One of the first questions that you’ll be faced with when starting to trade stocks is, “What stock trading company should I use?”

And this is a very important question to look into, as having a great online broker is the foundation of your ability to make money trading stocks.

If you get this wrong, you’ll end up paying way too much on stock trade commissions and cut into your profit.

Now, even with all of that said, the options available to you may be limited to what country you live in.

Not all brokers are available world wide, so you might have to do a little research and make sure the online broker you’re interested in will be able to help you out.

But to get you started, I’ll give you my favorite broker to use.

The Answer To Your Question: What Stock Trading Company Should I Use?

I’ve been with them for years and they’ve been nothing short of fantastic.

The sign up was incredibly easy and when I deposit money into my account (once the account was verified and fully set up) it was available to trade within a few hours.

I found their online support to be great as well.

They have a toll free phone number (1 888 783-7866), you can contact them through email or you can use their online chat (found here).

I’ve used their online chat a lot and have found it to be very very helpful.

They’ve also got quite an extensive learning section to show you how you can go about placing trades and using their online platform.

Beyond that, they give you a lot of great information on how to invest in index funds or dividend reinvestment programs (DRIPs) and of course, they walk you through the different order types and how you can place them.

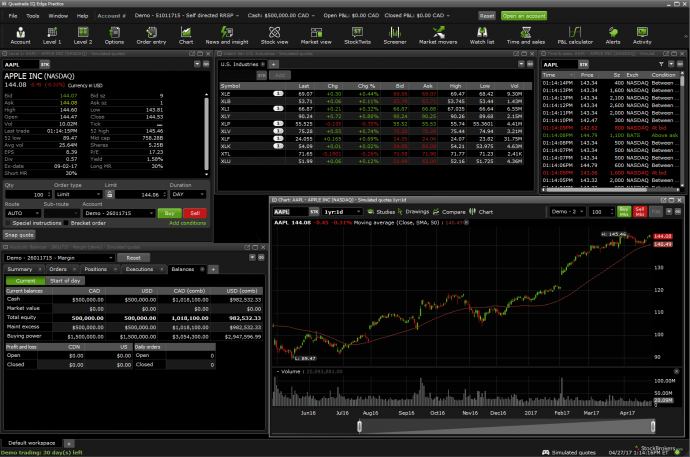

I use their IQ Edge trading platform. I’ve found it extremely easy to learn and get started with. (It’s the software that is shown when I’m giving trade related examples.)

When I signed up the minimum investment amount was $1,000 to open an account.

Now, if you want to make more exotic options trades you need to put up more money. For some brokers, this is a requirement before you can start trading options.

You can buy simple directional calls and puts with a regular account.

But if you get into more complex options strategies like Iron Condors you have to put a minimum of $5,000 into an account. For more information see “How to Make Money Trading Iron Condrors”

Questrade is available in many countries: Australia, Canada, China, Germany, Hong Kong, India, Ireland, Japan, Malaysia, Netherlands, Singapore, South Africa, United Arab Emirates, United Kingdom.

Questrade is not available in the USA.

For Stock Traders in the USA

But if you live in the good ‘ol US of A don’t worry! I’ve still got a recommendation for you.

From the research I’ve done, it seems like TD Ameritrade is probably your best option.

Their trading platform has many different options available and is very intuitive to use.

Over the past couple of years, they’ve really worked hard to make their mobile platform easy to use. And in doing so, it’s become a huge hit with investors.

Once You Have An Account: The Best Stock Trading Alerts Company To Use

Once you’ve got an online broker account set up and funded you’re ready to start trading!

Once you’ve got an online broker account set up and funded you’re ready to start trading!

And if you already know what you’re doing then you’re good to go.

But, if you’re still learning, you need to invest in yourself and learn more about how to go about trading stocks.

Start learning about the different trading styles that are out there (day trading, swing trading etc – you can read more about the different trading styles here in this article) and see which one suits you the best.

