With the recent volatility in the stock market, many investors are looking to trade options to hedge against their portfolios or to speculate on the direction of the market. However, before trading options (or your option trade alerts), it is important to paper trade first to learn the mechanics of how options work and to test out your trading strategy. In this article, as the best options trading alert service provider we will cover what paper trading is and 5 of the best free and paid platforms that you can use to practice.

What is Paper Trading?

Paper trading is a simula tion in which invest ors buy and sell securi ties without risking real capital. New investors frequently util ize paper trading to test strateg ies and assess perform ance before invest ing any real money; experienced traders may use paper trading accounts for trying out new strategies or markets; many platforms even provide free paper trading accounts that enable you to learn more about market fluctuations while becoming familiar with gains and losses. 💸

Why do I need to paper trade?

Paper trading options is a great way to learn about the market, practice, and hone your trading skills. With paper trading, you can form a trading strategy, backtest it, or try different strategies like social and copy trading. You’ll also want to understand Modern Portfolio Theory when trading options.

Advantages and Drawbacks of Paper Trading

Pros

Paper trading provides many advantages, including:

- Paper trading can help you familiarize yourself with the process without risking real money: paper trading allows you to become acquaint ed with it quickly, and can help avoid making costly errors in real life trading situations. 📚

- Before risking actual capital, paper trading allows you to test strategies without incurring any real financial liabil ity. 💰

- Rebuild ing trust can be simple: When they lose money trading live trades, paper traders often have the option to restart their positions quickly – something which cannot be done if trading real money losses occur. 🔄

- Paper trading is an ideal way to hone your stock trading skills: Paper trading allows you to trade stocks in a contro lled environment, giving you an ideal chance to build them and perfect them over time. 📈

Cons

Although paper trading provides many advantages to traders, there may also be potential draw backs that each trader should keep an eye out for, including:

- Paper trading involves not actually owning any shares and therefore cannot make or lose money from stock price movements. 🚫

- Paper trading does not equip you with the skills to control your emotions when investing, since there’s no money at stake; therefore, it may not provide the opportunity to learn how to stay calm when investments start going awry. 😕

- Paper trading may provide a false sense of security. With no actual money involved, taking more risks may make paper trading seem safer; this could result in losses when investing with real funds in the future. 🤔

How to Choose the Right Paper Trading Options Platform for Yourself?

Finding the appropriate paper trading platform is key to your trading success, yet can be a difficult decision to make. Here are a few tips that may help you select an appropriate paper trading platform:

Identify What Types of Trader You Are

The first thing you should consider is what type of trader you are. Are you a day trader or a swing trader? This will determine the time frames that you will be looking at and the types of strategies that you will use.

Your Goal as a Trader

First and foremost, you should determine your type of trader – day versus swing trading are two distinct approaches which should help shape how and when you trade. Each will dictate which timeframes and strategies will be most applicab le for your trading needs. 💡

As a trader, you should first establish your goals. What exactly do you want out of trading? Is your aim quick profits or long term investment growth? 🎯

The Cost of the Platform

A third factor to keep in mind when selecting a platform is its fees structure. Some platforms charge per trade while others impose monthly or annual subscrip tion costs. Be sure to understand these fees fully before agreeing to sign on with any platform. 💰

Consider the Customer Service Offered

The final factor you should take into consideration when choosing a platform is customer service. To make sure that help is available when needed, select one with excellent customer service. 🙋♀️

Features of the Platform You Need

At last, you should consider what features you requir e from your paper trading opti ons platform. Do you requir e real-time quotes or historical data? 📊

The Best Paper Trading Platforms in 2022

1. TD Ameritrade (thinkorswim)

TD Ameritrade is an American online broker based in Omaha, Nebraska. Common stocks, preferred stocks, futures contracts, exchange-traded funds, foreign exchange, options, mutual funds, fixed income investments, margin lending, and cash management services are just a few of the financial instruments that can be traded electronically through the stockbroker TD Ameritrade.

