Are you an options trader searching for the best tradin newsletter to take your tradng game to the next level? Look no further! In this article, we’ll be reviewing five of the top options trading newsletters available today. These servics aim to give traders insight into markets and offer them strategies that can help maximize profits and make money by trading options.📈

Before we dive into the reviews themslves, let’s quickly revi*w a few key terms to help clarify them…🤔

What is an Options Trading Newsletter?

🤑 Options trading newsletters are publications that offer up-to-the-minute news on market movements, buy and sell alerts, as well as specific tradi ng strategies 🙌. They help traders sta y abreast of all available options and strategies for tradi ng them successful ly.

Newsletters often offer advice on which weekly options are currentl y performing well or poor ly, the reasons behind their movement, and how traders could potentially profit by trading these options. In addition to that, some trading newsletters might provide access to chatrooms where traders can discus s and collaborat e with one another.

Benefits of Using Options Trading Newsletters

Options trading newsletters can often be a great resource for investors, as newsletters like these will quite often offer a variety of benefits that can help both novice & advanced traders alike. Some of those benefits are & include the following:

1. Getting An Increased Edge in Trading through Research and Analysis 📈

Researching and analzying financial data can give traders a strategic edge, giving them the ability to predict market movments more accurately.

And options trading newsletters can be an excellent source of research and analysis in a journey to increase a trader’s edge. Theese newsletters often collect information from various sources, like news releases, blog posts, proprietary data & research or other newsletters, so traders can better comprehend volatility patterns within individual stocks as well as in the overall market.

2. Access to Professional Strategies and Tips 💡

Options trading newsletters typically provide traders with various strategees and tips to maxmize their profits and minimize losses. These strategys may encompass various tactics, such as entry/adjustment/exit plans, capital allocation guidelines, and risk/reward analysis. Other strategys, such as understanding risk profiles, allocating capital efficiently and timing trade entry and exit points are usually included. In addition to that, newsletters offer education on option basics, the Greeks, and risk management. Tips include exploring different tactics through software applications and tools, making informed decisions to provide the best options trading alert service possible.

3. A Better Understanding of the Volatility of Options

Understanding options volatility can help investors make more informed decisions when they are using options trading newsletters. By studying the patterns of volatility from individual stocks and from the market as a whole, investors can select the most appropriate strategies for different time frames and volatility levels. This can be done through quant-based, statistically-sound options strategies, which focus on analyzing market analysis, technical analysis, and different types of options flow analysis. Additionally, understanding premiums from the the options alert services OR option trading newsletters can help investors understand how the top 1% avoid losses through IV Crush.

4. The Ability to Customize a Portfolio to Suit Investment Goals

Customizing a portfolio is crucial for succesful options trading, as it allows traders to tailor their strategies according to their individual goals and risk tolerence. With a personalized portfoliio, traders can quickly identify the ideal options trading newsletter tailored to their individual requirements. A well-designed portfolio helps traders identify trading strategies and educational services that match their experience level, budget constraints, and expectations. Trading options with a personalized portflio can provide traders with increased returns and minimized risks. Aside from that, traders have access to real-time trade alerts, detailed performnce reports, as well as high-quality education that will enable them to become better traders. 💰📈💡

Factors to Consider When Looking for Best Options Trading Newsletters

Finding the best options trading newsletters is an important & crucial part of any successful options trader’s toolbox & competitive advantage. With so many newsletters available, it can be difficult to figure out exactly which one is right for you & your trading needs. Before signing up for any newsletter, traders should consider a few important factors: cost, frequency of updates, and content quality.

