Are you curious to know how to start selling covered calls for monthly income? Look no further – welcome! Here you will find everything you need. 😃

I hear so many inquiries from individuals just starting their trading journey – particularly around options trading.

What Is A Call and Put, And Can It Work Before Placing My Trade?” “Can I Make a Living Trading Options, ” “What Is Settlement Date in Stock Trading, ” “Can I Earn A Living From Trading Options “

Before beginning to sell covered calls to make money, it is necessary to first understand the fundementals of trading options.

Otherwise, it’s likely you’ll just become even more confuesed and helpless in moving forward with life. 😕

If you are unfamilar with trading options and the fundementals, as well as selling covered calls for monthly income. it is advisible that before proceeding further.

To help you catch up quickly, I suggest reading “How to Make Big Money Fast Trading Options” and studying it until everything becomes clear (this shouldn’t take too long as the book’s an easy read and not too lengthy).

After you’ve completed step one, we can explore further this strategy by selling covered calls for monthly income. When we finish this phase we can discuss selling covered calls as an income source in more depth.

The Basics of Selling Covered Calls for Monthly Income

Options trading offers great flexibility for creating diverse income-generating trades.

Everything can be completely customized – from selecting a strike and date to taking either side of a trade (buy or sell), you have complete control to achieve exactly the results that suit you best.

Trading options is unqestionably the best way to create trades that pay out weekly or monthly, giving you financial security.

Never could you get such freedom when purchasing or selling stocks directly; when trading options you have more freedom and can take risks that could result in huge rewards.

Now, let’s examine this strategy and how you can set it up to generate monthly profits.

Before taking action on any strategy, the first step should be identifying when to implement it. Knowing how to utilize this technique is one thing; without understanding when best to employ it could end in money loss for you. 😞

So when you’re selling covered calls, you will only do this when you feel that the price of the underlying security (the stock, ETF, Index etc) won’t rise much higher than it’s current value.

When you sell the calls you get paid a premium in exchange for forfeiting the appreciation beyond the strike price.

To determine if stock will go up in price, you will have to look at the long term historical charts. From these, you’ll have to spot a trend or chart pattern that indicates the stock might be stagnant or about to trade within a range.

(If you aren’t up on your chart patterns, I suggest reading this book here to get a handle on them.)

Once you’ve found a stock that won’t increase in value much, you’re ready to move onto the next step.

After that, you want to do a little investigative work and find out how many shares each option contract controls for that stock (most often, 1 option contract controls 100 shares).

This will allow you to figure out just how many stocks and options contracts you’ll need to buy.

For this strategy to work, you’ll have to buy enough options contracts in order to cover the amount of stock you purchased.

So if you’ve determined that each option contract controls 100 shares of the stock, you would buy 100 shares of the stock for each option contract you wanted.

If you want to sell 2 call contracts (and the underlying security has option contracts that control 100 shares per each contract) then you would buy 200 shares of the stock.

You would start the trade by buying the 200 shares of the stock at the current market price.

Once you’ve done that, you’re ready to sell your call contracts and collect your premium!

To do that, you would choose an out of the money call (where the strike price is higher than the current trading value of the stock), choose a timeframe (expiry date) that was at least 1 month out and sell the calls and collect your money.

NOTE: To sell covered calls, brokers require a higher minimum deposit amount. With a margin account good brokers (like Questrade) only require 30-50% of the stock value in your account first. But in order to sell options, they require more money in order to approve your account (even though your loss is still limited when you place covered calls.) For more details, you can check it out here but just be aware that you need to have your account approved and set up properly before you can jump in and place one of these trades.

Now, choosing the strike price is something of a art that will come with some practice as you’re wanting to choose a strike that’s close enough to the current trading value of the stock (because this will give you more cash in the form of premium when you sell the calls) while choosing one that the stock value won’t climb above.

Typically, most traders will choose a strike that has been seen as a level of price resistance before.

Now, this may all seem like you can get free money using this trade but there is some downside to selling covered calls for monthly income.

The main one is that if the stock you purchased drops, you could lose more money than you gained when selling the calls.

