With the stock market at record highs, it has a lot of people looking at selling weekly put options for income.

And if you know what you’re doing, you can certainly make a lot of money doing it.

But before we get too deep into this strategy, let’s look at what’s actually involved in selling options.

The Basics of Selling Options

Most people who trade options are familiar with buying either a call or a put when they trade options.

In this way, they’re essentially making a prediction (or call) on which direction the market (if they’re trading an index) or a particular stock will go.

If they are bullish on the stock or index, they will buy a call. If they are bearish, they will buy a put.

It’s not much different than if you were buying stocks, except that you have an option to go short (in the case of buying a put) while limiting your downside loss if the trade doesn’t work out for you.

But if you sell options, it’s a little different.

When you BUY options, it’s important to know that your maximum loss is defined by the price you pay for the options. Essentially it’s capped at that amount. For more information on trading options, see this book called “How to Make Big Money Fast Trading Options.”

If you sell calls, technically your potential loss is unlimited, as the stock could increase infinitely and you would have to pay whatever the value of the stock is for every contract you hold at expiration. So this is a really risky trade.

On the other hand, when you sell put options your downside is if the trade moves against you will be assigned the shares of stock.

And it’s because of this that your online broker will often require you to have more cash in your account before they will let you sell options (IE place naked option trades).

So if you are selling options, it works just the opposite as if you bought options.

If you buy calls, you want the stock price to increase past the strike price you bought it at.

On the other hand, if you sell calls, you want the price of the stock to stay below the strike price you sold the calls at.

It’s the same logic on the put side.

If you buy puts, you’re wanting the price of the stock to drop below the strike you purchased.

If you sell puts, you’re wanting the price of the stock to stay above the strike you purchased it at.

Now, with those basics in mind, here’s how you’d go about selling weekly put options for income.

Selling Weekly Put Options for Income

In order to sell weekly options for income, you’d first choose a stock or underlying that had an expiration date at the end of the week.

So most of the time, you’d enter the trade on the Monday of a trading week and would set the option expiration date for the Friday.

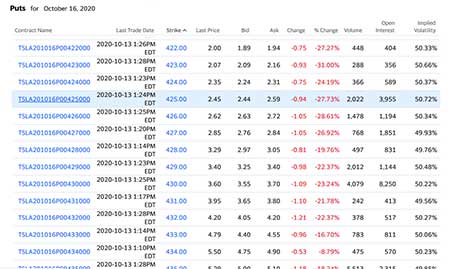

You can see an example from the image above and example of a put side trade.

From the highlighted example you can see the strike is 425, and the last price is 2.45 per contract.

When the picture was taken, it was on a Tuesday. But the date of October 16th is the next Friday and the price per share of Tesla was $445.01.

So based on this, you could potentially sell those for $2.45/contract ($245 for 1 contract at 100 shares).

If you were to sell these puts, you’d want the price of Tesla to remain above the $425 strike and for the option contract you purchased to expire worthless.

If Tesla dropped below the strike price you purchased it at, you’d have to buy it at the strike price.

One other thing to keep in mind is that when you sell options, you are credited the amount up front.

So if you were going to be given $245/contract for selling the puts in the example, you would receive $245 into your account when you initiated the trade.

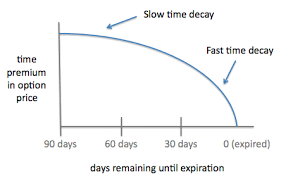

And as an option seller, you’re getting paid the premium upfront. With each day that goes by the option decreases in value due to time decay. This means you get to keep more and more of the premium as time goes on.

If you’re selling an option it’s called a theta positive trade. This basically means that as time decay accelerates (as the date gets closer to the expiration date of the option) the trade earns more money.

You can see from the image below how quickly time decay works as options approach their expiration date.

When you choose options to sell, you balance between choosing an option that expires quickly (so it has less time to move against your position) versus the premium you receive for selling it. The less time a trade has to move against your position the lower the premium will be.

So if you choose an option with an expiration date close to your current trade date, you’ll make less money than if you chose an option contract with a date that’s further out.

If you’re selling weekly put options, time decay happens the most during the last week of the option contract. But as we’ve mentioned, these weekly option contracts will bring in less premium as well.

Another thing to keep in mind is the volatility of the stock.

If the stock has a high level of volatility, then the premium is often higher. Especially when you compare it to a stock that hardly moves at all.

The volatility of the market or other news worthy events can impact a stock’s level of volatility as well. Things like earnings announcements can cause volatility to spike.

So that’s a brief overview of how you’d go about selling weekly put options for income.

And historically speaking, about 75% of all options contracts have ended up out of the money or worthless. So this can be an effective way of collecting some money if done right.

That said, within “The Empirical Collective” we focus only on buying options. And it isn’t that we’re against selling options. Rather, it’s because not every trader can afford to open a margin account large enough to sell options. This is because online brokers require more money put into a margin account before letting someone trade these options.

So to help our members make money faster, my team and I provide easy to follow directional option buying trades.

And if that interests you, you can sign up for our trade alerts through the discounted link here.

Answers to things people often ask

What are put options strategies?

Straddle a Call and a Put. The Straddle is a trading strategy that involves simultaneously buying or selling both a call and put with the same expiry date on the same underlying asset for the same strike price.