If you’re into fast action then maybe day trading is for you. This way you can close all your trades before the end of the trading day and rest easy at night. If you want to learn more about it, I suggest you pick up copy of the book “The Day Trading Manifesto” here.

Related Questions

What is the difference between trading stocks with an Online Brokerage vs Trading Stocks on my own?

You can get a better and more personal experience with an online broker than you would over your own.

One advantage of investing through the online broker is that they will be trained and equipped to answer all your questions, especially about risks. However, it is advisable to read every page of the website carefully before investing so you know what to expect if anything goes wrong or there are any changes in tax law.

What is the best online stock trading site for a beginner?

Robinhood. Robinhood is an app-based financial services company that provides stock market trading. The Robinhood app does not charge any monthly, annual, or other hidden fees to use the service. You pay $1 per trade and nothing else. Stocks are bought and sold with no additional commissions taken out after the first $200 worth of trades each month. Once you’ve bought up your first $200 in stocks for the month, every share thereafter will come without added commission fees.

How do beginners trade online?

There are a few steps to learn when trading online. First, set up an account with one of the major exchanges like Goldman Sachs or E*TRADE Securities. Next, deposit money into your account by funding it through a wire transfer from a bank account, sending funds over from another exchange or broker that allows transfers back and forth, or using PayPal or debit cards. Once the funds have been successfully transferred into your brokerage account you will be able to purchase stocks.

Can I start trading on my own?

Yes. That said, regular caution should be applied. You can increase your chance for success by having a regular plan and set of strategies, which you understand internally and do not need to deviate from in order to react to external stimuli.

The financial world is a fast-paced field that moves daily. That can make trading difficult if you’re using psychological momentums or following trends to inform your trades. However, the people who experience the most success understand how to work with their finances outside of the market movements and maintain their willpower regardless of what is happening around them so long as they keep hold of their inner knowledge regarding their investing goals and objectives.

Which trading app is best for beginners?

There are so many trading apps that it’s pretty hard to answer this question, but the great thing about modern day mobile devices is that they can support most major apps.

What app I recommend comes down to preferences. If you’re new, start with something like Coinbase or Robinhood. These are simple and easy-to-use mobile tools for crypto trading. If you prefer a more advanced app like actively managed trades of stocks or ETFs (exchange traded funds) then professionally managed portfolios might be your best option; choose whichever one suits you best based on your personal experience with securities exchanges in general.

Is Vanguard good for beginners?

Yes. Advanced investors may want to look elsewhere to get a more diverse portfolio, but if you’re just starting out, Vanguard is usually a good place to go. With the funds they have available, it’s going to be hard for an investor at any level of experience not to find something that will work for them. The only thing most people complain about is how much money Vanguards takes off the top in their fees – so advanced investors might still want something with lower fees anyway. But apart from the pricey VIP shares, everything else with Vanguard is maintenance free. Other investment companies would charge you every year just for changing your mind, but not Vanguard.

What type of trading is most profitable?

Options, because there is no limit to the number of investment choices and it has a much higher level of cash flow than other forms.

While it’s true that options don’t generate consistent and robust income like stock trading does, it generates more consistent and lasting income like index trading. The biggest difference between trading stocks/corn/futures contracts on an yearly basis versus investing in stocks on an hourly basis is that with one you can lose what you’ve made with another; while with trades you only risk what you had initially put into the trade (money). This translates to less stress on your end – which results in better returns for your money.

Is online trading safe?

Yes.

The idea of security is always of utmost importance, but with the internet only becoming more widespread it’s likely that your information is safe. Why wouldn’t your information be safe? First off, you have to consider who will profit on making personal data public. Another thing to consider is the types of companies handling your banking transactions. The government suppresses them if they are negligent or do not follow strict guidelines for online security, so it’s less likely that these companies will show misconstrued activity. Besides this, there are ways for individuals to secure themselves from hacks by ensuring changing their password on a weekly basis and deleting cookies every time they visit an account site.