But if you’re happy owning the stock long term then the premium you got might help to offset the loss.

Now, if the stock rises above your strike price, you’ll be called out of your position. This means that you will keep the premium that you collected, but will have to sell the stocks you bought.

Let’s look at a couple examples.

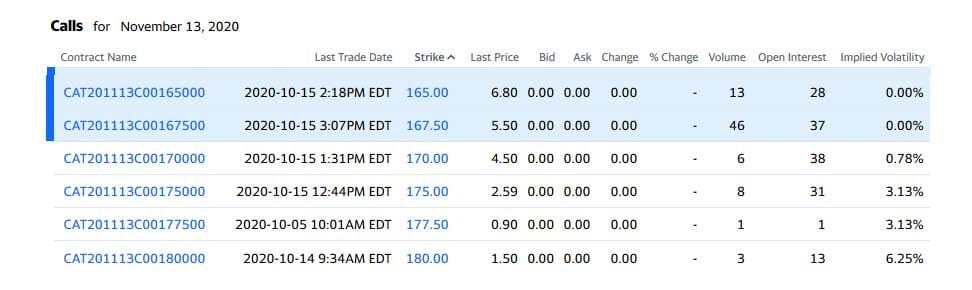

Below you’ll find an options chain for CAT and the expiry date is about 1 month away from the date the picture was taken. At the time the picture was taken CAT was trading at $168.95

From the picture above, you can see that the 175 strike calls were trading at 2.59/contract

So let’s say you wanted to collect some monthly income and sell covered calls on CAT.

You would first buy 100 shares of CAT and then sell the 175 strike calls for November 13.

This would give you $259 in premium ($2.59 x 100 shares per option contract).

Scenario #1

The price of the stock stays below the strike you sold the calls at and above the value you bought the shares at. Let’s say the price of CAT at expiry on November 13th was $170. In this case, you would have collected the premium $259 and you could sell all 100 shares of CAT for an additional amount of $105. So your total increase would be $364 on the trade.

Scenario #2

The price of the stock drops below the price you bought the shares at. If on the other hand, the price of CAT dropped to say $165 at expiration, your trade results would look like this: You collected $259 in premium but the shares of CAT dropped $395 ($3.95 x 100 shares). So if you sold all 100 shares of CAT, you would have lost $136 on the trade.

Of course, if you didn’t sell the shares you wouldn’t incur the loss right away.

This is a big reason why people will often use selling covered calls on stocks that they want to own for the long term (IE in a retirement account or just don’t ever want to sell) as it helps them generate income to offset the loss before the stocks go back up.

Scenario #3

The price of the stock increases above the strike price you sold the calls at. In this case, let’s say that the price of CAT increased to $175 at the November 13 expiration date. Here you would have collected the premium of $259 for selling the calls, but you would lose all 100 shares of the CAT stock (you would get “called out” of your position). But as the price of the shares increased, you would still gain a little from the share appreciation in the form of $105 ($170-168.95 x 100 shares).

So your total profit on the trade would be $364 and you wouldn’t own the shares of CAT any more.

You can see how your upside potential is capped.

But, you can see how you can make money using this strategy. You just want to be sure the price of a stock won’t increase much more.

Hopefully you’ve found this example helpful in your options trading education.

Just remember, it takes more money in your account in order to place covered calls. So if you’re sure a stock won’t increase or decrease in value much you could try a different options strategy like the one outlined in our “Clockwork Paycheck System” here .

And if you’re ready to take the plunge and get trading – but aren’t sure about these more complex strategies – you’re welcome to sign up for our options trade alerts through a membership in “The Empirical Collective” where we make simple, easy to follow options trades. You can get more details and sign up through the discounted link here.

Commonly searched for terms related to selling covered calls for monthly income

How much can you make a month selling covered calls?

It can vary when it comes to selling covered calls for monthly income.

The potential return for selling covered calls is limited to the maximum payout of the call minus the premium received. Potential profit will be realized once exercising or assignment on a call, whereupon there’ll be either no further profit possible (from assignment), or additional profit possible (from exercise.) A brief example would be suppose you sold 6-month covered calls with 3-months of premium income received, and then exercised them early upon expiration into shares that had risen in price by 10%. If your short call was at $1 outlayed, then your net profit would have been $120 ((($4*6) – $1) * 100).