The Cost of an Options Trader Newsletter

When selecting an options trading newsltr 📊, cost should always be taken into account. There are various services available on the market with various pricing plans; prices can range anywher e from free to hundreds of dollars per month. It is essential to choose a newsleter service that fits within your budget and provides excellent value for money. Befor e signing up with any newsletter provider, ensure you understand their type of information provided and whether or not it meets your trading needs. Most services provide data on stocks, options, commodities and other financial instruments 💰 that can help you make informed decisions about where to invest your money. Some even provide expert advice from experienced traders who offer valuable insight into potential trades and strategies – which is invaluable when searching for an excellent stock options advisory service. 👨💼

The Frequency of Updates of Trading Newsletters

Options trading newsletters 📰 offer investors the latest news and info in the investment world. When searching for an appropriate options trading newsletter, one factor to consider is how often it’s updated. Frequency of updates can make or break how usefu l a newsletter will be to investors. Timely and regular notifications are essential for options traders, as markets can shift quickly and unexpected events can significantly influence asset prices. Investors who receive infrequent or no updates from a reliable source may miss out on opportunities or take risks they were unaware of. By staying informed on what’s happening with their investments, timely information from reliable sources helps guarantee informed decisions are made. 💰📈

The Options Action Newsletter Content Quality

High quality content can make the difference betwee n a successful trade and an unsuccesful one. Investors should look for newsletters that provide reliable facts and figures as well as insightful analysis from experienced traders; this will guarantee readers have access to up-to-dat data when making investment decisions. Furthermore, subscribers should check that subscription fees are reasonable given the amount of useful information provided by the newsletter; doing so will help guarrante they get value for their money spent. 💰

Top 5 Options Trading Newsletters You Should Look Into

If you want to stay ahead of the latest news and trends in options trading, subscribin to one of these five newsletters is essentia1 😎. These publications provide daily updates on new trades and strategies, stock picks, alerts for potential red flags in the market, expert analysis on when to buy or sell options contracts, and more – perfect for both novice traders just starting out as well as seasoned veterans lookin g for an edge.

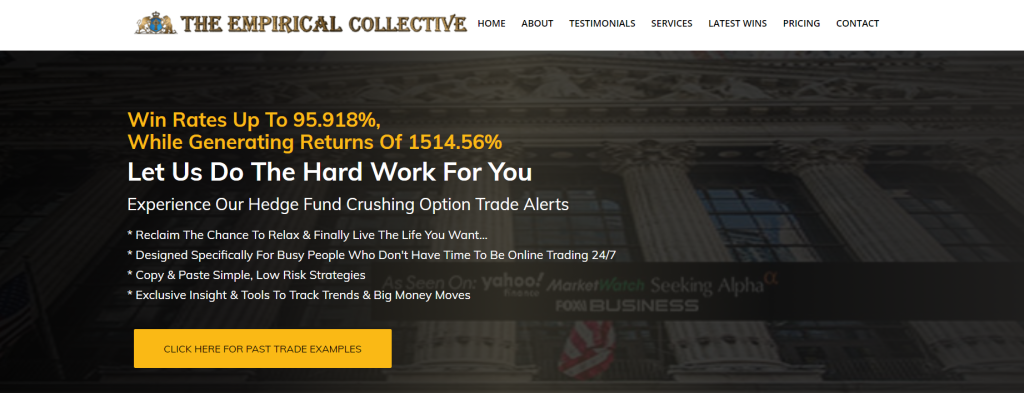

#1: The Empirical Collective

The Empirical Collective is the go-to website for traders seeking exclusive research and trade options not avaialbl e elsewhere. Their comprehensive platform offers a wealth 💰 of resources that will prove beneficial to all traders – novice or expert alike – with their propietary tools providing insight into current market movements that enable users to make informed investment decisions with ease 💻. Furthermore, their user-friendly interface makes navigatin their platform effortles s even for experienced investors. With The Empirical Collective’s comprehensive platform, traders have access to ample opportunities to succeed on their trading journey. 📈

Pricing

Their price of membership includes access to all of their amazing services, including their straightforward option trade alerts to buy calls or puts (along with sell notifications), which have generated enormous returns and win rates as high as 95.918%. They also give you access to insider knowledge that was previously only available to hedge funds and inside traders with their Government Stock Transaction Tracking System, Off-Exchange Trading Dossier, and other exclusive services.

