In the past few years options trading has increased in popularity as more people have learned about it.

In the past few years options trading has increased in popularity as more people have learned about it.

But if you’re just starting out and wanting to learn how to trade options, the whole process can seem bewildering.

After all, there are so many choices to choose from and ideas to consider.

So where do you begin?

That’s what we’re going to help you with here in this article on the best way to learn options trading as a beginner.

And to do this, we’ll answer a number of commonly asked questions that people have when they start trading.

What is options trading?

Options trading is the process of buying or selling an asset at a pre-negotiated price. Unlike stocks, options require a more advanced understanding of strategies and processes to trade them. Options give traders the ability to speculate on stock movements, and when markets are volatile, options can be used as a way of generating income.

There are two types of options: puts and calls and each of these options gives the holder the right to buy or sell an asset at a specific price by a certain date, regardless of what happens during that time period. Options have expiration dates, which vary in length, with most expiring within three months to a one year (there are some exceptions).

What are the benefits of options trading?

There are a number of benefits to options trading, including the ability to profit from the market regardless of whether it is bullish, bearish or range bound.

Options also provide traders with protection against unfavorable moves in the market and can be used for speculation as well.

In addition to that, the process of learning how place option trades is relatively easy, which gives almost everyone the chance to speculate in the market.

What are the risks of options trading?

When you trade options, you are essentially buying or selling the right to buy or sell a security at a certain price by a certain date. Like any investment, there are risks associated with trading options. For one, if an investor sells an option and it is not exercised by the buyer, the seller could lose more than their initial investment. Options are also a leveraged instrument, so your gains or losses can be multiplied exponentially.

When you trade options, you are essentially buying or selling the right to buy or sell a security at a certain price by a certain date. Like any investment, there are risks associated with trading options. For one, if an investor sells an option and it is not exercised by the buyer, the seller could lose more than their initial investment. Options are also a leveraged instrument, so your gains or losses can be multiplied exponentially.

What is the best way to learn options trading?

One of the best ways to learn options trading is by taking a course or reading books on how to trade options.

In addition to this, you need to practice as much as possible.

The more you trade, the better you will become at it!

We highly recommend that you trade using a practice account at first and following along the trades of a more experienced trader (like those found inside The Empirical Collective) or using an options alert service.

What are some tips for learning options trading?

There are a few key things to keep in mind when learning options trading:

- It is important to practice before making any big investments. Try opening a demo account and trading options with fake money to get a feel for how the market works.

- Do your research! Learning about different strategies and how they work will help you make better decisions when it comes time to trade for real.

- Stay disciplined and patient. Trading can be volatile, so don’t let your emotions get the best of you. Wait for good opportunities rather than taking unnecessary risks just to make a quick buck.

What are some common mistakes made when learning options trading?

When it comes to options trading, there are a few common mistakes that newbies often make.

Here are 2 of the most frequent offenders:

- Not being educated enough about options and how they work before trading them. This is crucial, as options are a complicated financial instrument and require a good understanding in order to be traded successfully. Without knowing what you’re doing, you’re simply gambling – and the house always wins if you’re gambling. Make sure to arm yourself with as much knowledge as possible before attempting to trade options.

- Over-complicating things. Options trading doesn’t have to be rocket science – sometimes the simplest strategies are the most effective ones. Many beginner traders try to find that “holy grail” and add a million indicators to their strategy and then open multi-leg options trades and it becomes a mess. Experienced traders have come to learn that the more complicated a strategy is, the more likely you’ll lose money trying to trade it.

What are some resources for learning options trading?

There are many resources available for learning options trading. You can get educational material from King Trading Systems, Khan Academy, or Udemy.

Or you can check out the link to the free options trading ebook we listed above.

How Does Options Trading Work?

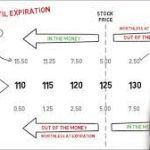

When you buy an options contract, you are purchasing the right to buy or sell a set number of shares of the underlying stock at a predetermined price before the contract expires. For example, if you purchase a call option with a strike price of $50 for XYZ stock, you have the right to purchase 100 shares of XYZ at $50 per share before the contract expires.

If XYZ stock exceeds $50 per share when the contract expires, your call option will be “in-the-money” and will be worth more than what you paid for it. If XYZ stock falls below $50 per share when the contract expires, your call option will be “out-of-the-money” and worthless.

The same principles apply to put options: they give you the right to sell 100 shares of XYZ at a specified price before expiration. If XYZ stock drops below that price by expiration, your put option will be in-the-money; if it rises above that price, your put option will expire worthless.

Options contracts are more volatile than stocks because they are a leveraged security and there is greater potential for profits (or losses). This volatility allows traders to make short-term profits on market movements without having to own the underlying stock.

How Much Money Do You Need to Start Options Trading?

Options trading can be a great way to make some extra money, but it’s important to understand that you need to have at least a little bit of money to start. The minimum amount you need is $200, but some of the more basic trading strategies require at least $5,000.