Is selling covered calls profitable?

Generally, the answer is yes. A call option gives the holder of that contract an attractive return on their cash if the underlying stock finishes above its strike price at expiration. For example, if you hold a call with a strike price of $25 and it’s trading at $23, then you would make money because your downside risk is limited to what you paid for it (in this case Let say you paid Let’s say $0.50 for that option) while your upside profit potential can be very significant (the $4 put back to the original purchaser).

Is it better to sell weekly or monthly covered calls?

If the stock price is at or near parity with or below the call exercise price, it’s better to sell weekly options. Because when these options are exercised, you only get the dividends for a week worth of shares.

What is a covered call?

A covered call is a type of options strategy in which a trader buys 100 shares of a security and simultaneously sells a call option on those shares.

This strategy is used when the trader feels that the security is going to remain flat or experience only marginal percentage gains over an extended period of time. The return would be the premium received from selling the option, minus any losses experienced if the underlying asset were to decrease in value significantly between purchase date and expiration date.

Ultimately, this strategy offers limited upside potential with limited downside risk provided that there are not large swings in price within one month after initiating coverage.

What are the benefits of monthly income from covered calls?

Covered call writing is an excellent strategy for retirement income generation. It can provide a very attractive return on investment depending on the strike prices chosen and the volatility of the underlying stock.

Writing covered calls produces nice, low-risk yields without having to take high risks with “a dart throw” high yield investments like junk bonds, forex trading or commodities leveraging which often come with unsustainable double digit returns in some cases. This strategy also generates monthly income that can continue into your retirement years when you stop trading them (this is especially true if you put your premiums into tax deferred accounts like 401k/457s/IRA).

How does selling a call option work?

Selling options is a way of providing future cash flows to the investor who purchased the option. A call option contract will be assigned if it is in-the-money by expiration, at which point the trader will have to sell shares at the strike price.

The selling of an option is also known as writing an option or being “short” on an option. The process works best when there’s a high probability that something will happen by expiration – for example, if you’re betting on whether someone will die before next Wednesday. It becomes less effective when bets are made further away from expiration dates.

What is an income strategy?

Income strategy is the process of creating a plan to generate continuous income.

An income strategy can be adjusted over time, but it helps to set incremental goals that are easily achievable if they aren’t achieved on schedule.

How can you make a living from the stock market?

The first thing you have to do is to invest in a few companies. There are plenty of sites online where you could buy stocks in any company with your money, or you can also use treasury bonds if you don’t want the riskier stock market. Next, follow the news about what’s happening with these stocks and wait for favorable opportunities to sell off for more profits than when they bought them. This way, everyone wins at the game of investing!

Why shouldn’t I sell covered calls?

Selling individual options is one of the most dangerous strategies in investing.

What you need to know is that when you sell an option, the maximum profit you can make per contract is known as your “premium”, or the amount paid when the buyer bought it from you. If for some reason, they end up using their right to buy one of your stocks at a particular price before it expires (that’s called “exercising”), then that’s when they’ll use what’s known as their “right” and immediately buy that stock with no time given back to either party.

What is a premarket call?

A premarket call is a stock trade done before the opening bell.

It allows for some investors who need to liquidate their holdings on an urgent basis to sell before the market opens and waits until it closes. Investors sometimes do this as a precaution if they don’t trust that their investments will hold steady over such a long period of time without having another opportunity to liquidate on short notice. However, there are also those who make these trades in order to increase the likelihood of making more out on smaller investment amounts early-on in the day.

How do you sell put options for income?

Put options are a great way to generate income in the stock market. You buy a put option and when the stock price falls you can purchase it at a discounted rate, and then later sell it for substantially more than what you bought it for.

Conclusion: People who own stocks receive significant benefits from buying or selling put options, but they themselves sometimes don’t understand how they work. If people hold put options with stocks that increase in value rather than decrease, their losses could be substantial. However if someone is willing to take an exceptional risk level such as investing in oil producers-it’s worth considering buying them because of projections about putting your money into other things like real estate could be too safe and cause stagnation over time.