When should you sell a stock for profit?

The short answer is when a stock reaches a point of your choosing.

The long answer varies from individual to individual, but there are two points in time that many investment advisors will recommend for stock sell-off.

One of these is the point at which you feel you’ve achieved your desired return on investment, or that it’s been too long since you bought your shares and losses may occur if not sold now. As with any valuable asset, stocks do fluctuate in price and so investors should be mindful of their own goals and risk tolerance when deciding to sell shares in order to avoid potential loss in value by continuing an investment portfolio based on the whimsical fortunes of Wall Street.

How can I buy shares without a broker?

No. Buying shares without a broker is nearly impossible.

Investing in stocks without the assistance of financial professionals can be risky, particularly for novice investors. If they don’t have enough capital to invest with, most brokers won’t give them access to investments that are considered “risky” by traditional standards.

About the only way to do it is to contact the company directly and see if you can set up a DRIP with them.

What apps do day traders use?

For day trading, it is best to use apps that are usually categorized under “watchlist.” Watchlists are used for keeping track of stocks by their tickers.

It’s important to also check the fair value of any watchlisted stock. This can be done on sites like Yahoo Finance or Morningstar. You would need to visit these sites periodically; they provide live updates in addition to historical data.

Stock market apps utilize tools like widget timers and alerts for tracking performance in real time, but most novice traders will still find more use in news feed-based applications like IBD – Investors Business Daily Breaking News or CNBC News Widget Pro due to their top stories function; however, both come at different prices.

How much can a beginner day trader make?

To be honest, the return varies depending on the type of trading strategy and market conditions.

If you do a lot of margin trading, there is a chance to make a large short-term profit from price volatility, but it also creates an enormous risk. Professional day traders simply cannot afford not being in control at all times – that means that they refuse to buy anything on margin. And while some people have been successful with this style for years or even decades, it’s rare to find one who has been consistently successful over time doing just about anything in speculating without risking too much money at any given time.

Which app can I buy stocks?

Maybe the best option is Robinhood, which gives you a free stock trading app with no inactivity fee.

It’s a mobile app that lets you invest without commission fees and, to boot, it’s streamlined so there are less messages and delays when executing trades. It can have a little bit of an interface issue when searching for tickers, but all-in-all users seem really happy with it. They also have a web platform that integrates directly into their mobile apps without sacrificing your privacy or security browser identity by defaulting to HTTPS protocol at all times. In other words, they have great customer service!

What if Vanguard goes bust?

Vanguard never goes bust as some say, as they have a number of collaborations with major banks to ensure ongoing liquidity, but it does happen. In 2002 for instance, a Portuguese bank called Banco Espirito Santo lost €3 billion over the course of two days and brought down the whole group that had been financing external companies on behalf of Espírito Santo Financial Group holdings. Which led to a “SAFE” method being developed by CEMAFI in Brazil, which is just among other measures that became law in Brazil in 2006 following the collapse of Vale do Rio Doce (Vale), Brazil’s second largest mining company.”

How much money do you need to start a Vanguard account?

A $1,000 deposit will get you started. Vanguard offers three different accounts- individual, joint, and ROTH IRAs. They differ in terms of the types of investments offered, the number or commission-free trades allowed each month for active investors (The Fidelity Investments Double Cash Account is a comparison contender), and minimum investment amounts required to open an account.

Individual Accounts offer clients access to mutual funds without paying commissions when buying or selling up to the number of trades listed in their fee schedule . These monthly “buys” are limited by the fee schedule only; you can make unlimited “sales.” Minimum initial deposits are $1,000; subsequent deposits may be made within 30 days with no minimum amount.

What is the easiest most profitable business to start?

Buying and reselling items on eBay or starting an FBA business.

If you don’t have the money for that, you could start an online blog or make youtube videos.

Can I become a millionaire day trading?

Yes, but it’s the exception not the norm.

