The Wendy Kirkland P3 system (otherwise referred to as the Wendy Kirkland Price Surge System) has been getting some attention from traders lately.

So it begs the question: Is this system (or any of the wendy kirkland books for that matter) any good?

That’s what we’re going to look into here, starting by looking into Wendy Kirkland herself.

About Wendy Kirkland

Wendy Kirkland is a trader who has made a name for herself in the world of finance. After enduring a disaster that destroyed her successful gift shop, Wendy became obsessed with trading options and eventually wrote a book on the subject. In addition to her trading experience, Wendy also claims she’s an expert on chart patterns and stocks. This led her to create the Price Surge System, which is designed to help traders capitalize on stock movements.

Wendy’s years of experience and expertise have culminated in the Millionaire Maker Research Center, where she helps people from all walks of life learn about financial security and navigate through changing markets. Her latest project is the Price Surge System, a comprehensive program that includes a book, DVD, and newsletter. The service provides weekly charts, newsletter samples, and performance insights.

The Price Surge System

In the Price Surge System, Wendy Kirkland explains a number of different chart indicators while trying to paint a clear picture of her trading plan in the P3 System. Her goal in doing this is to bridge the gap between being a beginner and a seasoned trader. In writing this book, she is trying to equip beginners with the knowledge they need successfully increase their option trading education, while at the same time serving up a strategy that will help experienced option traders with its ability to accurately predict and time bursts of upward stock movement.

In the Price Surge System, Wendy Kirkland explains a number of different chart indicators while trying to paint a clear picture of her trading plan in the P3 System. Her goal in doing this is to bridge the gap between being a beginner and a seasoned trader. In writing this book, she is trying to equip beginners with the knowledge they need successfully increase their option trading education, while at the same time serving up a strategy that will help experienced option traders with its ability to accurately predict and time bursts of upward stock movement.

P3 System: Option Trading Basics and Putting Profit Probability Potential On Your Side

When trading options, it’s essential to keep in mind that you are playing the odds 🎲. Your aim should be to maximize potential 💰profits while limitin🚫 losses – which is where Wendy Kirkland P3 System comes into play.

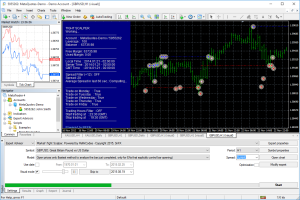

The P3 System is an intelligent piece of software that assists traders in making money 🤑 by identifying short-term price patterns and openings. This is accomplished by taking into account three factors – probability, pattern recognition and price projection – giving traders an edge in the market and increasing 🤑 chances of profit while decreasing📉 risks.

So how can you utilize the P3 System effectively? The first step to usin🔧g it effectively is learning its correct use; this includes understandin🤔 the basics of option trading and chart reading. Once you’ve done that, then using the P3 System to identify high probability trades with excellent 💹profit potential will become possible – remember it’s always better to play odds in your favor!

Testimonials

After searchin🕵️ for testimonials online, we came across such ones on Wendy Kirkland’s site:

At first, when I learned about Wendy Kirkland Price Surge System, I was skeptical; but after learning more and watchin some videos by Wendy herself, I decided to give it a try – and am glad I did! This system is easy and works wonderfully. Thank you, Wendy!

I have been using the Wendy Kirkland Price Surge System and it has made me quite a lot of money! Thank you for creating it!

Thank you so much for creating the Wendy Kirkland Price Surge System; it has enabled me to make so much money quickly!

Although these testimonials weren’t exactly problematic for us, we found them a bit generic compared to many of those found at The Empirical Collective which contain more specifics in them.

Trade Results

On their website, we saw Wendy mention a win/loss percentage of 75% with this strategy and claims she completed 268 trades between January 2018 and December of 2021 generating profits of $70.774.

Final Thoughts

Overall, we don’t have much bad to say about the wendy kirkland p3 system.

While the cost seems reasonable enough ($99 upfront), with the low win rate, it’s hard to see how their system really offers much value at all.

But before we close this article, we should probably mention a few of her other products, as she has so many :).

Also, for more wendy kirkland reviews, you can visit our article here.

Related products

Wendy offers a lot of different products on her website, and we’ll go through a few of them here.

Weekly Options

Weekly options are a unique trading opportunity. They are only available to members of the Kirkland 120 Weekly Advisory Group, which you can subscribe to on a monthly or quarterly basis.

Weekly options typically expire within one week, so trading them is an immediate trading strategy This makes them a more cost-effective way to trade around short-term patterns and events in specific time periods. For example, many traders focus on straight forward long term trades, holding them for months or even years at a time. However, weekly options offer an alternative approach and can be valuable tools when used correctly.

Of course, you can lose that much faster if the underlying asset doesn’t move in the direction of your trade too..

Wendy Kirkland’s New “Alpha Moves” Trading Strategy

One of Wendy Kirkland’s trading strategies is called “Alpha Moves”.

According to their website, this strategy is based on the idea that there are highly probable patterns in the market which can be identified and exploited for profit.

This statement isn’t helpful or very specific, as essentially ANY stock trading strategy is trying to do this exact thing.

When we looked on her website, we couldn’t find any information other than she claims she adjusted the strategy to reflect the current market conditions.

On their site, they claim they have a trade history for this strategy of a 78% winning percentage, with an impressive 355% gain.

