The 52-week money challenge (featuring our amazing how to save $5000 in a year chart) is an excellent way to save $5,000 by the end of this year. This article will show you how much it takes and what your options are to save that much cash!

What would $5K mean in your life? Would you use it pay bills or take care of other financial needs like giving gifts to others or buying a used vehicle for yourself? Maybe you’d rather spend it on something fun like going on vacation somewhere warm investigating the new & unique things that seem to be happening around every corner.

And I’m not being crazy here – having a goal like that can really help motivate you to where you feel like those weeks disappear a little faster!

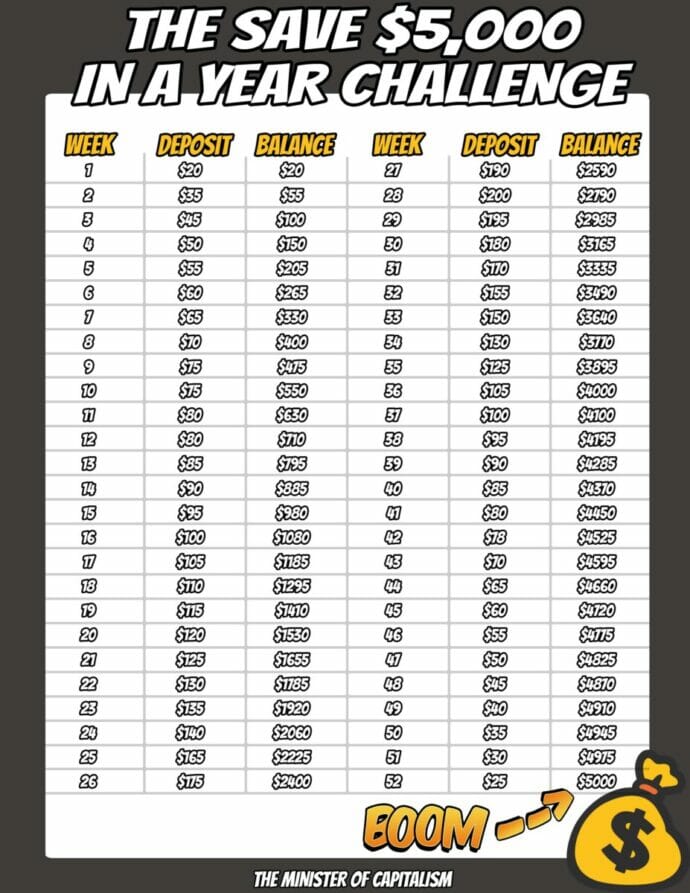

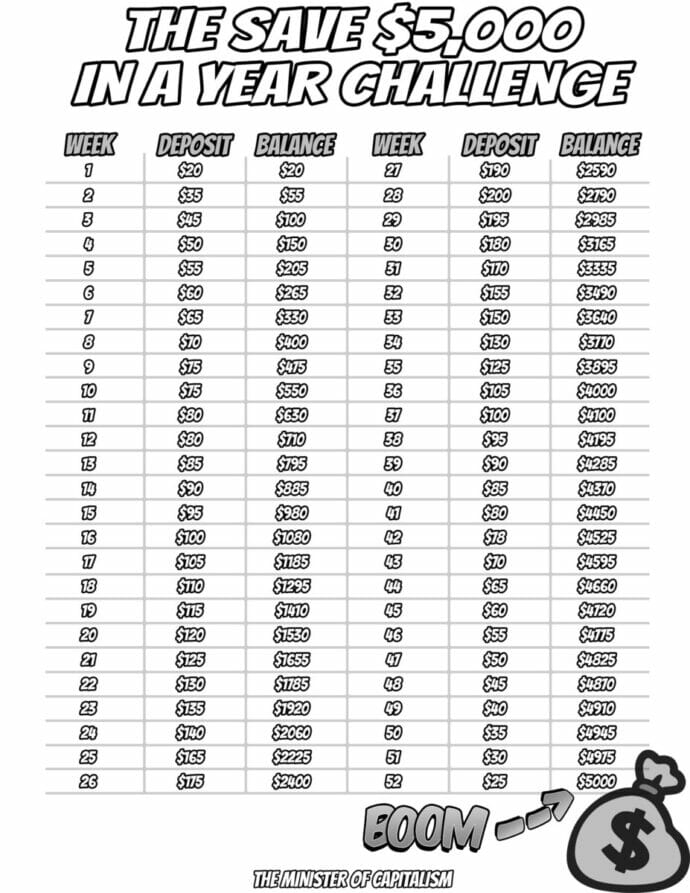

52-Week Money Challenge: The How to Save $5,000 in a Year Printable Chart

Click Here to Download The Printable Versions (Color and Black & White Versions Included)

Click Here to Download The Printable Versions (Color and Black & White Versions Included)

The 52-week money challenge is designed this way for a couple of reasons. You start out with relatively small amounts, making it easy for you to meet the weekly savings goal. As you do this, you’ll continue to build confidence as to how much you can actually save each week, forming a new habit!