#2: Seeking Alpha Newsletter

The Seeking Alpha Newsletter 📰, whil e not exclusively focused on trading options, is an extensive investment newsletter that keeps readers informed of the newest trends and developments in the stock market. With reports from top financial experts, it offrs detailed analyses of stocks, commoditites, and othe r financial markets. Furthermore, subscribers recieve news on new economic policies, corporate earnings announcements, as well as timely information regar ding global geo-political events.

The Seeking Alpha Newsletter provide s readers with an intuitive design to quickly locate pertinent stories. Daily coverage of finance and economic headlines keeps investors ahead of the competition when making informed investment decisions. Furthermore, exclusive interviews with top industry professionals offer unique perspe ctives on current financial matters.

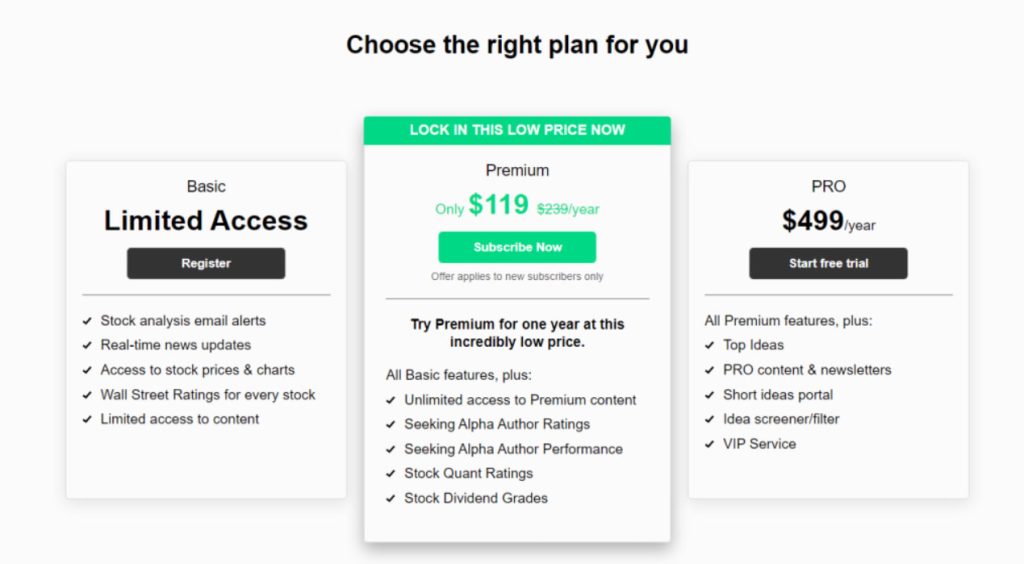

Pricing

The online investment community Seeking Alpha strives to provide its users with the best quality investment advice and industry news. As part of this mission, Seeking Alpha offers three plans for their subscribers. Basic, Premium, and PRO which you can see below.

#3: The Weekly Options Trading Newsletter

The Weekly Options Trading Newsletter is an email subscription that offers valuable insights, strategies and tactics to maximize profits in the options market. Each week, subscribers get expert advice from top analysts with decades of experience trading stocks, futures and more. The newsletter gives investors detailed analysis on upcoming markets and trends so they can make more informed decisions when investing in options.

Subscribers to this newsletter receive timely reports on global events that may impact certain stocks or commodities. It also shares essential news on economic indicators like gross domestic product (GDP), unemployment rates and inflation – essential pieces of data for any trader. Each edition also provides up-to-date performance data so subscribers can track their portfolios between editions.

