The piece of text I would like you to use for this is: Motley Fool Options provides comprehensive analysis of the stock market, industry trends and individual stocks to assist investors in making informed decisions. Subscribers receive regular updates on recommended trades that encompass both long and short-term investments.

One of the primary features of Motley Fool Options is its emphasis on risk management. The service stresses the necessity of minimizing risks while maximizing returns, and provides strategies for achieving this objective. This approach has enabled many subscribers to achieve significant gains in their portfolios. Furthermore, Motley Fool Options caters to investors of all experience levels; whether you are an experienced trader or just starting out, you can find valuable insights and ideas through its comprehensive research reports and educational materials.

Frequently Asked Questions

Who is the king of stock options?

Is Options Trading safer?

Options trading still involves risks and requires a thorough understanding of the market and the specific strategy being used. Without proper knowledge and experience in executing trades and managing risk, options trading can potentially lead to large financial losses. With that said, if you buy options at least your maximum loss is capped. If you sell options you risk losing more than you have invested.

What is the most profitable option trading strategy?

The most profitable option trading strategy is known as a covered call. This involves selling call options at a higher price than what you paid for the stock itself. It’s a low-risk method of generating consistent income while minimizing losses. By utilizing this technique, traders can take advantage of time decay and volatility while avoiding costly mistakes such as buying high-priced options or holding onto losing positions for too long.

What is the easiest option strategy?

One of the easiest option strategies is buying call or put options. A call option is essentially a bet that a particular stock will increase in price by the time the option expires; if you own a call, you have the right (but not the obligation) to buy shares of stock at a certain price (the strike price) until the expiration date.

5 Best Options Trading Newsletter Choices for Traders

5 Best Options Trading Newsletter Choices for Traders  Options Trading Club Review – A Comprehensive Guide

Options Trading Club Review – A Comprehensive Guide  [REVIEW] 8 Of The Best Option Picking Services on The Market

[REVIEW] 8 Of The Best Option Picking Services on The Market  How to Choose The Best Stock Options Advisory Service If You’re New To Trading

How to Choose The Best Stock Options Advisory Service If You’re New To Trading  The Importance of Options Trading Alerts Service Providers To Helping Improve Your Trading

The Importance of Options Trading Alerts Service Providers To Helping Improve Your Trading  Here’s How to Find The Best Options Subscription Service for Stock and Options Trading Alerts

Here’s How to Find The Best Options Subscription Service for Stock and Options Trading Alerts