But there aren’t any specifics about any trades that were placed, so it’s hard to say whether this is ACTUAL data or theoretical data based on a backtest.

The other thing, is that we didn’t see whether she comes up with a recommendation based on collecting premium (IE from the selling of options) or if she is doing something like just buying simple calls and puts.

Because the strategy itself will require a certain level of capital required just to be able to make the trades if you do decide to follow her trade ideas.

FAQ

People also asked the following questions when looking for information on the wendy kirkland price surge system:

How do you trade options?

In order to trade options, the trader must first create an option contract. This can be done by buying or selling a call or put option on a given security with the intention of profiting from the difference in the price of that option over a certain period of time.

Why do you need a stock scanner?

A stock scanner is software that helps you to find opportunities in the stock market. The software can help you identify stocks that are undervalued, as well as ones with a high potential for growth.

When an option does reach expiration, and the holder wants to exercise it, who do they buy the shares from (or sell the shares to)?

In a typical option contract, the buyer has to purchase shares from the seller in order for the holder to exercise their right.

When deciding how much money you need:how much are you looking to make per day?

When you’re starting out in day trading, it’s important to think about how much money you need to make each day in order to reach your goals. How much profit do you want to see each day?

If you’re looking to make $500 per day, that would mean a yearly profit of $126,500. You could achieve this by trading for just 45 days at the $500 per day level. But remember, these are just averages–your results may vary.

It’s also important to keep in mind that your profits will depend on the market conditions and your skill level as a trader. So don’t get discouraged if you don’t start making money right away! It takes time and practice to become successful in day trading.

Does following the wendy kirkland trading system generate weekly profits?

No. We found her system has a low win rate when compared to other competitors (like The Empirical Collective) and she doesn’t offer much in the way of extra value add ons. Instead, she tries to upsell you on purchasing additional material through her website here.

How does day trading work?

The day trading process is often referred to as “swing trading”. This type of trading is a strategy that uses short-term movements in the market and looks for momentum. Swing traders will buy and sell stocks for profit, often within a few hours.

How much money do you really need for day trading?

The minimum amount of money you need in a trading account to day trade is $20,000.

But if you’re swing trading (which is generally better for most people), it depends on many factors, including the size of your trading account and the amount of risk you are willing to take. You can start with as little as $500 or $1,000 and trade with as little as $2 or $5 per trade.

When you’re starting out in day trading, it’s important to have realistic expectations about how much money you can make. Many new traders think they can earn a living day trading with just a small account size, but that’s not the case. In order to be successful at day trading, you need to have a lot of capital so that you can trade multiple contracts and increase your buying power.

Most successful day traders use a margin account, which allows them to borrow money from their broker to purchase more stocks. This increases their buying power and allows them to take advantage of opportunities that would be unavailable if they were using a cash account.

For this reason, most professional day traders have accounts with at least $50,000 or more. This gives them enough capital to trade multiple contracts and still maintain a low risk per trade.

It’s also important to have realistic expectations about how much money you can make as a day trader. Many people think they can quit their job and live off of their day trading profits, but that’s rarely the case. Day trading is hard work and it takes time and practice to become successful. The average person who tries day trading will likely lose money in the first few months or years before becoming profitable.

That said, it is possible to make a living day trading if you’re patient and willing to put in the hard work. But it’s important to remember that it’s not a get-rich-quick scheme; it takes time and effort to become successful.

If stock trading isn’t a good fit for you, check out our articles on Can You Get Paid to Watch Tiktok? Here’s What You Need to Know or our article on Can You Make 200 a Day with Doordash? Find Out How to Maximize Your Earnings — or you could start with the basics by reading our article on Investing in Options: A Beginner’s Guide

What are puts and calls in options trading?

When you buy a put, you have the right to sell the underlying security at the strike price.

A call is the right to buy the underlying security at the strike price.

Both options expire on the same day.

You can only exercise your option if it is in-the-money.

If you own a call, and the stock goes down, your option will become worthless.

Why wouldn’t I be willing to pay $1,000 if I can see that the system will make me $10,000 a year?

It’s understandable that you might be skeptical about this system. After all, who wouldn’t want to make an extra $10,000 a year? But let me ask you this: Why wouldn’t you be willing to pay $1,000 if you can see that the system will make you $10,000 a year?

I’m sure you’re wondering how this is possible. How can I guarantee such a high return on your investment? The answer is simple: I can’t. No one can guarantee any particular return on investment. But what I can tell you is that options trading offers opportunities for consistent income that far exceed anything else available in the market today.

But don’t just take my word for it, click the link above for a list of recently closed trades.

It’s incredible to see how they’ve been able to make money whether the market’s gone up or down .

The Best Option Alert Service: Top 7 for Trading in 2023

The Best Option Alert Service: Top 7 for Trading in 2023  5 Best Options Trading Newsletter Choices for Traders

5 Best Options Trading Newsletter Choices for Traders  Options Trading Club Review – A Comprehensive Guide

Options Trading Club Review – A Comprehensive Guide  [REVIEW] 8 Of The Best Option Picking Services on The Market

[REVIEW] 8 Of The Best Option Picking Services on The Market  How to Choose The Best Stock Options Advisory Service If You’re New To Trading

How to Choose The Best Stock Options Advisory Service If You’re New To Trading  The Importance of Options Trading Alerts Service Providers To Helping Improve Your Trading

The Importance of Options Trading Alerts Service Providers To Helping Improve Your Trading