To trade options, you need to be able to successfully predict future changes in stock prices. This can be difficult for beginners, so it’s important to do your research and learn as much as you can about the market before investing any real money. It’s also a good idea to start with a small sum of money that you can afford to lose – this will help minimize your losses if things don’t go according to plan.

Make sure you enter a trade properly by using the buy sell option prices available on most platforms. This will help ensure that your trade goes smoothly and without any unexpected surprises. And finally, remember to practice trading with paper money before investing any real cash!

Options Paper Trading

When you paper trade options, you’re using fake money in a practice (dummy) account to trade on a broker’s platform. This is a great way to learn how the market works and to test out your trading strategies without any risk involved.

One of the benefits of paper trading is that it can help you practice the skills of knowing when to enter a trade and how to price it. When you’re in a real-world situation, emotions can often get in the way. But with paper trading, it’s easy to know that there are no losses or gains attached to the account, which helps keep emotions at bay.

It takes time for people who start with small amounts of money to be able to gradually grow their funds over time by paper trading. In fact, many people recommend starting out with at least $2,000 in order to have enough capital available for different types of trades.

Option Trading Strategies

1. Long call

When you buy a call option, you are giving yourself the right to purchase shares of the underlying stock at a specific price, known as the strike price. The expiration date is also set when you buy the call option. If the stock price goes above the strike price by expiration, your long call will be in-the-money and the option contracts you bought can be cashed in for a profit. For example, if you bought a call option with a strike of $50 for $2, and the stock price was at $60 at expiration, your long call would be worth $8 (the difference between $60 and $50).

If you buy a call, you have no cap on how much money you can make because (technically, at least) there is no limit to how high the stock could go before your option expires – meaning you could make many times your initial investment!

Of course, if the stock price drops below the strike price you purchased the option contract at, you would lose your entire investment.

2. Covered call

A covered call is an option trade that involves the sale of a call, but also buying the stock that underlies it. This can be a way to generate income in risky situations which can turn into safer trades if the stock price finishes below the strike price at expiration.

A covered call strategy is a way to make money by taking advantage of volatility. If the stock stays below the strike price, you keep the premium from the sale of the call and you keep the stock.

If the price of the stock appreciates past the strike, you have to sell the shares of the stock you bought previously at the strike price and keep the premium received when you sold the call.

So if you had previously bought 100 shares at $33 and sold a $35 call for $1.25 in premium, you could receive $125 in premium plus $3500 for the sale of the stock at $35 each.

3. Long put

A long put gives the holder of the contract the right to sell an asset at a predetermined price. The upside on this investment can be many multiples of the initial investment if there is significant movement in the stock price. Unlike shorting a stock, which has unlimited downside potential, a long put strategy doesn’t require you to purchase any shares, giving traders more flexibility.

This type of option increases in value as the stock price goes down, making it an effective way to make money from the decline of a stock. The downside on this investment is capped at your initial investment, so there is no risk of losing more than this amount if the stock rises significantly before expiration. In other words, a long put can be better than shorting a stock because it caps its downside and has unlimited upside potential.

4. Short put

When you sell a put, you hope the stock is above the strike price at expiration. This way, the option will expire worthless and you’ll keep the premium. If it’s below the strike price, your broker may close out the position before expiration and take a loss on it as well as keep your premium.

In this case, you could lose more than your initial investment as your trade is not capped.

5. Married put

A married put is a hedged position. When you are in a married put, you own the underlying stock and also buy a put. This strategy’s cost depends on the market value of both the underlying asset and its option premium, as well as how many shares are covered by each contract.

The main benefit of using this strategy is that it provides downside protection. The put acts as insurance against lower stock prices. If the stock falls in price, the option will gain value and offset some or all of the losses.

This strategy is only effective when the option’s price will rise to a point where it outweighs its downside risk. The potential upside offset by the downside guarantee of the option makes this strategy appealing to some investors.

People also asked questions like these when searching for the best way to learn options trading

Is it easy to learn option trading?

Yes and no. It depends on your prior knowledge and trading experience. If you don't have any experience in trading, then options can be very confusing and overwhelming. However, if you have some basic knowledge of how the markets work, then learning to trade options is not that difficult. There are many resources available online and in libraries that can help you learn the basics of options trading. Many brokerage firms also offer classes or webinars on options trading to help their clients learn more about this topic.

Can I get rich trading options?

Yes, you can get rich trading options. However, it takes a lot of work and dedication to become a successful options trader. There are certain strategies and skills that you need to learn in order to be successful. Options trading is not for everyone, but if you are willing to put in the time and effort, it can be a very profitable way to make money.

Is options trading just gambling?

No, options trading is not gambling. Options are a strategic investment tool that can be used to hedge risk and make profits in a variety of market conditions. When used correctly, options can provide traders with a high degree of leverage and can help them to achieve greater returns on their investment. However, options trading does involve risk and should only be undertaken by traders who are knowledgeable about the risks and rewards involved.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History