Can you sell covered calls on Robinhood?

Yes, you can.

You can sell covered calls on Robinhood if your brokerage account is on Robinhood. You cannot sell covered calls on any accounts for which the platform is not the broker-dealer. It was rumored that this would change in May of 2019, but there have been no updates since that time.

What are the benefits of trading selling Covered Call Options?

The only downside risk is that you get “called away” from the shares you own and you have to sell the shares you sold the calls on.

So you’d be giving up some upside potential on the shares you purchased.

What is dividend monthly income?

Dividend monthly income is the term for receiving dividend payments in equal parts or monthly intervals.

A person can select their dividend company to receive dividends on a quarterly, semi-annual, annual, or periodic basis. Monthly dividend payments are generally an option when an investor has chosen to invest in stocks that offer dividends. When part of your investment portfolio contains investments from companies that pay out dividends, you may have an option about how often these companies choose to pay them. Choosing a monthly payment plan may save some commission costs and taxes if you reinvest funds into another investment property rather than taking withdrawals from your retirement accounts for month expenditures.

What is a call option?

A call option is a contract in which the holder has the right, but not the obligation, to buy 100 shares of an underlying security at a fixed price for a fixed amount of time.

A call option is an agreement that provides the buyer with an opportunity they hope will be profitable. One common use of options protects against loss on stocks they own for periods when there’s uncertainty about what will happen to their value.

The buyer doesn’t have to exercise their right if they don’t want it or if it doesn’t seem profitable any more – this is called “doing nothing”. But exercising their rights usually involves paying money – this is called “doing something”.

Why invest in dividend stocks?

It’s often said that dividends are “cash paid to shareholders who have invested in the company”. When you buy dividend stocks, you’re literally being bribed to hold/invest your money with them.

This means companies are returning capital back to shareholders. Dividend stocks are usually more stable than shares of common stock because they do not experience fluctuations in share prices or large spikes of volatility based on new announcements or rumors, but instead by the announcement of profits at set intervals determined by the company. Since dividends are fixed and predictable, investors can prioritize their investment strategies easier when using this investment strategy

What are good stocks to sell covered calls?

The stocks you want to sell covered calls on are ones that, once they’ve gone up in price, you’re no longer interested in buying.

A lot of traders use covered call trades to trade high volatility options with less risk because the most likely outcome will yield the best outcome for them i.e. a stock going up or remaining stagnant. That being said, there’s not a single “good” kind of stock to sell covered calls on as each trader will have their own preference and reasons for holding a position – what’s good for one person may not be the other’s cup of tea!

Is it better to buy calls or sell puts?

It’s better to buy calls because “when buying options, one can net a profit of up to the premium they initially paid for the option”. While the potential loss is unlimited when you sell an option.

When you purchase a call on an asset, you are purchasing it with the hope that at some time before expiration your call will be worth more than its original value. This makes “buying calls” riskier but potentially more profitable. When you sell or write put options, then at least some of the time your profits will be capped by their higher strike price which was what originally attracted buyers of your put contract.”

What is the riskiest option strategy?

The riskiest option strategy is the long straddle.

The Long Straddle involves buying an out of the money call and investing in an out of the money put. It will only make a profit if there is a significant price change, but this investment does come with higher volatility and wide potential consequences.

What is the most successful option strategy?

Markets are always unpredictable, which means that a strategy can never expect to be successful on a consistent basis. Traders should therefore plan their strategies on the basis of risk and reward relative to each other instead of success or failure as separate events. In some cases, you may wish to take more risk for greater potential returns. In others, you may seek less risk with more limited potential returns for those days where its best not to play at all. A trade is only ever as good as the analysis behind it and the conditions from which it was taken – you cannot make money off trades if they never come in because you made an incorrect prediction beforehand!

Do call options have unlimited risk?

Yes. If you sell naked calls, the option risk is unlimited because you can lose more than the initial premium paid for the call option. It’s possible to get into a situation where there is such an unfavorable movement in your underlying that you might lose all of your investment and then some.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History