Most people who go into day trading and expect quick rewards and riches out of it will be in for a rude awakening because that just doesn’t happen. For most people, even when they work hard at day trading for many years, they still won’t be millionaires. The vast majority will regret ever getting into day trading to begin with because all their savings will get whittled away by high investment costs and commissions (in addition to never making any money).

So instead of jumping headfirst into this risky business venture without fully understanding the dos and don’ts of successful day traders, I urge you to study up first.

Why do most day traders lose money?

Day traders take a high-risk approach to trading, which leads to a higher number of losses.

The chances of winning are less than 50% even if you trade with the best tools for daytrading – trading software and automated trading bots. If you use different tools, the chance of winning decreases sharply.

On the other hand, there is another very powerful trend working against most day traders: commissions that eat into their profits every time they make trades on margin stocks or ETFs. Many day traders lose more money on commissions that they made in profit on stock trades during the course of one week’s worth of trading!

Is online trading easy?

No. At least that’s the short answer.

Long answer: Yes and no. There are a few important factors to consider but this answer will not take the place of the day trading courses from other institutions that have been mentioned below. They provide a much more thorough discussion. It should also be noted that there is a lot to learn about trading in order to become skilled enough for it to at all seem easy or worthwhile, so if you want something you can master in a weekend work project then online trading probably isn’t going to satisfy your needs, especially at first while you’re learning how things work.

It’s certainly possible for anyone with access to financial markets online – almost anyone with an internet connection! – sign up for an account and start trading successfully, but it’s not the norm.

Is trading a good career?

Yes. It can be a good career for the right person, but trading is also one of the most morally bankrupt professions. A trader’s job has nothing to do with “selling” or “buying,” and it has everything to do with, according to a former trader in high-frequency trading with Credit Suisse, “trading with a focus on speed”. The faster they trade, the more money they make. Successful traders never have to work again if they don’t want because their income usually ranges from $100k-$300k per year. In 2006 an average trader made about $200k/year before bonuses — now that number is probably twice as much.”

Can you buy and sell the same stock repeatedly?

Yes, and it has a name.

The term for this is “day trading.” Contrary to popular belief, day traders do not typically buy and sell stocks back-and-forth all day. Day traders focus on price gaps that often widen in morning hours before narrowing or closing at the end of the trading day. The point of such trades is to capture very quick profits (or avoid losses) that would not be achieved through holding a position for longer periods of time without missing any significant market moves during the course of the trade’s duration.

Can I sell a stock for a gain and buy it back?

Yes, but the strategy is rarely profitable.

There are traders who try to time the market, look for cycles in stocks’ prices, or predict when a stock can trade at a higher value. But this strategy does not have good odds of being profitable because timing the market successfully would typically involve lightning-fast computations by an expert using complex algorithms relying on historical data. The more information that becomes available about probabilities and trends in financial markets or regarding stocks in particular, the less likely it is that any given trader will be able to manipulate their own advantage over others based on personal insight alone.

How much can you make from stocks in a month?

This question does not have a specific answer. However, you are more likely to make the most money from stocks when you buy stocks with high returns depending on your risk tolerance. Consider picking low-risk if make less than $5k per year, medium-risk for those who make less than $100k or high risk if you make over $200k and don’t mind losing some of the capital.

If the stock market is volatile and involves a certain level of vulnerability and you can afford to lose some cash then pick high risk for stocks but keep in mind that their return could be very minimal as well as them crashing completely so buyer beware!

How do you buy shares for beginners?

There are a number of online stock brokerage firms these days. Which one is appropriate for you depends on your trade frequency, the type of stocks you invest in, and what you want to invest in.

For beginners it’s usually best to start with a set commission structure even if that means paying higher fees because having access to market quotes and comparative prices will be more important. There’s no way for me to know which account or company would be best for you without knowing more details about your circumstances so please do look at the various options available, speak with a broker, fill out an application form and let them know as much detail as possible.

What is the best free trading app?

If you are not looking for complicated trading strategies, the best free trading app is Robinhood.