The 1 year long program starts with you saving $20 during week 1. In week two, that amount jumps to $35 bucks, and keeps increasing each week.

At the end of week 16, you’ll have already saved over $1,000, and by week 35, you’ll have almost four thousand stashed in your bank account.

Saving money is a habit, one that can easily become ingrained and built into your daily routine. That’s why we start you out slowly with the goal in mind: To prepare for the weeks when you save larger amounts in the middle of the year.

We’ve tried to design this challenge in such a way that it allows for you to life your life, while still being able to save the $5,000.

If you end up taking this challenge at the start of the new year and have spent more than normal during the holiday season (which, let’s be honest – is pretty typical), we’ve started the challenge off using smaller savings amounts.

In this way, you can ease into the habit of saving.

Saving $5,000 in a year is no small feat

I’m sure the thought has been running through your mind: “Where will I come up with $5,000? I’m stretched thin as it is!”

But it’s possible to find hundreds if not thousands in savings by targeting a few categories where with significant cost-saving opportunities.

Some of the big ones include these spending areas:

- Your Internet Subscriptions

- Cell phone/Cable TV/Internet Service

- Insurance like home or auto insurance

- Heating rates for your house

- Food: like eating at restaurants, ordering in, or buying extra snacks that you might not need.

Internet Subscriptions

With so many online subscription services out there (like Netflix, Disney+, IFTTT and so on) these expenses are almost hidden from view, but can add up significantly when it comes to sticking to a monthly budget.

A good idea is to list and go over all of your subscription services to see if there are any that you can live without.

Cell Phone, TV, Internet Providers

If you’ve been paying for your cable or satellite TV service and it’s costing more than $100 a month, then switching over to an online TV service (like Amazon Prime) could save you up tp 1k over the course of a year!

As for your cell phone provider, did you know it’s not uncommon to pay $40 for the same unlimited service using one of your existing providers’ sub-brands?

Regardless of whether you want an affordable cell phone plan or just reduce the amount of data you have, many money experts say that smaller carriers offer better value.

Check out great options like Cricket Wireless, Total Wireless or Mint Mobile.

You may find yourself saving ~$50 per month just by doing that!

For internet service providers, don’t be afraid to call them up and tell them you’re thinking of switching providers. This is often enough for them to offer you an additional discount to stay.

If that doesn’t work, you can always see what their competitors can offer you.

Insurance Services

You’re probably not saving as much as you could on your home and auto insurance. But you can cut the cost of these products by seeing what the competition can offer.

So don’t sleep on this one, as many people ignore this and spend more than they should.

Most people just assume that they’re getting a good deal. In reality, there are often other companies out there who offer lower rates who would love your business.

Getting a little more creative: Did you know that the typical auto insurance customer can save up to $500 a year by bumping their deductible from $250 up to $500? If you push your deductible even higher to $1,000, you will end up saving a cool thousand bucks.

Heating Rates for Your House

In over half of the states, you are allowed to shop around to find other providers for your electricity or natural gas due to the industry being deregulated.

That alone could save you each and every month.

To take it even a step further, by installing a programmable thermostat, the typical household can lower their heating and cooling costs by 20-25% during winter time or summer months.

Food

Many households spend a lot of money eating at restaurants, and ordering take out.

In fact, the average American spent $67 a week on takeout in 2021. That’s $268 per month.

And for a household, that amount is often much higher, generally over $500 per month.

With a little advance planning and a willingness to make more meals at home, that can be a huge monthly savings.

Don’t Just Save, Start Making Making Money

Cutting your budget is never an easy task. (Even with the incredible how to save $5000 in a year chart I gave you!) But sometimes, you might just run out of places to cut. And that’s when making more money becomes an important option for survival!

Concluding Thoughts on this 52 Week Challenge

You’ve already seen the 52-week money challenge and the how to save $5000 in a year chart – so you know how to get started.

But I have one last tip to help you get started: Open a dedicated account with an online bank! That way your savings efforts can grow even more in a high interest rate account.

Then each and every time you deposit a little more into that account, it has the opportunity to grow and compound over time.

