Would you like to learn a trading strategy that is both safe and profitable?

According to some experts, grid trading may be just what you are looking for!

This approach involves buying and selling currencies at predetermined price points, which can help you minimize your losses while maximizing your profits.

Keep reading to find out everything you need to know about this exciting trading strategy!

No-Loss Grid Trading – What Is It & How It Works

Grid trading is a popular technique that allows traders to buy and sell shares without worrying about the current price of an asset.

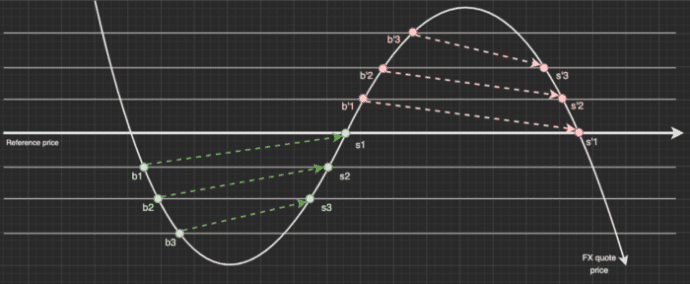

Essentially, you create a price grid where you buy at certain levels and then sell slightly above that level.

So if the market is dropping slightly, you could buy a number of positions at different points and then sell them as the price recovered.

Each of these points are set at points of equal distance from each other.

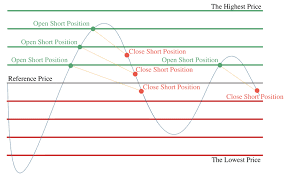

This strategy involves placing trades that are opposite the existing trend, hoping that the trend will reverse and that you can close out your trades for a small profit on each.

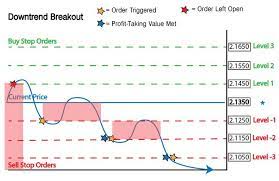

Of course, if the market moves in only one direction, you can get into several losing trades in a row. That’s why it’s important to use a limited number of orders and have enough money to hold your positions until zero-loss is reached.

The strategy itself is similar to one gamblers use when playing roulette in that they choose one color to bet on, and if they lose, they keep doubling their wager until they finally win.

This strategy is the exact opposite of typical risk management strategies which reduce risk and trade size after losses and increase them after wins.

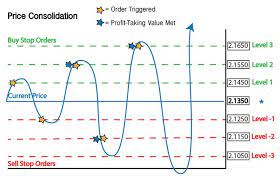

No loss grid trading strategies are best used when prices trade within a range and the market is trading sideways.

The Benefits and Drawbacks of using the Grid Trading strategy

The benefit to trading this system is that you don’t really have to identify a market trend, as you’re placing trades that are opposite the current direction and hoping prices to revert back to the mean.

And this can be extremely profitable when it works.

The problem is, you don’t really know beforehand when or if the market will revert back to its mean, so you could place trades that you hold for a loss, as the market doesn’t revert back soon enough.

The other issue is choosing the correct grid size (IE the distance between each trade you place) to correctly match the downswing or upswing.

For example, if you decide to place new trades that are 5 points apart, but the security you trade oscillates 100 points, you can see how you’d quickly run out of capital to trade – and you could get stopped out.

So being able to correctly manage your trades in this strategy is absolutely crucial.

An Example of a No Loss Grid Trading Set Up

As we’ve already mentioned, the grid system consists of setting up a series of buy and sell orders at different prices, with the aim of making a profit when the price moves in either direction. For example, if the price of an asset is currently $10, a trader might set up a grid with buy orders at $9, $8, and $7, and sell orders at $11, $12, and $13. If the price falls to $9, the trader will make a profit on their buy order at $8, and if the price rises to $13, they will make a profit on their buy order at $12. The key to successful no-loss grid trading is to ensure that the distance between your buy and sell orders is large enough to cover any potential losses.

A Quick Summary Of A Price Hedging Grid Strategy

A price hedging grid strategy is a trading method that doesn’t require you to identify the market trend. It uses predefined size and intervals with no stop-loss or take-profit placed at those intervals. You can set the number of levels in a grid strategy to any amount.

As we’ve mentioned grid strategies don’t need to identify market trends, as they use trading rules instead of technical analysis. Grid Trading can create profit opportunities in any direction, but it’s risky if the take-profit values aren’t reached. Grid Trading requires more monitoring than manual trading does and involves managing a greater number of orders.

It is important to understand how your market generally performs before creating a grid trading strategy. If you are in a trend, close any pending orders that go against the trend. For an effective grid trading strategy, watch for triggered positions and make sure the price doesn’t reverse before reaching the take-profit level you’ve set.

The thing to keep in mind is that this technique can involve a lot of effort and trade adjustment – a lot more than if you sign up for an options alert service.

Best Stocks For Grid Trading

There are a number of different stocks that can be used for grid trading. When looking for the best stocks, it is important to consider liquidity, volatility, and price movements. The following are some of the best stocks for grid trading:

1) Apple Inc. (AAPL) – Apple is one of the most liquid stocks on the market and has a history of strong price movements.

2) Amazon.com, Inc. (AMZN) – Amazon is another highly liquid stock with a history of large price swings.

3) Facebook, Inc. (FB) – Facebook is known for its high volatility and fast-paced price movement.

4) Netflix, Inc. (NFLX) – Netflix is one of the most volatile stocks on the market and can provide opportunities for quick profits.

