So my friend, you’re interested in trying to figure out how to generate monthly income by selling puts are you?

Well, you’ve come to the right place then as I’ll give you the facts you need to know before you get started so you can make the most informed decision possible.

First of all, if you’re interested in selling put options for income (whether that’s on a weekly or monthly basis) you’ll have to have a solid understanding of what the basics of trading options are.

If you aren’t 100% up to speed on this, I recommend picking up a copy of “How to Make Big Money Fast Trading Options” first, as it will give you a solid foundational understanding of what’s involved, as well as making clear and defining different options trading terms.

Or if you’re wanting a really quick and basic refresher you can see the article I’ve written, “How to read options chains”.

Just to be clear on this, if you’re looking to generate monthly income by selling put options, this typically anything to do with day trading options.

If you’re selling put options to make a living, you’ll be using a swing trading style as it’s more of a passive income generation strategy as opposed to the much more “hands on” day trading approach.

So, if you’re still with me and aren’t looking to day trade options, let’s keep going.

The Basics of How to Generate Monthly Income by Selling Puts

If you’ve been following along my blog for any length of time, you may have already read the post on “Selling Covered Calls for Monthly Income” and if you have (and understood it) then basically what we’re going to be doing in this article is investigating the other side of this trade by looking into selling put options.

First things first, though.

Before you can begin selling puts you will have to make sure you’ve deposited enough money in your brokerage account and have taken the steps necessary to get your account approved by your online broker to make sure you’re qualified and allowed to sell put options.

Brokers all have different minimum cash requirements in order to be able to sell put options. But most of them require you to have either all of the cash needed to settle the trade sitting in the account or a large portion of it.

This is just to ensure that if you sell your put options and the trade ends up in the money, you’ve got enough cash in your account to cover the trade.

(If you’re still looking for an online broker with low cash requirements, I recommend Questrade.)

Now, don’t skip over this step like so many people do.

If you want to sell puts, make sure you’ve got your account set up before. It can take a little while to get it set up. (Well, that and some brokers can require $25,000 or more in an account before they will let you sell puts. So you might have to do some fancy financial footwork to fund your account first.)

But once you’re set up, you’re ready to get going on this.

Step 1 – Choose a Number Stocks That You Actually LIKE

If you’re selling puts the worse case is the trade ends up in the money and you buy the stock. (And this can be a pretty hefty amount of cash to come up with. Remember, 1 put contract controls 100 shares of the stock. So if you have to buy 100 shares or more of stock it can add up quickly.)

And if you’re selling puts for monthly income, your goal is to collect the premium and not own the stock.

So that’s your downside.

You can soften the blow of getting stuck with stock by only selling puts on something you’d like to own.

If you’re selling them on a company just because it’s volatile, you might not be happy to own it. A high premium value might not be worth it in some cases…

So with that in mind, I’d recommend you look to only sell puts on stock that you wouldn’t mind owning.

Use whatever metrics or thought process that fits your investment model here.

For me, I generally stick with well known stocks and preferably ones that issue dividends.

But I’ll leave that one up to you.

Step 2 – Get Technical

The goal of selling puts for income is to have stock price stay above your strike. So you want to choose stocks that will either stay the same in or increase in price.

(Because if the value of the stock drops below the strike you’ll end up owning the stock.)

To do this, you’ll want to put on your technical analysis hat and filter your list of stocks. After that you’ll be left with stocks indicating they are trading within a range or likely to go up.

If you don’t know what you’re looking for, I recommend you get this book on spotting positive charting set ups.

You’ll probably be trading put contracts that expire about a month from when you’ll place a trade. So you will want to look at charts 1-6 months out. This will give you an idea of the general stock trend (whether it’s going up or down).

This will narrow down your list of favorites a little more.

From there, you want to look at put strikes that have been shown as a level of resistance before.

Eliminate any stocks that don’t have puts at or below a resistance level. Then list the remaining stocks based on how much premium you will make if you sell the stocks.

From there you’ll be left with a handful of stocks that you can choose between to place a trade.

Let’s look a quick example using Telsa to show how you can generate monthly income by selling puts.

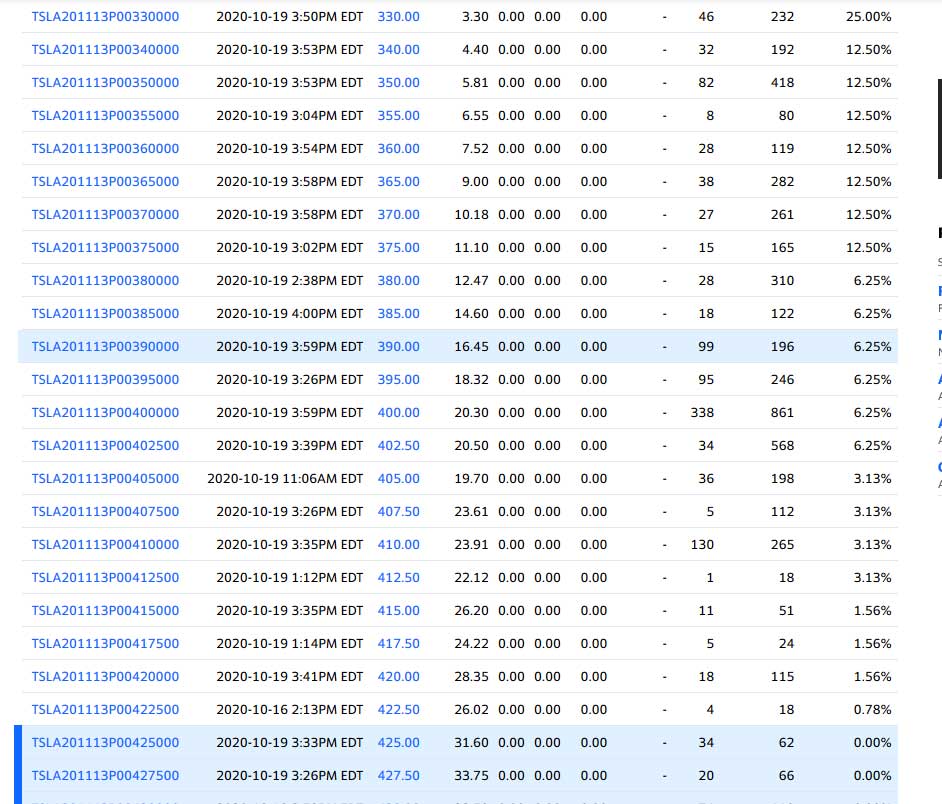

The options chain I’ve pulled up are for the November 13 Puts, expiring roughly 2.5 weeks away from when the screenshot was taken.

Let’s say you did your analysis & liked Tesla and wouldn’t mind owning 100 shares at $390/share.

Based on that, you could sell the 390 strike puts for $16.45/share. (When the screenshot was taken was before the market opened so only the last trade price is displayed of $16.45. No Bid/ask prices are shown.)

So if you sold 1 put contract it would bring you $1645 in premium for each contract you traded. ($16.45 x 100 shares).

Now, if the value of Tesla dropped, you’d have to cover the 100 shares of Tesla x $390 – $39,000.

How much of the $39,000 you’d have to have in your account to cover depends on your broker.

Now, this is just a rough example to illustrate the point. But you can see how you can generate some income with trades like this can’t you?

As an option seller, the odds are typically in your favor. This is because statistically the majority of option contracts expire worthless.

But even with that, you can end up owning a lot of stock you might not want to if you screw this up. And that could tie up a huge part of your trading capital with stock or you might lose if you sell them.

So if you decide to do this, I recommend following the trades of someone who has a proven track record of selling options.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History