investing

Historically “Heavy Handed Fed” May Tank The Stock Market – Here’s How…

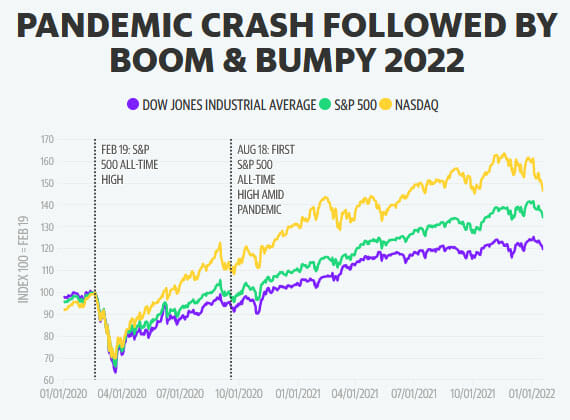

With the Federal Reserve prepared to begin raising interest rates from near-zero levels, investors should brace themselves for a bumpy ride this year.

The ones who will be hardest hit are those who have been passively investing their money without any form of active management or insight beyond putting their money blindly in a fund.

Here’s how it has historically played out…

Wall Street Thinks Consumers Are Screwed

Wall Street Thinks Consumers Are Screwed  Wall Street Applauds Powell’s Interest Rate Plan

Wall Street Applauds Powell’s Interest Rate Plan  Russian Invasion of Ukraine Intensifies, S&P and DOW Spike Higher

Russian Invasion of Ukraine Intensifies, S&P and DOW Spike Higher  Goldman Sachs: Inflation’s Gonna Be Worse Than You Think

Goldman Sachs: Inflation’s Gonna Be Worse Than You Think  Historically “Heavy Handed Fed” May Tank The Stock Market – Here’s How…

Historically “Heavy Handed Fed” May Tank The Stock Market – Here’s How…  Investing in Options: A Beginner’s Guide

Investing in Options: A Beginner’s Guide