Which Trading Pair is Suitable for Grid Trading?

When it comes to grid trading, there are a few things you need to take into account.

The main thing to keep in mind is is the volatility of the currency pairs you select; with more volatile instruments, your grids will have more opportunities to scalp profits. In addition to that, make sure you’re aware of any costs associated with trading the instrument because lower costs give you a greater chance for success in grid trading.

The 5 Most Important Grid Trading Parameters

When it comes to grid trading, there are a few key parameters that can make or break your success. Here are the 5 most important ones:

1. Entry price:

This is the price at which you enter into a trade. It’s important to make sure that your entry price is realistic and in line with market conditions.

2. Exit price:

This is the price at which you exit a trade. It’s important to make sure that your exit price is realistic and in line with market conditions.

3. Stop loss:

This is the price at which you will exit a trade if it goes against you. It’s important to make sure that your stop-loss is reasonable and in line with market conditions.

4. Take profit:

This is the price at which you will exit a trade if it goes in your favor. It’s important to make sure that your take profit is reasonable and in line with market conditions.

5. Risk/reward ratio:

This is the ratio of how much you’re willing to lose on trade vs how much you’re hoping to gain. It’s important to make sure that your risk/reward ratio is reasonable and in line with market conditions.

How to use No Loss Grid Trading in Your Own Trading Strategy?

As we’ve mentioned, grid trading can be a very effective way to trade, but it does require some careful planning. Here’s a step-by-step guide to using grid trading in your own strategy.

- First, you need to determine the overall direction of the market. Are we in an uptrend or a downtrend?

- Next, you need to identify the major support and resistance levels. These are the price levels where the market has a tendency to reverse direction.

- Once you have identified the major support and resistance levels, you can start placing your orders. For example, if you are trading in an uptrend, you would place a buy order at the support level and a sell order at the resistance level.

- As the market moves back and forth between your buy and sell orders, you will gradually make small profits that add up over time. The key is to be patient and let the market come to you.

- Once you have made a profit, you can then withdraw your funds and reinvest them into another cryptocurrency. This way, you can continue to grow your portfolio and take advantage of all the different opportunities that the market has to offer.

Tips for using No Loss Grid Trading Successfully

No Loss Grid Trading is a system that some people swear by and others are very skeptical of. First and foremost, you need to have a good understanding of technical analysis. (To learn all about technical analysis, visit our section on getting started in technical analysis here.) The system relies heavily on support and resistance levels, so you need to be able to identify those levels accurately. Second, you need to be patient. The system can take a while to work, so don’t get impatient and bail out early. Finally, be disciplined. Stick to your stop losses and take profits when they’re there. If you can do all of those things, you should be able to use No Loss Grid Trading to your advantage.

Frequently Asked Questions

What conditions can I use the classic grid?

Typically you want to look to trade assets that are range bound and oscillate between previously set levels of support and resistance.

Why should I use a grid trading bot?

By using a bot, you can automate your grid trading strategy and take some of the emotion out of the equation. Bots can also help you to stay disciplined with your trading, which is essential for long-term success. In addition, bots can monitor the markets 24/7 and place trades on your behalf, freeing up your time so that you can focus on other things. All of these factors make grid trading bots a valuable tool for anyone looking to get into this type of trading.

When to close grid trades?

Typically you close a grid trade when it reaches 1.5 the grid length from the price we bought and opened the trade at.

What is the capital requirement for day trading?

Day trading is a form of speculation in securities in which a trader buys and sells shares throughout the day, with the aim of making small profits each time. In order to be a successful day trader, it is essential to have a good understanding of the markets and to be able to react quickly to changes. But what many people don't realize is that day trading also requires a significant amount of capital. The minimum capital requirement for day trading is $25,000, and most traders will actually start with even more than that. This may seem like a lot of money, but it is necessary in order to cover the costs of commission and fees as well as to provide adequate protection against losses. So if you're thinking of getting into day trading, make sure you have the capital required to give yourself a fighting chance of success.

What is the drawdown?

For many people, the drawdown is simply the act of withdrawing money from an investment. However, the term can also refer to the point at which an asset's value decreases. A stock market crash or a sudden dip in the value of a currency are both examples of a drawdown. In investing, it's important to be aware of both the possibility and the effects of a drawdown. Protecting your assets from sudden market changes is essential to preserving your wealth. At the same time, recognizing when a drawdown has occurred can help you take advantage of opportunities to buy low and sell high. Understanding the concept of a drawdown is an important part of being a successful investor.

The Best Supply and Demand Indicator for Trading in the Zone

The Best Supply and Demand Indicator for Trading in the Zone  Candlestick Scanner MT4: How Does It Work & Does It Help?

Candlestick Scanner MT4: How Does It Work & Does It Help?  Learn How to Day Trade for Beginners – What You Need To Know Before Trading

Learn How to Day Trade for Beginners – What You Need To Know Before Trading  Getting Started With Tick Scalping & Tick Chart Trading

Getting Started With Tick Scalping & Tick Chart Trading  Weekly Options Trading Signals: A Great Way to Make Money Or a Great Way to Go Broke?

Weekly Options Trading Signals: A Great Way to Make Money Or a Great Way to Go Broke?  Base Camp Trading Review: Find Out If This Service Is A Scam Or Legit

Base Camp Trading Review: Find Out If This Service Is A Scam Or Legit