In the past year, a group of amateur investors from the online forum WallStreetBets has taken the investing world by storm. These members of the community trade options in a variety of ways and have had success in many different types of investments. In this article, we will take a look at how the members of this community trade options and what some of their strategies are.

In the past year, a group of amateur investors from the online forum WallStreetBets has taken the investing world by storm. These members of the community trade options in a variety of ways and have had success in many different types of investments. In this article, we will take a look at how the members of this community trade options and what some of their strategies are.

How Does The Wallstreetbets Options Community Trade?

The Wallstreetbets options community is a group of traders who share ideas and strategies for trading stocks and options. The community is active on the Reddit website and has over 200,000 members. The community is known for its aggressive and often risky trading style. This has led to some big wins, but also some big losses – especially among those just starting to learn options trading.

One of the most popular strategies used by the community is the combination of calls and puts. The two types of options are calls and puts. A call is the option to buy a stock at a certain price within a certain period of time while a put is the option to sell a stock at a certain price within a certain period of time. Each type of option has its own benefits and risks.

Calls are often used when investors think that the price of a stock will go up in the future. Puts are often used when investors think that the price of a stock will go down in the future. If you want to see what stocks WallStreetBetst thinks will go up or down, visit WSBcheck.com

Some of the important terms that you just need to be familiar with if you want to start trading options, especially in the Wallstreetbets community are basic ones like terms such as Options, Options expiry, Options, exercises, and Implied volatility & IV crush.

Options

Options

In trading, options are securities that allow investors to buy or sell an underlying asset at a set price on or before a certain date. Put options give the holder the right to sell the underlying asset, while call options give the holder the right to buy the asset.

There are many different types of options that can be traded, and each has its own unique set of rules. Some of the most popular types of options include index options, currency options, and commodity options.

Options can be used for a variety of purposes, such as hedging against losses or speculative betting on future price movements. Options trading can be risky, but it can also be very profitable for those who know how to use them effectively.

Option Expiry

An option’s expiry is the date on which the option contract expires. If the option is not exercised by the expiration date, it expires worthless. The last day to trade most options is usually the third Friday of the month, but sometimes it’s the following Monday if Friday is a holiday. Expiries can occur any day of the week for weekly options.

Option Exercise

Option Exercise

When you buy a call option, you have the right but not the obligation to buy shares of the underlying stock at a set price, known as the strike price. If you decide to exercise your call option, you’ll pay the strike price and receive shares of the underlying stock.

You might exercise your call option early if the market price of the underlying stock is trading above the strike price plus the premium paid. By exercising early, you can lock in a profit. If you hold the position until expiration and it’s in the money, your broker will automatically exercise it for you.

Implied Volatility & IV Crush?

Implied volatility is a mathematical calculation that attempts to find the future volatility of a security. It is derived from the prices of options on that security. The higher the implied volatility, the greater the expected price movement of the underlying security. Implied volatility is not a measure of actual past volatility, but rather a market-derived expectation of future volatility. When markets are expecting high levels of future volatility, option prices will be higher as well. The reverse is also true – when markets are expecting low levels of future volatility, option prices will be lower.

While implied volatility can be a useful tool for gauging market expectations, it should not be used as the sole factor in making investment decisions. Other factors such as historical volatility and technical analysis should also be considered.

In the options market, there is a phenomenon known as IV crush. This happens when the implied volatility (IV) of an option declines sharply after the option is bought. The result is a decrease in the value of the option.

IV crush can be a problem for traders who are long options because it can eat into their profits. However, it can also be used to advantage by savvy traders who know how to trade it.

Options Greeks

In options trading, the term “Greeks” refers to the various risk measures associated with an option position. The most important Greeks are Delta, Gamma, Theta, and Vega.

Delta measures the rate of change of an option’s price with respect to changes in the underlying asset’s price. Gamma measures the rate of change of Delta with respect to changes in the underlying asset’s price. Theta measures the rate of change of an option’s price with respect to changes in time. Vega measures the sensitivity of an option’s price to changes in volatility.