Robinhood gives users access to zero commission trades, meaning that if it costs $1,000 to buy stocks using one program, there would be no additional cost on the other side. This makes buying and selling stocks painless and easy. It’s also very intuitive for beginners or people who find themselves spending more than an hour a day on Wall Street Journal articles trying to understand what exactly Goldman Sachs invested in last quarter. For those of us with less than spectacular math skills but still dabbling in analyzing market trends, this is perfect! And just like everything else these days – everything can be found with just a single search engine query away.

Can I day trade with less than 25k?

No. It is against the law.

That said – even if it were allowed – it’s not advisable to day trade with less than $25,000.

Trade costs such as commissions and spreads can be substantial enough that they can cost you more than your entire account balance in a single trading session – the point where you’re probably no longer day trading but simply trying to survive until the end of the week. A small account will never provide meaningful profit potential, and there’s an undeniable risk that any little thing (such as a big market shakeup) will push your meager holdings into a permanent loss in just one or two trades.

Is day trading illegal?

No. Day trading is not illegal, even though it can be hard on your nerves.

Day traders are businessmen and women who buy and sell securities within the same day. Day traders need fast internet connections to communicate with other investors rapidly enough for this type of short term investing to work efficiently. These connections must be able to handle large amounts of data, which means that just about anyone can do it – as long as they’re willing to put in the time and effort! It’s important that you only trade what’s within an acceptable risk limit, because one bad decision can cause heavy losses. This investment vehicle is best reserved for seasoned professionals with a proven track record of successful trades.

Can I make a living day trading?

Yes, you can.

That said, day trading is not for the average person. A good strategy will include some level of expertise in day trading, technical analysis, charting tools, market sentiment and macro-economic indicators. If you’re just starting out with day trading then I suggest checking out this free course offered by Wharton to get the basics down before jumping into the forex arena with both feet.”

I recommend taking an algorithmic approach that involves backtesting your method over a predetermined data set of previous trades to find which pattern produces the best results. This will allow you to determine if day trading is worth it at all based upon how much risk there would be involved per trade versus how often they would be profitable.

What is a day trader salary?

There is no right answer. Day traders set their own salaries because the income from day trading depends solely on how much you trade, not how long you work or what your qualifications happen to be. In general, a less-experienced day trader will likely make less money in a month than an experienced full-time trader will make in a year.

Where the individual defines success for self = deciding salary and financial goals.

Can I make 1 percent a day trading?

In theory it is possible, but in practice often not. The profits from 1% per day trading will be much less than 100%.

In reality, anything more than one percent a day can’t last for long because investors would just pull their money out. This leaves the one percenter with a cash pile that’s quickly diminished by withdrawals and commissions – whatever isn’t enough to generate a 1% increase in the next day’s worth of transactions simply vanishes away. And so does any chance at generating earnings on this scale long-term.

Is Robinhood app safe?

Yes.

That said, in Robinhood’s own words, “Like most online stock brokers, we buffer trades from the big rates swings in the market.” That means they sometimes will postpone your investor money to compensate for a potential future loss.

The problem is that not all investments are profitable. Some loans go bad and some stocks go down instead of up. If there’s a drop in interest rates or markets generally, Robinhood could have a hard time making you what you expect to earn on investment because it has to hide losses from previous investments as best as possible so as not to scare off new customers with high rates of risk.

Can you lose money with Vanguard?

Yes. But that’s true with all investment accounts.

One of the main reasons Vanguard has such a strong reputation for long-term performance is that we don’t follow the practice of “timing” or “market timing” investments.

Timers and market timers try to time the market, and execute their investment decisions based on whether they think global or domestic markets are more favorable at any given time. Vanguard does not strive to do this because there is no data to back up that it will yield better results in pursuit of our purpose – helping you meet your financial goals. So if someone at some point got lucky enough to sell securities with declining values, then bought them later with higher values, nobody could guarantee they would make money by doing so, especially over several decades.

