If you’re new to the stock trading game and are wondering how to start day trading stocks, you’re in the right place.

Now before we get too deep into this, let’s review the different trading styles that traders use.

#1 – Swing Trading

When swing trading, positions (trades) are generally held for a few days to a few months.

In this style of trading, the trader is ok with holding a trade overnight. So they won’t be closing their positions before the end of the day.

Traders using this style of trading will have to use a larger stop loss. They will also need strong nerves to hold onto a trade if it goes against them.

Typically this type of trader is looking for short-term profits but doesn’t want to be tied to their computer like a day trader would.

With all of the stock trade alerts that I give my members inside “The Empirical Collective” they are all swing trades. This allows people the flexibility to follow our trades even if they have other jobs or responsibilities. But they can still trade along.

If you’d like to join, your journey starts by clicking the link here.

#2 – Position Trading

Position trades are ones that are held for the longest amount of time.

These sorts of trades are generally held from a few days to a few years.

These are trades that are looking to capitalize on big macroeconomic trends or shifts in the world economy.

I won’t go so far as to say that these trades are “set it and forget it” but at times it can almost be at times.

Traders using this trading style are looking for HUGE moves and giant swings in their favor. In cases like this, they are looking for a few THOUSAND point moves.

So if you get all jittery and excited when you’re up 20% on a trade, this wouldn’t really be a style that will work for you.

#3 – Scalping

Scalping is by far and away the fastest moving trading style.

If somebody’s scalping, everything is done at warp speed where trades are held for a few seconds to a few minutes.

But that’s about the extent of it.

These traders are looking to exploit a quick pattern or order flow to catch a point or two as a stock trends in one direction.

The upside of this is that you’re never in a position for very long. And this leaves less of a chance that you’ll have it move against you.

They will often rapidly play both sides of a trade. They can get in on the way up and then short it on the way down.

This trading style is best suited for someone who is able to make quick and decisive trading decisions in the moment and has laser-like focus.

Needless to say, this sort of trading requires you to be actively trading all day (so you’re at your computer all day)…. or at least until you hit your target profit for the day.

#4 – Day Trading

Day trading involves holding a trade up to a few hours.

Day trading involves holding a trade up to a few hours.

But one of the biggest rules of day trading is that you need to close out ALL of your trades before the end of the trading day.

If you don’t, you’re getting into more of a swing trade.

With day trading, it’s best suited for people who like closure. This is because in day trading you close your trades before the end of the day. In doing this, you don’t have to worry what is going to happen overnight.

Quite often, when you hold a trading position overnight many different things can happen that causes stocks to move dramatically (gap) up or down.

Of course, if the stock gaps in your favor you’ll be ecstatic.

If it gaps in the opposite direction of your trade…. well, not so much.

This type of trading is best suited for someone who likes to start and finish things in one day.

In fact, Samuel is our the financial genius behind all of my trading systems. That and he is the one who gives out the vast majority of the trade alerts in “The Empirical Collective.”

His book will give you a head start into becoming a much better trader. And I think it’s crucial for new traders to educate themselves before they dive in and start trading. And this book is a great place to start.

For more on this subject, see “Which Stock Trading Site is Best for Beginners.”

Final Thoughts on How to Start Day Trading Stocks

The best piece of advice I can give you is to try and pick the trading style that reflects your personality the best.

If you’re super focused and hyper- maybe you want to look into being a scalper.

If you can’t stand the thought of being chained to your computer all day you should investigate being a swing trader.

Do you hate the idea of having the market move against you in after hours trading? Maybe day trading is for you.

Regardless of the trading style that you end up choosing, just try not to fall into the trap of mixing trading styles.

Many new traders start out daytrading, but then end up holding trades overnight if they move against them.

Your best bet is to close the trade and take the loss.

And this is where most new traders are too scared to take a loss. The problem is, they hold the trade hoping it will turn around for them.

Unfortunately this can be one of the new trader’s biggest mistakes.

So once you’ve chosen your trading style be sure to stick with it. Even if that means taking a loss from time to time.

If you’re interested in becoming a day trader, I highly recommend you pick up a copy of “The Day Trading Manifesto” by Samuel Goldman. It covers everything you need to know before trying to become a day trader.

If you’re interested in becoming a day trader, I highly recommend you pick up a copy of “The Day Trading Manifesto” by Samuel Goldman. It covers everything you need to know before trying to become a day trader. The Best Supply and Demand Indicator for Trading in the Zone

The Best Supply and Demand Indicator for Trading in the Zone  Candlestick Scanner MT4: How Does It Work & Does It Help?

Candlestick Scanner MT4: How Does It Work & Does It Help?  Learn How to Day Trade for Beginners – What You Need To Know Before Trading

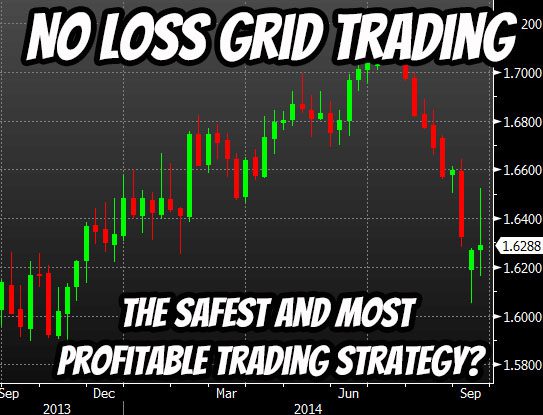

Learn How to Day Trade for Beginners – What You Need To Know Before Trading  No Loss Grid Trading – The Safest and Most Profitable Trading Strategy?

No Loss Grid Trading – The Safest and Most Profitable Trading Strategy?  Getting Started With Tick Scalping & Tick Chart Trading

Getting Started With Tick Scalping & Tick Chart Trading  Shark Fin Trading Indicator: Here’s How to Discover This Harmonic Trading Pattern

Shark Fin Trading Indicator: Here’s How to Discover This Harmonic Trading Pattern