Pricing:

Pros

- Commission-free stock and ETF trades.

- Free research.

- High-quality trading platforms.

- No account minimum.

- Good customer support.

- Large investment selection.

Cons

- Account fees

- Mutual fund fees

- Fractional shares

2. E-Trade

Over the last decade, online trading has become increasingly poplar among investors. E-trd is an influential 🤑 web-based brokerage firm which offers services like stock and options trading, mutual funds, retirement accounts and more.

E-trade has earned recognition from Barons for its user-friendly 🤝 platform and has been recognized as one of the best online brokers. Additionally, they provide 24/7 custmer support as well as extnsive research and educational materials that enable clients to make more informed investment decisions.

No matter your level of investment experience or novice status, e-trade is an invaluable option for online stock and option trading. 🤑

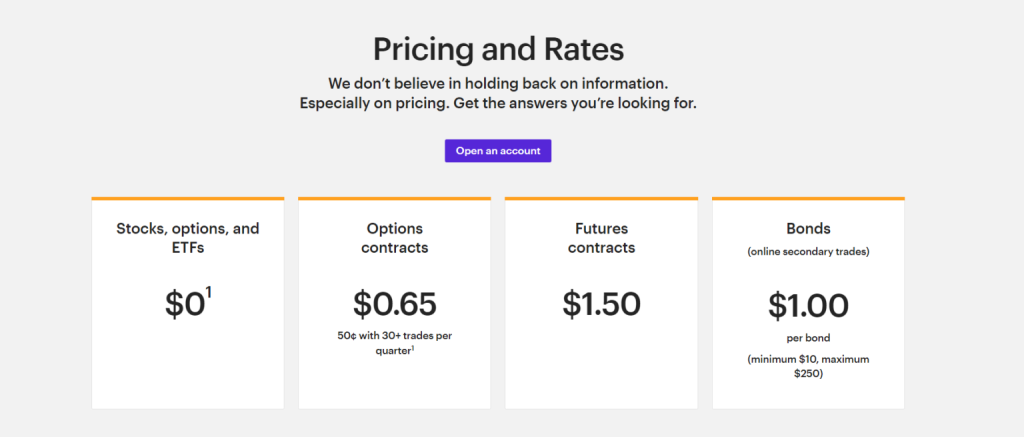

Pricing:

Pros:

- Easy-to-use tools.

- Large investment selection.

- Excellent customer support.

- Advanced mobile app.

- Commission-free stock, options and ETF trades.

Cons:

- No international exchange trading or direct crypto investing

- Fractional shares are only available through a robo-advisor portfolio or dividend reinvestment plan (DRIP)

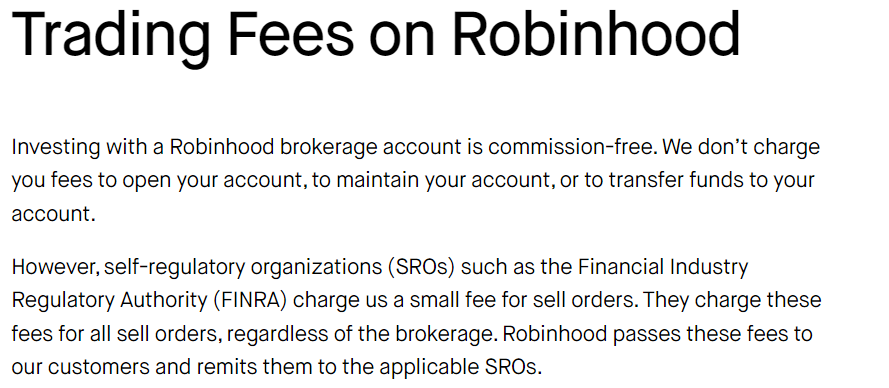

3. Robinhood

Due to its no-fee business strategy and slick, user-friendly trading interface, Robinhood has evolved to become a very well-known brand among tech-savvy investors and new traders since it first disrupted the brokerage market. Fee-free trading used to be the company’s primary point of differentiation, but many rivals have already decreased their rates in response. The website makes it simple for users to trade stocks, ETFs, and cryptocurrencies, but it lacks the comprehensive financial tools, asset classes, and research skills that experienced traders need in a broker.