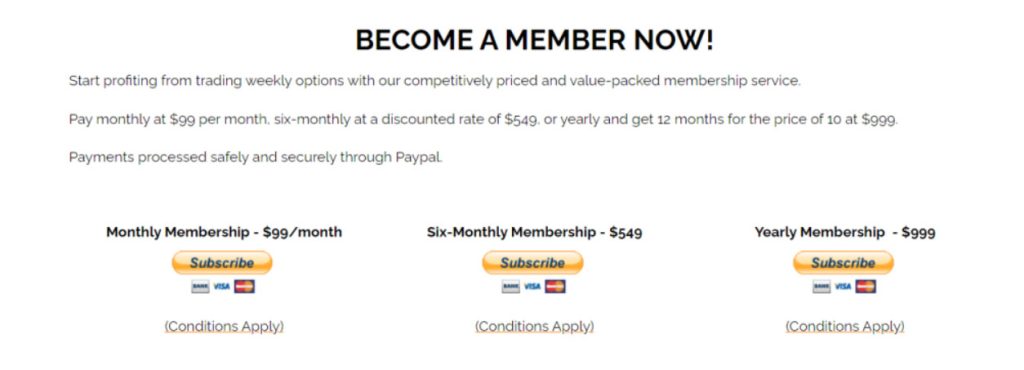

Pricing

You get access to everything you need with their weekly options advice service membership to make money trading weekly options.

#4: Benzinga Options Newsletter

Benzinga Options Newsletter is a daily email newsletter published by Benzinga, an online financial media company. It covers the fast-moving world of options trading and provides timely updates on new opportunities in the markets. The newsletter offers market insight and analysis from seasoned traders, enabling readers to make informed decisions when it comes to their investments.

The Benzinga Options Newsletter provides various types of options coverage for stocks, ETFs and indices including puts, calls, and spreads. Not only does it provide daily news alerts about current market trends but also offers strategies that investors can use to take advantage of them. Subscribers get access to detailed charts that show potential entry points and target prices as well as videos offering educational content on option trading techniques.

Pricing

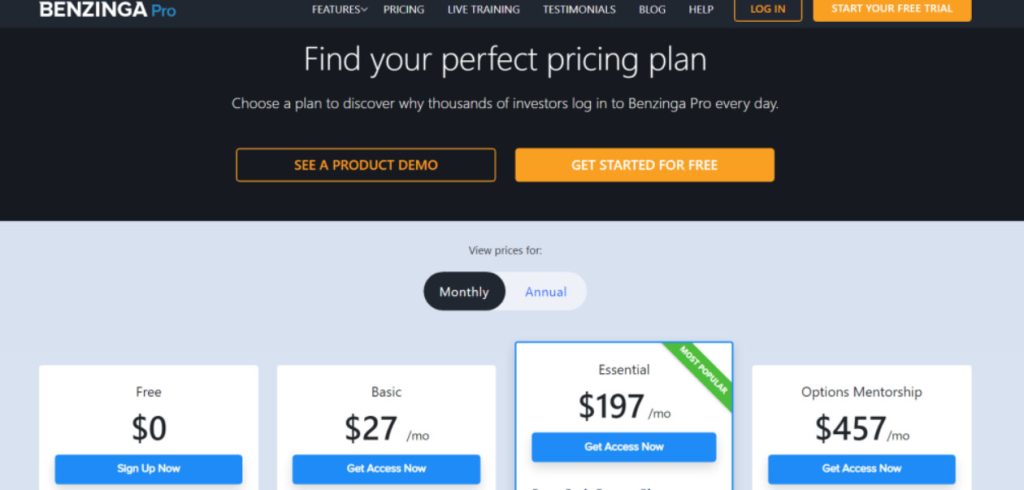

Benzinga’s Options Newsletter Pro Plan offers a valuable and innovative way to stay apprised of the options market. It combines Benzinga’s cutting-edge news, research, and analysis with an easy-to-navigate platform that provides timely data on options trading volume, IV rank and more. The Pro Plan subscription includes Free, Basic, Essential, and Options Mentorship.

#5: OptionsGeek – Options Trading Newsletter

Please be aware: OptionsGeek 😎 has ceased accepting new members. OptionsGeek provides up-to-date insights, analysis and strategies for sucessfully navigating today’s uncertain markets. They offer solutions that help traders make informed decisions, whether they be novice investors or experienced traders.