How much should you invest in ETFs?

The answer to this question is personal and depends on your financial goals, risk tolerance, and total current assets. We recommend that all of our clients consult their own tax or financial advisor before investing in exchange-traded funds.

Who is the richest day trader?

The richest day trader is Paul Tudor Jones II, with a net worth of $4.5 billion.

Paul Tudor Jones II, founder and president of Tudor Investment Corporation and current chairman of the board for Robin Hood Foundation, is the richest day trader in the world with a net worth of $4.5 billion.

Will day trading make you rich?

No. Day trading is a difficult way to make money because of the high risks. With day trading, you don’t have the opportunity to hold shares for an extended period of time, so your returns are variable – if you win on one trade, you’ll lose more on the next trade. It’s also difficult to get out of a position that doesn’t work out for any number of reasons, especially in fast-moving markets.

Of course, you can make money day trading but due to the risk, most people don’t become rich.

Should I quit my job to day trade?

No.

If you have quit your job, don’t go out and trade a bunch of stocks! There really is a lot more to it than just watching the stock’s price fluctuate and buying or selling shares based on their value. A lot of people lose money because they lack the discipline to only invest in one company if they’re not sure which direction it will go. Plus, there are different trading strategies that require comprehension of advanced economic concepts as well as advanced mathematical concepts. In short, maybe put off trading until you’ve got a little background first…

Why day trading is a bad idea?

Day trading is certainly not a bad idea, but it’s perceived as risky for the everyday person which means that people with limited investment capital might be discouraged from giving it a try.

Day trading is risky because of basic psychological reasons. Investors who are new to day trading may start day trading by taking on too much risk at one time and clinging to their investments for too long if they don’t do well in the first few trades they make. So new investors can lose money unwisely without understanding what they’re doing or why their “less than perfect” strategy isn’t working like they thought it would.

The good news is that more experience teaches you how to trade better, you learn how to cut your losses quickly when a trade goes against you.

What is the average return for day traders?

It’s a difficult question to answer precisely because it depends on the trader, the market they trade in, and a variety of other factors. Generally speaking though, the return has been quoted to be less than 1%.

An interesting point about trading is that there are different types of traders with different aims and expectations. Though some traders need to make more than 1%—or what can be gleaned from an interest-bearing asset such as a savings account—others make enough money after fees and commissions; others still only do it for fun or out of curiosity. There is no job profile whatsoever compatible with day trading because it levels its own playing field.

What type of trading is most profitable?

Any trading is profitable. Some trades are more enjoyable than others however.

Now, the only people who may find some trades more “financially” rewarding (e.g., gambling) will end up paying for it with mental stress, which usually leads to physical stress and other health problems that accumulate over the years. So yes, any trading has its merits or drawbacks; it’s not possible to calculate what type of trade will be most profitable in the long run without regard to personal happiness or sense of achievement as well as financial success given a finite amount of time on this planet.

Can I be a full time trader?

Some people are literally able to trade full time, but for most people it’s a difficult life choice. It takes tremendous discipline and additional skills- sometimes programming help- to make trading work. You need to be near your screens at all times or sleep with one eye open between computer sessions for two decades before you can expect the kind of wealth that affords trading as your sole income source. If you’re disciplined, obsessive about money management, and serious about the commitment needed to win in investing as a career choice- trading is an option worth exploring as long as you do so cautiously and without wild expectation. Entering any profession with wild expectations guarantees lower odds of success.

Most people are better of following the trade alerts from The Empirical Collective.

What is the 30 day rule in stock trading?

The 30 day rule is a common trading rule in which stocks should not be held for more than 30 days; we often hear people say stock should not be held for more than 3-5 days.

Time on your side. If you are trying to time the market so that you buy low and sell high, it’s best to avoid holding onto stocks for too long. Why? There are lots of reasons, but the main one is taxes! You won’t have grown your money by just sitting on cash waiting for things to happen. Sooner or later you’ll have to pull some profits out of what you’re holding, and the taxes will eat into what you’ve made if they’re left in your account too long.