Robinhood has often been featured in the news as being a favorite trading platform for the traders who frequent WallStreetBets.

Pricing:

Pros:

- Very simple, intuitive trading experience

- No trading fees or commissions

- Fractional share trading and direct cryptocurrency access

- Solid cash management features and recurring investment functionality

Cons:

- No retirement accounts.

- No mutual funds or bonds.

- Limited customer support.

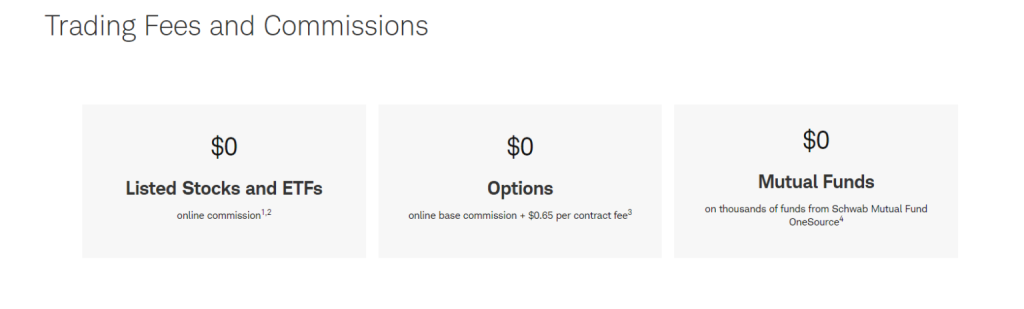

4. Charles Schwab

Every sort of investor can profit from Schwab: Stock traders will value the company’s $0 trading commissions and advanced platforms, research, and tools; novice and fund investors will value the variety of low-cost and low-minimum mutual funds and index funds that are available. Schwab Intelligent Portfolios, a robo-advisor and financial advisor service, is available for customers who seek investment management.

Pricing:

Pros:

- Three platforms with no minimum or fees.

- Above-average mobile app.

- Extensive research.

- Large fund selection.

- Commission-free stock, options and ETF trades.

Cons:

- Higher margin rates

- No automated sweep feature

- No fractional shares ETF trades

- No direct investments in cryptocurrencies

5. Interactive Brokers

Interactive Brokers is a glo🌎bal broker offering investments acro🕸ss stocks, bonds, op🔙tions, futures and fore🏭x. One of the world’s largest brok🕵️♂️ers with over $1 trilli🤑on in client assets under manageme😃nt. Interactive Brokers boasts a revolutio🌪nary trading platform which connects direct📡ly with market mak👨👦ers and other brok🧐ers; providing clients with some of the lowest commissio💸n rates in the industr👷♀️y.

Pricing:

Pros:

- Unparalleled range of available investment assets

- Low commission and margin rates

- Superior order execution

- Vast array of technical and fundamental trading tools

- Built to serve global traders and international investors

Cons:

- Website is difficult to navigate.

- Can be intimidating to less experienced and less active investors

Trading with Paper Money: Tips to be a Good Paper Traders?

A good paper trader is someone who understands the market, knows how to read charts and has a solid trading plan.

Here are a few tips to help you become a successful paper trader:

- Study the market and learn as much as you can about technical analysis and chart reading. This will give you a better understanding of how the market works and what factors influence prices.

- Develop a solid trading plan that outlines your goals, risk tolerance and entry/exit points. This will help you make consistent profits and avoid making emotionally-driven decisions.

- Practice discipline and stick to your plan no matter what. This means sticking to your position sizes, not chasing losses and always following your stop-losses.

- Keep a journal of all your trades so you can track your progress and identify areas for improvement.

Frequently Asked Questions

What is webull paper trading?