It will be some of the easiest money you’ve ever made. 😀

Click Here For My Story About This

When Slacking Off Made a Small Biz Owner $40k Each And Every Year

When it comes to choosing between making money and saving money, most would rather make money.It’s seen as the sexier option, because it’s the great enabler that allows you to buy and consume even more.Saving on the other hand, is seen like the abrasive and depressing uncle you always try to avoid.

But saving money doesn’t have to be as painfully grueling as you think.

Years ago, I worked in the manufacturing industry for a small business.

And from the management and ownership side, it was in complete disarray.

The place was disorganized, the employees were unhappy and they weren’t making nearly as much money as they could.

The owner had this strange habit of making repeat parts for customers even though he lost money doing it.

When the owner’s wife mentioned they lost $40,000 every year making parts for a certain customer, I was shocked.

For the life of me, I couldn’t understand why he kept doing this.

To top it off, the customer wasn’t even nice!

They were extremely demanding and abrasive, and routinely had tens of thousands in outstanding invoices that they hadn’t paid.

At this point, the customer had been marketing his products for about 5 years. So it wasn’t like it was a new product that needed time to get known in the industry.

To make matters worse, the parts were extremely time-consuming to make, and were plugging up the shop’s ability to take on any new (profitable) work.

I couldn’t help myself.

I had to bring these things to my boss’ attention.

So I made my case, citing all of the points above.

I pointed out that by firing this unprofitable customer, it would be like giving himself a $40,000 year raise.

(Of course, to MAKE $40,000 you would have to generate a higher pre-tax amount to realize the full $40,000… but for the sake of illustration, let’s not get hung up on the details.)

I even doubled down.

I said he could fire the customer, hire another worker and then make them sit on a stool in the corner all day and the company would be in the same financial position as it was by making parts for that customer.

Eventually my old boss came around and told the customer that it just wasn’t working out.

And as soon as he did, he added a cool 40 grand to his bottom line and increased the shop’s capacity to take on more profitable jobs – all by doing less work.

When it comes to saving money, I this example always springs to mind.

Saving money doesn’t have to mean depriving yourself of all things fun and exciting.

Sometimes it’s as simple as taking an honest look at your finances and making a couple of simple adjustments.

And at the end of the day, plugging holes in your financial ship makes sailing through life a lot less stressful.

With this in mind, I’ve come up with a simple to follow 52 week savings plan that will land $5,000 in your bank account in a year.

Sound impossible?

Well, just like my old boss, saving a big chunk of money isn’t always as difficult as you might expect.

Click here to download the printable plan and see how you can make it happen.

Here’s to saving painlessly!

Your Minister of Capitalism,

Brett Davison

Get Hedge Find Beating Options Trades Delivered to Your Inbox!

Tired of missing out on the huge gains in the market?

Wishing you knew which trades had the best odds of succeeding?

Would you like to know EXACTLY how & which trades to place WITHOUT having to spend years learning?

Well now you can let our Team of Trading Experts & Exclusive AI Trading Software do the work for you!

When searching for a how to save $5000 in a year chart, many people often wondered what the answers were to these questions:

How can I save 5000 in a year?

There are many ways to do it. But a few practical ideas involve cutting back on the types of food you eat.

A few common sense savings strategies include the following steps:

– assessing your food budget to see where you can cut back or save more, or cutting certain things out entirely.

– cooking from scratch instead of buying pre-packaged foods at the grocery store. This not only saves a lot of money, but it also allows you much greater control over your nutrition and health.

– avoiding wasting food – if you’re hungry soon after eating, have a snack instead so as to avoid going out and buying another meal

How can I save $5000 in 6 months?

It’s possible to save $5000 in 6 months by making a list of expenses and cutting as many as you can out. Living as frugally as possible, cooking your own meals at home, grocery shopping with a list and preparing for trips ahead of time can help cut down on unnecessary spending. Another good step is to challenge yourself to spend $1 less every day than you already do.

How can I save 5k in 12 months?

Here are a few ideas on how to do that:

1. Set your budget and try to stick to it.

2.Consider shifting to more of a minimalist lifestyle. This protects your family from buying items that aren’t needed, and that you have no space for, or will never use. It also teaches kids about the value of hard work and being satisfied with fewer things.

Buying quality items later in life instead of cheap ones often provides much better value in the long run.

3. Give up your daily latte that costs around $4 depending on where you live, and five dollars saved each day equals 150 in a month and 1,800 in a year. And that’s just one example of how small daily expenses can really add up over time.

How much money do you save in the 52-week challenge (if you don’t use the how to save $5000 in a year chart)?