The Greeks can be used to measure both the potential risks and rewards associated with an options position. By understanding how each Greek affects an option’s position, traders can make more informed decisions about when and how to enter or exit a trade.

What is Glitch in Options Trading?

What is Glitch in Options Trading?

A glitch in options trading is a type of error that can occur when an order is placed to buy or sell an option. This can happen due to a number of factors, including human error, system errors, or problems with the brokerage firm. Glitches can often be resolved quickly, but they can also cause major delays and disruptions in the market.

What is a Wallstreetbets Stocks Trading Options Meme or Stock Options Meme?

Meme stock trading is a type of trading where people buy and sell stocks based on popular social media sites like Reddit – who have popularized the use of memes in their posts. Meme stocks are often volatile and can be risky to invest in, but some people believe they offer high potential rewards. (Also, see the article we’ve written on how to make money on WallStreetBets)

There are a few things to consider before getting into meme stock trading. First, it’s important to understand the risks involved. Meme stocks are often highly volatile, which means they can go up or down in value very quickly. This can make it difficult to predict when to buy or sell, and you could end up losing money if you don’t time your trades correctly.

Another thing to keep in mind is that meme stock prices can be influenced by online communities, so it’s important to be aware of what’s being said about a particular stock before investing.

Frequently Asked Questions

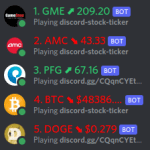

What is discord-stock-ticker?

Discord-stock-ticker is a Discord bot that allows users to track their favorite stocks on a Discord server. The bot includes features such as stock price tracking, news alerts, and more. It is a free and open-source project created by Stock Ticker Bot Devs. The bot is available for Windows, macOS, Linux, and Android. Discord-stock-ticker is a useful tool for any investor or trader who wants to stay up to date on their favorite stocks. The bot makes it easy to track stock prices and get news alerts without having to leave Discord.

What is sentiment-analysis?

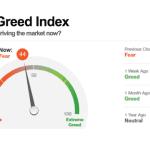

In the investing world, there are a variety of analysis techniques that can be used to help make decisions about what stocks or options to buy or sell. One such technique is called sentiment analysis. So, what is sentiment analysis in options trading? Simply put, it is a method of using market data to try to gauge the overall mood or sentiment of traders. This can be done by looking at things like the volume of trading activity, the types of orders being placed, and even the language being used in online forums and chatrooms. You can use a tool like WSBcheck.Com to check the social sentiment of sites like WallStreetBets. Some traders believe that sentiment analysis can give them an edge in the market, as it can provide valuable insights into how other traders are feeling about a particular stock or option. However, it is important to keep in mind that sentiment data is often very noisy and can be difficult to interpret correctly.

What is the meaning of terminal in trading options?

In the financial world, the word terminal has a very specific meaning. It refers to a physical device that allows a trader to interface with a trading system. This system may be an electronic communications network (ECN), an exchange, or a broker. The terminal provides the trader with quotes, news, and other data that they need to make informed trading decisions. The term terminal can also refer to the software that is used to access these systems. This software is typically installed on a personal computer or laptop and provides the same functionality as a physical terminal. Many traders prefer to use software terminals because they offer greater flexibility and mobility.

What is a short squeeze?

In the world of finance, a short squeeze is when shorts are forced to buy to cover their position. This usually happens when a stock price starts to rise quickly, and the shorts are caught with too much exposure. A short squeeze can also happen in other markets, such as commodities or currencies. In these cases, it typically happens when there is a sudden shortage of assets. For example, if there is a wheat shortage and prices start to surge, farmers with wheat contracts might be forced to buy more wheat than they planned in order to fulfill their obligations. This would cause prices to go up even higher, leading to more squeezes.

What is the meaning of day trading?

Day trading is a term used to describe the act of buying and selling securities within the same day. Day traders look for opportunities to buy and sell stocks, options, and other securities in order to make a profit from the price differences. Most day traders work from home, using online brokerages and trading platforms to buy and sell securities. They typically use technical analysis to find trading opportunities, but may also rely on news and events to place their trades.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History