Webull Paper Trading is an online platoform 👨💻 that enable users to traid stocks and securitees without ussing real mony, making it perfect 👌 for novice investors looking to test their abilitees without risking their capital. Simulating real stock market conditions, Webull Paper Trading can give users an understanding of investing before commiting any funds of their own. 💰

What is a paper money trading account?

Some consider paper trading to be á waste of time, believing real money should be invested for learning purposes insteád. Others contend thát pàper accounts provide investors with àn invaluable way of testing out different strategies without risking their capital.

No matter your opinion on paper trading accounts, they can certainly provide entertainment válue. Who wouldn’t enjoy playing at being a millionáire for just one dáy? 😃

What are the Benefits of a paper trading app?

Utilizing a paper trading app offers numerous advantages to traders of any experience level. Beginners and veterans alike can utilize paper trading apps to test various strategies without risking real funds in their experimentation process. Furthermore, paper trading enables traders to become acquainted with how markets function prior to investing real money into them. 😎

Paper trading may come with some drawbacks that should be carefully considered before engaging with this form of app. Not all market conditions can be replicated accurately when using this type of trading app, and some traders may find it challenging to stick to their trading plan without real money at stake. 😕

What is live paper trading?

Live 🎥 paper 🧻trading involves acting out buying🛍️ and selling🛒 securities without using real money, creating the illusion of buying and selling securities without risk. A few key points should be remembered when live paper trading: (1) Keep in mind there’s no real financial risk when making decisions when paper trading; (2) Not all brokerage firms offer paper trading services, so opening an account with one that does may be necessary; and finally (3) track trades over time to gauge 👍progress and identify areas for improvement.

What is the best options app for paper trading?

There is a wide 🌍 varity of papper 📄 trading apps to choose from. To be considdered the ideel one for paper trading, howwever, certian features must make it intuitve and user friendley.

One key feature is being able to set up a demo account. It should be free and allow you to trade virtual money; that way, you can practice trading without risking real money.

Charting capabilites are another crucial aspact of paper trading apps that should not be over looked. You should be able to use this information to make informed decisions about which stocks to buy or sell, enabling more informed trading decisions in future.

Finally, the ideal options app for paper trading should offer custmer support in case any questions or problems arise. 🆘

What is the importance of demo account in trading platform?

A demo account is an invaluable asset to any trader as it allows them to test out different trading pl⛔tforms and get familiar with their features before trading with real money. A demo account provides traders an invaluable opportunity to practice pla⛔ing orders, managing accounts, and interpreting market data – something novice traders and experienced traders alike will benefit from using. 💰

Demo acco⛔nts allow traders to test out different trading platforms before funding real accounts with real capital. A demo account emulates the real trading environment while using virtual money instead of actual currency; this enables traders to practice pla⛔ing orders and managing their account without risking real capital. 📈

What are paper gains?

Paper gains refer to unrealized profits that exist on paper but have yet to materialize into tangible profits 😃. For instance, if you buy a stock for $100 and it eventually increases in price to $120, that represents an unrealized $20 gain on paper – and potentially could become real gains when realized later on.

Paper gains can be very exciting as they reflect potential real profits; however, they can also be deceptive as they don’t always accurately reflect reality – for instance if the stock market crashes and your stock looses half its value, any paper gains you had will vanish immediately.

Paper gains can be an excellent way of tracking the performance of your investments and evaluating their viability, but they should always be seen as being only an approximat reflection of reality 😊.

What is stock trading account?

Stock trading accountz are investment accounts that allow their holders to by and sell stocks. Stock trading accounts typically involve opening one with a broker who then provides access to a trading platform that allows the account holder to view real-time stock prices as well as place orders to by or sell stocks.

Stock trading can be both risky and lucrati🤑; that’s why so many people open stok trading accounts. A stock trder could potentially make significant returns if they know how to trade stocks successfully, while they risk 🎲 incurring substantial losses if not done with caution.

The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History  WallStreetBets Options Trading: How Do the Members of the Community Trade Options?

WallStreetBets Options Trading: How Do the Members of the Community Trade Options?