With the Federal Reserve prepared to begin raising interest rates from near-zero levels, investors should brace themselves for a bumpy ride this year.

The ones who will be hardest hit are those who have been passively investing their money without any form of active management or exinsight beyond putting their money blindly in a fund.

“I believe that in 2022, we will witness greater volatility than we have seen in the previous year, and even during the previous decade. Volatility began to rise in 2021, and I believe it will continue to rise in 2022.” Erin Browne, portfolio manager at Pimco, stated on Yahoo Finance Live.

Stocks have a mixed track record during Fed rate hike cycles in the past.

According to new analysis from Goldman Sachs’ senior U.S. equities strategist David Kostin, the S&P 500 has declined 6% on average in the three months after the first rate hike in recent cycles. Stock market weakness has been brief, but returns have been significantly less juicy than investors have come to anticipate.

According to Kostin, the S&P 500 has returned 5% in the six months after a cycle’s first rate rise.

“When we get to these kinds of transition points in the market — and the key changeover is going to be the Fed starting to boost rates — that usually indicates greater corrections,” Browne noted. “I believe there will be more significant adjustments along the way.”

Browne is positive on semiconductors, citing the industry’s continued financial success as a result of the pandemic-driven chip scarcity.

To Browne’s point, markets are already acting strangely – particularly in areas with high valuations (ummmmm, like tech stocks maybe?).

The Nasdaq Composite fell 2.6 percent in Tuesday’s session, pushing it to its lowest level since October. On Wednesday, the Nasdaq entered correction territory, which is defined as a 10% drop from a recent high.

According to Yahoo Finance Plus statistics, all five components of the high-growth, widely held FAANG complex (Facebook/Meta, Apple, Amazon, Netflix, and Google) have lost more than 4% year to far. Netflix has dropped 14% ahead of its earnings on Wednesday evening, leading losses in the FAANG sector.

“There is no such thing as a market that goes in a straight line. We believe that a severe correction in the stock market is quite possible in the coming weeks and months, given the substantial and significant change in Fed policy that has begun to be implemented and the fact that the stock market is extraordinarily overpriced. However, there’s little doubt that several short-term relief rallies will take place along the route” said Miller Tabak’s chief markets strategist, Matt Maley, as he issued a warning.

Get Hedge Fund Beating Options Trades Delivered to Your Inbox!

Tired of missing out on the huge gains in the market?

Wishing you knew which trades had the best odds of succeeding?

Would you like to know EXACTLY how & which trades to place WITHOUT having to spend years learning?

Well now you can let our Team of Trading Experts & Exclusive AI Trading Software do the work for you!

Historically “Heavy Handed Fed” May Tank The Stock Market – Here’s How…

With the Federal Reserve prepared to begin raising interest rates from near-zero levels, investors should brace themselves for a bumpy ride this year.

The ones who will be hardest hit are those who have been passively investing their money without any form of active management or insight beyond putting their money blindly in a fund.

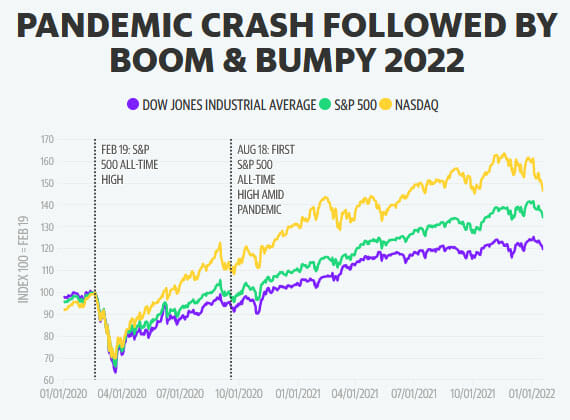

Here’s how it has historically played out…

With the Federal Reserve prepared to begin raising interest rates from near-zero levels, investors should brace themselves for a bumpy ride this year.

The ones who will be hardest hit are those who have been passively investing their money without any form of active management or exinsight beyond putting their money blindly in a fund.

“I believe that in 2022, we will witness greater volatility than we have seen in the previous year, and even during the previous decade. Volatility began to rise in 2021, and I believe it will continue to rise in 2022.” Erin Browne, portfolio manager at Pimco, stated on Yahoo Finance Live.

Stocks have a mixed track record during Fed rate hike cycles in the past.

According to new analysis from Goldman Sachs’ senior U.S. equities strategist David Kostin, the S&P 500 has declined 6% on average in the three months after the first rate hike in recent cycles. Stock market weakness has been brief, but returns have been significantly less juicy than investors have come to anticipate.

According to Kostin, the S&P 500 has returned 5% in the six months after a cycle’s first rate rise.

“When we get to these kinds of transition points in the market — and the key changeover is going to be the Fed starting to boost rates — that usually indicates greater corrections,” Browne noted. “I believe there will be more significant adjustments along the way.”

Browne is positive on semiconductors, citing the industry’s continued financial success as a result of the pandemic-driven chip scarcity.

To Browne’s point, markets are already acting strangely – particularly in areas with high valuations (ummmmm, like tech stocks maybe?).

The Nasdaq Composite fell 2.6 percent in Tuesday’s session, pushing it to its lowest level since October. On Wednesday, the Nasdaq entered correction territory, which is defined as a 10% drop from a recent high.

According to Yahoo Finance Plus statistics, all five components of the high-growth, widely held FAANG complex (Facebook/Meta, Apple, Amazon, Netflix, and Google) have lost more than 4% year to far. Netflix has dropped 14% ahead of its earnings on Wednesday evening, leading losses in the FAANG sector.

“There is no such thing as a market that goes in a straight line. We believe that a severe correction in the stock market is quite possible in the coming weeks and months, given the substantial and significant change in Fed policy that has begun to be implemented and the fact that the stock market is extraordinarily overpriced. However, there’s little doubt that several short-term relief rallies will take place along the route” said Miller Tabak’s chief markets strategist, Matt Maley, as he issued a warning.

Get Hedge Fund Beating Options Trades Delivered to Your Inbox!

Tired of missing out on the huge gains in the market?

Wishing you knew which trades had the best odds of succeeding?

Would you like to know EXACTLY how & which trades to place WITHOUT having to spend years learning?

Well now you can let our Team of Trading Experts & Exclusive AI Trading Software do the work for you!

You might also like

Crypto is Changing the landscape of Philanthropy

CryptoHybrid Work Is Allowing Businesses to Scale Their Workforce – Here’s How to Take Advantage of It

BusinessWeekly Options Trading Signals: A Great Way to Make Money Or a Great Way to Go Broke?

Options TradingBase Camp Trading Review: Find Out If This Service Is A Scam Or Legit

Options TradingShark Fin Trading Indicator: Here’s How to Discover This Harmonic Trading Pattern

Invest / Trade / Stock TradingOil Prices Drop 30% in a Week?

News