Do I pay taxes if I sell a stock and buy another?

Yes.

If you’re selling stocks to buy more stocks all in the same day, then it’s possible that you owe the IRS capital gains tax on that entire amount. If you’re just buying or selling individual shares of stock, then there are no capital gains nor losses associated with that transaction. The only thing the IRS will be interested in is if your income changed between them two days (one when they sell and one when they purchase).

Can I sell stock today and buy tomorrow?

Yes.

To sell a stock today, just find the company you’re interested in on Yahoo Finance and click “Trade.” Set your price bands to match how you want to buy or sell your stocks, enter the number of shares that you want, and that’s it!

What is the best time of day to sell stock?

Typically in the morning section, between 9:30 and 10:30 am EST.

But overall, the best time to sell stock is at the market high, when the price of your security is at its highest point. This is because you’re selling for a profit and profit will be measured by how much more (or less) you spent for the asset and how much it’s worth right now. The closer that your purchase price is to what it’s worth currently, the lower your profit margin will be. A low profit margin means that you’ll have a hard time turning a healthy amount of money after fees, commissions, taxes etc., so if you can get an extra 2% or 4% return on your trusty mutual fund with some short-term trading, buy!

How do day traders avoid wash sales?

Day traders avoid wash sales by waiting 31 days before they buy the same asset again.

Exchanges require traders to establish ownership of an underlying security after recent sale, if they intend to sell it at a profit within thirty-one (31) days of their purchase. Day traders will not be permitted to sell or transfer positions in four stocks or securities per year, with any one day trader allowed no more than two transactions on any given day while this rule is in effect. If you are day trading an ETF that pays distributions for example, you can’t have found out there was a dividend available today and then buy the same ETF tomorrow without violating the exchanges’ “Wash Trading Rules”.

How can I double my money in a month?

Save as much as possible to invest in a mutual fund with a reasonable rate of return, such as your 401(k). Invest the rest. If you’re saving 22% of your income per year, for instance, and earning 8% on an investment, you’ll have nearly double your money in six months.

Theoretically speaking this is possible if there were no fees related to investing and no taxes on capital gains from investments. Realistically however it may take a lot longer considering expenses like these often make our returns lower than expected. Especially considering that investors are subject to taxation for capital gains (gains made by selling any kind of financial asset) at their federal tax rates which can vary depending on each individual.

Does Coca Cola have a DRIP plan?

Yes it does.

A “DRIP” is an acronym for dividend reinvestment program where you purchase stock in one company, and the dividends are automatically invested back into additional shares of that same company.

Do you need 25K to day trade Robinhood?

Yes. The day trading requirements are $25,000 for stocks or $5,000 for options. You can also earn up to $500 in cash rewards per month (requires eligibility).

How do day traders prove income?

Several options for proving income are to show an investor their most recent bank statements (most recent three months of transaction history is usually sufficient), most recent bank balance statement, or current paycheck stubs. A broker’s advice regarding verifying stock earnings is probably the best route if they’re not already providing it. If one doesn’t have any documentation at all, then this will be challenging and require some creativity on behalf of whomever asks.

Is 1000 dollars enough to day trade?

No. You need a minimum of $25,000 in order to day trade.

Answer: If you are serious about day trading, it should be enough, but before jumping in head first, you should know the following.

Day traders commit to an unpredictable lifestyle and if they trade actively (most do), the income may vary widely week-by-week or month-by-month. There is always a risk that you will suffer losses greater than your net worth. Be prepared for this loss by keeping some cash available to avoid having to sell stocks just to meet daily expenses like mortgage payments or groceries that cannot be put on credit cards.

These risks can be mitigated by proper knowledge of investing, but these risks still exist for any investor who does not do their homework before committing to trading.

Can I sell my ETF anytime?

Yes. You can sell your ETF anytime, though we recommend that people hold onto their investments for at least five years.

