When you start trading options, there are so many questions. And one that comes up a lot is, “What happens when options expire in the money?”

A lot of people find trading options to be a bit confusing. This makes sense, as they are more familiar with trading stocks.

And there can be a lot of confusion with all of the common terms used in options trading.

But I’ll go over a few of the more common ones here.

You can get an excellent guide written by Samuel Goldman that gives you all the ins and outs of trading options. It’s called, “How to Make Big Money Fast Trading Options” and you can get through Amazon here.

What Happens When Options Expire In the Money?

Before we can get too deep into this, we’ve got to cover a few different terms. And we have to do this before we can explain exactly what happens when an option expires in the money.

The first thing to understand is the strike price of the option.

The strike price is the price at which the option can be sold.

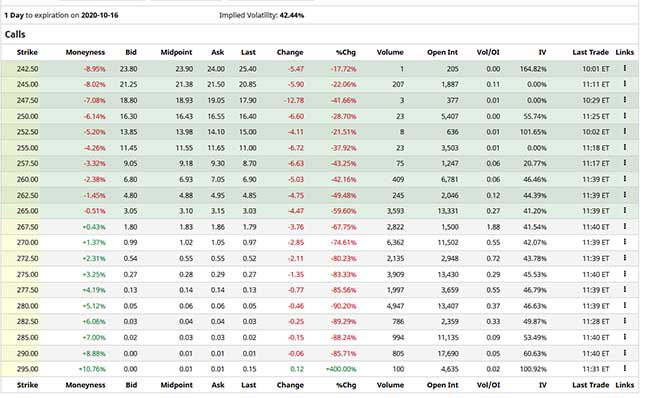

Below is a picture of an options chain for Facebook. At the time the picture was taken, Facebook was trading at $265.76

In the far left column, you can see the Strike column.

So when it comes to Calls, anything BELOW the current trading value of $265.76 is considered “in the money.”

This makes the strike prices of 265 and below in the money.

So, if you bought calls at any of the strikes below $265.76, you’d be in the money.

This would mean that you would make money.

If your contract expired in the money your account will be credited the value of the option. Or you can purchase shares of the company at the strike price you had the option for.

Let’s say your options expired and the value of facebook was $265.76 and you bought the $265 strike calls. You could then exercise your option and buy facebook stock at $265/share.

If you SOLD the 265 strike calls and it expired in the money, you’d have to sell 100 shares. You’d sell the stock to the person who had bought the 265 strike call. If the price of facebook was $265.75 at expiration, you’d have to transfer 100 shares of facebook stock from your account. Or you’d have to come up with $26,575 to cover the price of buying and issuing the shares.

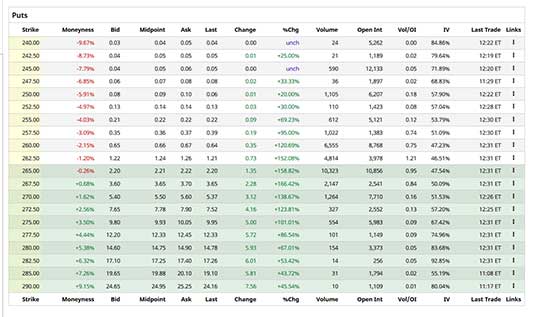

We can run through the same example on the PUT side of the trade as well.

So when you look at the PUT column, any strike above the 262.50 strike would be in the money. As you can see from the 265 strike and up the options would be in the money.

This is because when buying puts you want the value of the stock to expire BELOW the strike price you purchased.

So if you had purchased the 265 puts and the value of facebook was 257.63 when the option expired, you’d be in the money and you could either let the option expire and collect the money.

If you SOLD these puts, you would be assigned shares of facebook at the strike price of 265 per share. If you don’t have enough money in your account, you will be temporarily assigned the stock. Then it will be immediately sold and you will owe the difference between the strike and value of the stock. So this would be 265-257.63 = 7.37 x 100 shares per contract. This results in $737 plus the cost of the assignment fee.

As you can see, this can add up in a hurry when you’re selling options.

But as trading options is a form of leverage, your gains or losses can be multiplied a lot faster than if you were stuck with just trading stocks on their own.

