Trading options is often an enigma to those new to it, leaving many individuals perplexed about its viability as an income stream. Many may wonder: Can You Really Become Rich Trading Options? 🤔

And that is exactly the question we aim to answer in this article.

But first, let’s investigate what options actually are.

How Do People Make Money Trading Options? The Basics of Answering, “Can You Get Rich Trading Options?”

When purchasing and selling stocks, you are purchasing one share for each stock you acquire or sell.

This is the standard way of investing and trading, and most people understand it well: to buy shares in any given company, simply open an investment account, fund it with money from any source you can find and buy as many stocks as you can afford.

Simple? ? Right. When signing up with an online broker and creating an account (depending on what type of account it is), typically what is called a “Margin Account” will be created for you.

Simply put, an online broker will extend you a certain amount of credit so that when purchasing or selling stock you don’t have to pay 100% of its value upfront.

By borrowing their money to buy or sell stocks that would normally be beyond your reach, this strategy provides some leverage.

Leverage plays an essential part in answering the question “Can You Become Rich Trading Options?”

Online brokers will often only require you to invest 30-50% of the stock’s value upfront – providing you with two to three times greater purchasing power.

Let’s quickly examine an example. 🧐

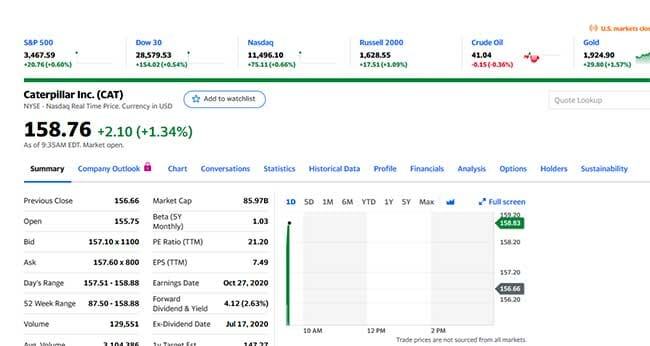

Let’s say that you wanted to buy shares in Caterpillar (CAT). From the picture you see below, the shares are currently trading at $158.76.

So if you wanted to buy 100 shares WITHOUT a margin account, you’d have to come up with $15,876.

But if you had a margin account where you only have to put up 30% of the value of the stock, you’d only have to come up with $4,762.80 (roughly).

Can you see how powerful leverage can be?

Now all of a sudden you’re able to buy and sell a lot more stock than if you had to come up with the full amount.

If you’re looking for an online broker that can give you this sort of margin, I highly recommend you check out Questrade here.

Now that you’ve got an idea of just how leverage works, we can start talking about trading options, as leverage is a key concept to understand before you begin trading them.

When it comes to trading options, you aren’t buying shares like when you purchase stock.

Rather, it’s almost like you’re renting the stocks for a certain amount of time.

So if you buy options on CAT, you’re essentially able to control a certain amount of shares for some time. It’s said you have the option – but no the obligation – to where you can buy the stock at a certain price.

Instead of buying shares, you buy option contracts. Each contract typically controls 100 shares of stock (which can vary depending on the stock – be sure to check before you put your money up).

For now we’ll only look at simple directional options trades (which are the same as the weekly trade alerts that we give out inside our membership site, “The Empirical Collective” found here) where you buy “Puts” or buy “Calls”.

If you think the value of the stock will increase you would buy “Calls”. On the other hand, if you thought the value of the stock was going to fall you would buy “Puts”.

Now, from our example CAT is trading at $158.76 – so let’s say that you think the value will go up.

So you can select any strike price on the Call side. If you chose to buy the 157.50 strike, your trade is “in the money” meaning that the value of the stock is above what you have the ability to buy the stock at ($157.50). If you bought the 160 strike, your call contracts would be “out of the money” meaning that the price of the stock would have to increase beyond $160 for you to make money.

At the time of making this example, it was Oct 9 2020. So if you bought the 160 calls, essentially you’d be saying that before the end of the trading day (as the contracts in this case happen to expire on October 9, 2020) the price of CAT stock will be above $160/share.

In order to buy the 160 strikes, you would pay between the Bid and the Ask price for each contract (just like you do when you buy stocks). So you’d pay between 0.20-0.11 per contract.

Let’s say that you wanted to buy 1 contract and got it filled at $0.16.

As each contract controls 100 shares of stock, the cost would be $0.16×100 shares per contract = $16.

In this way, you could essentially rent 100 shares of CAT stock for the day for $16.

Now, options contracts are typically offered at the end of each trading week, where they expire on Friday. So you can set the time you rent the stocks for almost any length of time by just buying contracts that expire further away or closer to the date you purchase them.

And you can buy contracts at almost any strike price you can think of, so you have…well… a lot of different options when you’re trading options.

The further out of the money your contract is, the less you’ll pay per contract.

Also, if your contract expires pretty quickly (like our end of the day expiration example) they will cost a lot less as well.

And this makes sense, because with either less time available before the contract ends or the more the stock has to increase or decrease in value in order to reach your strike price, the less likely it is that the contract will reach your strike price. And because the odds of this happening are lower, the price you pay per contract is then lower than if the strike price was closer to the price the stock is currently trading at.

Now, if you thought the price of the stock was going to drop, you’d buy “Puts” and the process would be the same way – you’d just be looking at the columns to the right.

Getting back to our example of leverage, can you now see how you can really leverage a small amount of money by trading options when compared to having to buy stocks on margin?

Of course, the trade off is that your timing for the stock to move in the direction you want has to be correct or you’ll lose whatever money you’ve used if your contracts end up “out of the money” when the expiration date comes.

So getting back to the question, “Can You Get Rich Trading Options?” – as you can see, with this kind of leverage, the answer is a resounding, “Yes!”

If you’d like to learn more about how to trade options, I suggest you read the book “How to Make Big Money Fast Trading Options” here.

But if you’d like to get trading options immediately and leverage your money right away, you can always sign up to receive simple directional options trades through our membership site here.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History