As with anything in the market, there are risks involved when trading securities and/or financial instruments. If you’re looking for a quick sale, it may not be worth waiting proceeds from an ETF until it’s been turned over five times total. On the other hand, if you want to take advantage of higher rates of return during a bull market then you should wait until your investment has been turned over five times total. In any case, make sure to invest enough money upfront so that you’ll have enough funds ready to reinvest after selling off certain shares while still getting a reasonable rate of return on your overall portfolio balance.

What is the downside of ETFs?

The downside of ETFs is that they are actually not very “efficient”. When you invest in an ETF, you don’t really own any stocks; instead, the company runs a kind of auctioning process internally to decide what company stock equity to buy and sell.

ETFs try to track indexes like the S&P 500 (SPX) or NASDAQ 100 (NDX), but one deviation could be enough to cause significant losses that may happen long after the initial purchase was made. Another downside with ETFs that run on computers is computer systems can make mistakes during processing at various points in time which could lead to errors like getting the wrong type of index exposure.

Are ETFs safer than stocks?

Yes. ETFs can be safer than stocks for two reasons. First, they’re more diversified and include a large number of securities so you get less risk and volatility by owning and investing in them.

Second, the funds sit on an exchange where you buy them, which is generally more stable than individual companies that exist out in the world somewhere which could go under without notice.

Do day traders work from home?

Yes, most day traders work from home.

Today, there are a lot of traders that work from home. In order to trade from your computer at home, you need a fast connection to the Internet and an investment account for them to trade with.

But, it’s almost an alternative answer to the question, “What Stock Trading Company Should I Use?”

In asking a question like this, someone could be wondering what trading alerts company they should use.

Once you’ve decided on your trading style, you need to find a mentor whose trades you can follow.

If you’re wondering, “What is the best penny stock trading platform?”, then you need to check this guy out. His track record is stellar and he became a millionaire before turning 22. I don’t know of a more qualified teacher out there when it comes to learning how to trade penny stocks.

If you’re looking to maximize your leverage and trade using options, you should check out our membership area within “The Empirical Collective.” Inside we publish weekly options strategies where you buy calls or puts. My team and I give you everything you need – entry and exit alerts – all wrapped up in one simple email. If that interests you, you can sign up through the discounted link here if there’s still room.

The regular priced sale page is available here.

So far during the first part of this year we’ve had a great win average. This is a real testament to just how hard my team has worked to provide incredible stock trade alerts for our members. Our trades are swing trades, so you don’t have to be on your computer all day to follow our trade recommendations.

If you’d rather stick to trading regular stocks I’ve been following this guy for quite some time. He trades small cap stocks that are set to explode higher. If you sign up for his membership, you’ll get his pre-market commentary, and entrance into a real-time community forum. In the forum, he comments on the daily happenings of the market and gives trade alerts. You can check him out here.

So many traders rush in and start trading without taking the time to educate themselves beforehand. And it often doesn’t end well.

I know investing in yourself or spending the money to get trade alerts from someone else might SEEM expensive. But in the long run it could save you thousands of dollars.

The Best Supply and Demand Indicator for Trading in the Zone

The Best Supply and Demand Indicator for Trading in the Zone  Candlestick Scanner MT4: How Does It Work & Does It Help?

Candlestick Scanner MT4: How Does It Work & Does It Help?  Learn How to Day Trade for Beginners – What You Need To Know Before Trading

Learn How to Day Trade for Beginners – What You Need To Know Before Trading  No Loss Grid Trading – The Safest and Most Profitable Trading Strategy?

No Loss Grid Trading – The Safest and Most Profitable Trading Strategy?  Getting Started With Tick Scalping & Tick Chart Trading

Getting Started With Tick Scalping & Tick Chart Trading  Shark Fin Trading Indicator: Here’s How to Discover This Harmonic Trading Pattern

Shark Fin Trading Indicator: Here’s How to Discover This Harmonic Trading Pattern