Their team of experts consists of world-class financial analysts and veteran traders with decades of experience in the market. They apply their knowledge to craft actionable advice that can help you succeed at options trading. Furthermore, they offer consulting services tailored to individual needs and objectives.

OptionsGeek provides all the resources necessary for sucessful trading, whether you’re trading short or long-term. They have everything you need to maximize profits while limiting risk exposure.

Frequently Asked Questions

Is option trading like gambling?

Option trading is a popular investment strategy amongst investors. It allows them to speculate on the future price of a stock or other asset without actually owning it. But some people think that option trading is merely gambling and not an effective way to make money.

Option trading is a popular investment strategy amongst investors. 📈 It enables them to speculate on the future value of stocks or other assets without actually owning them. Unfortunately, some people consider option trading nothing but gambling and not an effective way of making money. Option traders argue that to be successful at this type of investing, one must carefully analyze and understand the markets rather than simply blindly following an algorithm. With due caution and research, option traders can reduce risk while earning returns from short-term bets on stocks. As with any type of financial speculation, there are risks involved; however by limiting exposure to individual trades you could potentially increase your chances for success. Ultimately, it is the investor’s prerogative whether they believe option trading to be similar to gambling or not. 🤔

Which stocks are best for options?

Options trading is becoming a popular investment choice among investors of all levels. Leveraging stock price movements without own ing it allows investers to boast their returns and manage risk at the same time. But how do you know which stocks are ideal for option trading? When selecting stocks for options trading, several factors need to be taken into account 📈: volatility, liquidity and open interest. Volatility measures how much a stock’s price moves around; higher volatility offers more potential profit in shorter time frames 💰. Liquidity refers to how easy it is to find buyers or sellers when placing trades; having high liquidity makes getting in or out of a trade quicker and simpler (check the bid / ask spread – if it’s within a few cents then your option contracts are likely liquid). 😎

Can options be undervalued?

Options trading can be a really great to make money, but it comes with its share of risks. Just like anything else. 😊 But one key question for options traders to ask themselves is: whether or not they can fin d an undervalued option? And, if so, how can they actually take advantage of it? Undervalued options are typically those with implied volatility at a level below their historical volatility or Delta (often below 0.5). This indicates that while stock prices have moved in response to changes in the market, the movement hasn’t yet been fully reflected or shown in the option’s price – yet. 😅 To take advantage of an undervalued option, traders must understand all factors influencing its pricing & adjust their strategy accordingl y. They might even use hedging strategies such as buying put options to protect themselves against potential losses if they do end up entering a trade and getting an undervalued option. 😎

What is the most successful option strategy?

Having a great option strategy is an important element of investing, and a winning strategy has the potential to generate amazing returns! But which strategy is the most successful? Many investors turn covered calls when looking for a higher return on their investments with relatively low risk.

Covered calls offer investors two primary advantages: protection and income. By writing covered call options, investors are able to protect their initial stock position from further losses while also earning additional income in the form of premiums paid by buyers of those same call options. This means that even if the stock price drops, an investor can still earn money from selling their calls. Additionally, if the underlying stock price rises beyond the strike price, then they will benefit from both capital gains and premium income. As such, this makes covered calls one of the most attractive and profitable strategies available to traders today.

The Best Option Alert Service: Top 7 for Trading in 2023

The Best Option Alert Service: Top 7 for Trading in 2023  Options Trading Club Review – A Comprehensive Guide

Options Trading Club Review – A Comprehensive Guide  [REVIEW] 8 Of The Best Option Picking Services on The Market

[REVIEW] 8 Of The Best Option Picking Services on The Market  How to Choose The Best Stock Options Advisory Service If You’re New To Trading

How to Choose The Best Stock Options Advisory Service If You’re New To Trading  The Importance of Options Trading Alerts Service Providers To Helping Improve Your Trading

The Importance of Options Trading Alerts Service Providers To Helping Improve Your Trading  Here’s How to Find The Best Options Subscription Service for Stock and Options Trading Alerts

Here’s How to Find The Best Options Subscription Service for Stock and Options Trading Alerts