A Note on expiration dates: if you combine this strategy with long puts on an underlying commodity you might want to make sure to set your straddle-to-expiration sell order steps above your buy order step on any put position, so that it can get executed first in case of fast market losses before its short counterparts have expired already.

What are the pros and cons of selling weekly options?

Pros of Selling Weekly Options : Less commitment. Early assignment protection. Not as liquid as monthly options or longer-term options.

Less liquid – this means that the buying and selling are less frequent, meaning options are more expensive to buy and sell

Cons of Selling Weekly Options : More expensive to “buy” due to lack of liquidity . Have an early assignment clause which can result in a very low cash receipt if you entered into the contract at a time when the underlying asset was not at or above your strike price. *Also worth noting that any lapse provisions may come into play with weekly options*

Should you be worried about risk in selling weekly options?

The open interest for weekly options is roughly the same as it is for monthly options, but the weekly option doesn’t have any “time value” that offsets potential losses that can come into play. Instead, if you’re long a weekly option and that contract expires out of the money, you lose your entire premium paid with no time to recover.

What is a put option?

A put option is an investment contract that gains value for the holder when the price of the underlying asset falls.

It gives its owner (the one who bought it) the right, but not an obligation, to sell a stock at a certain price for a given time period. Put options are primarily used to protect against market downturns in stocks or other securities (such as commodities).

What does it mean to sell a put option for income?

Selling a put option for income is sometimes considered as a form of getting safe dividends from short term investments, similar to stock buy backs or dividend reinvestment plans.

The company puts the holder “in the money” every month by paying them a cash amount. The investor can purchase this type of binary options contract at any moment going forward because there is no purchase required up front other than premium payment. And since a put option seller receives income monthly during out trading period, it makes sense that they would want to sell their put option before the end of this cash flow generating period because this could lead to an interference with cash flow replenishment from either fresh capital being invested in for purchases or from dividends being reinvested back into shares.

How do you sell options for income?

Selling options is a great way to make money. If you think that an asset is going to rise or fall significantly in value, then buying or selling options on such assets would be a good bet (depending on the direction).

There are many types of option markets available and there’s something for everyone with varying levels of knowledge and time commitment. For example, you might want to trade the equity market; this would involve stocks, ETFs or mutual funds. You can also buy index futures on commodities like wheat or oil. And finally, you can trade debt instruments like bonds and notes for income generation purposes too!

What are the risks of selling option?

The risk of selling an option is that if the underlying asset trades below the strike price at expiration, your losses will be unlimited.

Is it possible to get paid every week by selling Options?

Yes, but it’s risky.

There are different ways to get paid for options trading, but usually they need a large account or else all the money gained from trading could be lost with one bad trade. The best way to make money in the financial markets is by using margin and leverage; this can lead to big gains if your position goes well and huge losses if your position goes against you. If you’re trying to use options as a way to generate consistent income that covers expenses (e.g., mortgage and other monthly bills), then this means risking more of what you already have in order to generate more–unless there’s another source of cash coming in WITHOUT risk, such as an Inheritance or Trust Fund.

Should I sell weekly puts?

Yes. Selling weekly puts is a great way to generate income, as it is very safe and affordable, but still generates a decent return on an investment. The typical duration of most contracts for this strategy is every Saturday, which helps out those who need the money sooner than later–sometimes avoiding lengthy delays before settlement.

Of course, that said, you should only do that if it fits your trading and investment style.

Can you make a living selling options?

Yes. Many people make a living by trading options.

In this case, you need to have money in order to invest it and be able to take the risk… Otherwise, you could buy stocks or other investments that offer greater returns without incurring as much risk. In general, putting larger sums of money into an investment will result in better returns. This is the opposite of how it works with smaller investments though because when investing a large sum, both winning and losing trades hurt more relative to their individual sizes. This makes taking a lot of trades where each one has a low probability for success expensive and risky – but if one trade does hit then your total return could be enormous.

What is the downside of selling options?

Selling options usually has a greater financial downside.

When selling options, the most important factors to consider are what is your risk of being wrong and what will happen if you are wrong?

The most significant advantage of buying an option is that it provides the buyer with a “right” but not obligation to buy shares at a set price, on or before a certain date. The disadvantage of this policy is that the trade-off for this right would typically be high cost per share. On top of that, there’s also no contractual guarantee that said company can’t go bankrupt before those shares can be delivered.

Is it better to buy or sell options?

The main question to ask is if you are short or long.

If you are wishing to profit from the downward movement in the price of an asset, then it is better to buy put options because they allow for unlimited gains when trading stocks. If you are interested in profiting from the upward trend in prices, then it is better to purchase call options. If you are long on stock and wish to protect your position, purchasing a put option could be a good idea because it gives the purchaser of this contract leverage against possible declines in prices. This protection can be used with any type of stock listed on an exchange rather than only stocks that may have options available for sale by some exchanges.

What are the benefits of buying a put option?

Buying a put option can be a low cost way to protect yourself from a stock losing value too quickly.

However, there are two very important things you need to know before choosing this investment. First, exercise prices for put options have never been lower than at this moment. That means that it won’t take much of a pullback in the market for puts buyers to get exercised against and lose money. Second, other factors affect stock prices besides your company’s fundamentals — such as interest rates and other macroeconomic factors over which your company has limited control–and these may cause stocks or indices to move rapidly in one direction or another despite short-term weaknesses in the company’s financial performance.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History