The return can really be amazing if you’re buying options as well. Because the cost to buy an option contract is much less expensive than if you were to buy the equivalent 100 shares of stock. But you can still share in the stock value appreciation.

Now for a Brief Recap

if you’re buying options you want your option contract to expire in the money. So if you buy calls, you want the price of the stock to be ABOVE the strike you purchased your option at. If you buy puts, you want the price of the stock to be BELOW the strike you purchased your option at.

This gives you the right but not the obligation to buy the stock at the strike for calls. In the case of puts, it gives you the option of selling the stock at the strike.

As I mentioned before, maybe this all seems a little confusing to you as compared to trading stocks. But with a little practice and research it will become much easier.

And the benefits of trading options make it worth the work. You’re able to make much larger returns while risking much smaller amounts.

So if you haven’t been getting the results you want from stocks, you should look into trading options.

And if you’re a beginner still learning to trade, I’d advise you read this book on trading options.

Or if you’re wanting to trade along with us inside “The Empirical Collective” as we go about buying calls and puts in our options swing trading style you can sign up through the discounted link here.

Once you’ve done that and have a few winning trades under your belt, you’ll come to know exactly what happens when options expire in the money.

Because when our options expire in the money (again, because we buy calls and puts) we celebrate and put another trade in the win column.

Other commonly wondered about questions related to the question, “What Happens When Options Expire in the Money?”

What happens when options expire?

If the value of an underlying asset rises above the strike price, then it’s in-the-money. If an option expires in-the-money, the holder is entitled to buy the underlying security at its strike price.

If options expire worthless (if an option has a negative value), they are canceled. This is because having a negative position would not make sense for a trader and a broker, because a broker can’t sell your securities to you for less than what he paid you for them! So basically if “inflation” or “time decay” cause an investment’s value to get worse over time until it becomes more negative than zero.

What happens when a put option expires in the money?

When an option is in the money, it means that the owner of the put option has a right to sell, or otherwise exercise their contract at a fixed price (the strike) and receive a fixed amount (the premium).

Therefore, if you own a put option and it’s in the money, then you’re eligible for payment if your contract is exercised. The payment can vary depending on how much time is left until expiration; however compensation is usually made in cash or securities.

Do you lose money if options expire?

Yes. If your option is out of the money when it retires, you lose money.

If it is the money, however, you will make money.

Options, unlike futures, are perishable products. When they expire, the owner no longer has any rights to that underlying financial instrument or commodity’s future value if it increases in worth.

What happens to ITM options on expiry?

Simply put, you make money. If they are a cash-settled option, your option contract will be closed and the money deposited in your account automatically.

If it’s not cash settled, you will end up with the stock in your account. So you will end up buying the stock at the strike price you bought the option contract.

If you don’t have enough money to do that, typically your broker will take possession of the stock and sell it immediately. They will charge you a fee for doing this, but you will receive cash in your account from the sale.

What is the risk in selling puts?

You can lose money if the option expires and the share price is higher than the strike price.

Options trading often involves a lot of risk. A trader might sell a put to collect upfront cash, but only if it’s more than what they calculated as being their maximum possible loss before any portion is “at risk.” This formula is based on the options’ contract terms including how much time until expiration, how many shares are simultaneously purchased, total premium collected for all contracts sold, anticipated percentage change in the underlying asset’s price during that period of time, and volatility over three months. The preliminary loss total figured out includes commissions paid plus expected share dividend income received which subtracts from overall expected profit.

What happens if you don’t sell options before expiration?

If you fail to sell your option before expiration, it will be worth nothing. In other words, the buyer of your option could either keep or be assigned an “In-the-money” position in the underlying shares.

So the answer is – it depends on whether or not an option is in the money. If it is, you make money. If it isn’t, you lose money.

Is it better to buy ITM or OTM options?

This depends on your strategy.

But for the most part, it’s better to buy OTM options and sell ITM.

On average, ITM options will return a player more than seller of OTM options. The quadrants for the combinations are as follows:

Are puts riskier than calls?

Yes, because the stock market tends to trend upwards.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History