In this case, the idea is to save $1 on the first day, and then add an additional dollar to the amount being saved every day after that. So Day 1 would be $1, Day 2 would be $2, Day 3 would be $3 and so on.

By the end of the year, you would have saved $1378.

How can I save $5000 in 3 months?

1) Cut your expenditures by $1000-1500 per month. Assess what you spend and find ways to cut back on items such as entertainment, eating out, alcohol, subscriptions to tv/youtube/Netflix services.

2) Find freelance work online at sites such as Fiverr or Upwork to earn an extra $500-1000 per month.

3) Do something productive with the remaining time – take up a hobby, learn a new skill (whether it be computer programming or photography), and other energy- and mood boosting activities might include exercising (and eating healthy), volunteering in your neighborhood or community organization, doing volunteer work for an animal welfare shelter.

4) Alternatively, don’t do anything that will incur any extra costs.

How can I make $5000 quickly?

Ask a rich person for it. 😀

But if that doesn’t work, then maybe try one of these methods:

-get a second job or become an entrepreneur and set up your own business

-rent your dorm room out on airbnb/spring break berkshires/etc. But if you decide to do this please be safe! Check reviews, use safe practices like verification, background checks, lockable doors and so on.

How can I save 10k in 3 months?

First, you’ve got to understand how saving typically works.

The basis for a saving lifestyle typically hinges on two things:

1) setting a minimal amount that you’ll need to spend monthly and then determining which expenses can be “trimmed” from your budget

2) growing your savings continuously by keeping them in a separate savings account with a high rate of return.

Establishing these two things benefits the saver a couple ways:

1) it will make it more difficult to withdraw cash from funds because they won’t be readily available in hand or through an ATM

2) it establishes good habits

How do you save money fast for a 26 week money challenge?

Here’s what I would recommend with regard to budgeting for a 26 week money challenge

1. If you want to save $100 each week for this 26 week money challenge, then that means you’ll need to set an initial goal of saving $2600 before you get started. This may sound trivial, but setting a well defined goal is a big part of succeeding.

2. For this particular case let’s say you make about $500 per paycheck or bi-weekly, so that would mean setting aside ten percent of your paycheck is not too bad; but if it were hard to set aside even 10% go ahead and try setting aside 20% (that way getting back down later is easy peasy); the idea here is to save as much as possible and really stretch yourself for a certain amount of time in order to maximize your savings.

What is the 5 dollar savings challenge?

The idea behind this particular challenge is to save each and every $5 bill you receive.

So if you pay for something and get any $5’s back as change – you’d save them.

The goal is to save all the $5’s you get during the year – stash them away – and then count them all up at the end of the year to see just how much you’ve saved.

When is the last time you took out your bank statement and combed through it looking for recurring charges?

This is an often overlooked action. And it’s too bad because it can have incredible results when it comes to saving you thousand of dollars every year.

What can I do for extra money?

There are lots of different ways that you can earn extra cash, such as:

– Having a go at property investing.

Tired of renting and want to finally be a homeowner? You could find something on the market now or invest in property that will provide you with an income, capital growth and some come early retirement day reality.

– Freelancing on Upwork. Look for gigs relevant to your area of expertise and soak up those skills — it can help you pick up great habits like deadline finishing, prioritizing and structuring projects (read: make better employees!). Don’t forget to work around your current commitments; after all, no one knows what you do as well as you do!

– Work from home! There are so many remote and work from home opportunities coming available these days that you should be able to find something that will work well for you.

Of course, working a second job is a great way for you to earn extra money. And if you look for one that will take up as much time as possible, you won’t have the luxury of spending the other time on leisure activities. After all, it’s often in times of leisure that we find ourselves spending extra money. You could be a personal assistant or nanny in your spare time, tutor kids after school, bartend at night-time events in the area, freelance write articles/blog posts… it’s really about what can you do and can make money from?

Where am I going to come up with $5,000?

The first thing you want to do is create a budget and cut down your expenses. If there’s still no way for you to come up with $5000, consider pawning some of your possessions and selling what you don’t need to free up some extra cash.

Aside from that, you’ll have to take on additional work. Whether that comes in the form of a side hustle or an extra job will depend on you and your skills and abilities.

The [Best] Cash Back Apps for Amazon – Here’s How You Can Get Money Back on Every Purchase!

The [Best] Cash Back Apps for Amazon – Here’s How You Can Get Money Back on Every Purchase!  Earny Reviews: Is Earny safe & Does Earny Work?

Earny Reviews: Is Earny safe & Does Earny Work?