So you’ve decided on both a trading style and have come up with figuring out how to day trade options, have you?

If so, that’s fantastic!

It really is – not many traders actually do the research and get as specific and defined to the point where they’ve honed in on a specific trading style.

Most bounce around and “try” different things and often give up in the end.

But that’s not going to be you, because I’m going to explain exactly how to day trade options, point you in the right direction and you’re going to take action and go for it, aren’t you?

Of course you are! And you’re going to get fantastic results too!

So let’s get into this!

How to Day Trade Options – A Startup Guide

The first thing we’ve got to be clear about one major point.

The first thing we’ve got to be clear about one major point.

Day Trading Means You Close Your Trades at The End of Each Trading Day

Now, because you’re looking to day trade options, that means you’re opening and closing all trades within one trading day. Or, by definition, what you’re doing isn’t day trading but in fact swing trading.

And this is an extremely important thing to keep in mind as if you’re day trading, you’re going to need to trade stocks that have a high level of volatility or their options have a very close option expiration date (or both).

If you don’t do at least one of these things, there’s a very good chance that the options you choose to trade might not move enough during the trading day for you to make any sort of profit before you close out your trades at the end of the day.

The other route you can take (if you don’t want to trade stocks with a high level of volatility or trade contracts with a close expiration date) is to trade a larger number of options contracts (IE scale your trades up) so that even with a small movement in the options’ value, you stand to make a profit that’s worth the risk.

But that’s the first big decision that you need to make – just how you are going to go about executing these trades, whether you’re going to employ a typical day trading style, where you leverage your trades up to a level where a small price movement in the underlying option will produce enough profits, or if you take a more conservative approach and trade a smaller number of contracts that where the stock has a higher level of volatility and shorter time before expiration.

It’s a trade-off between the two and you’ll have to make that call on your own.

If you’re used to day trading already then you’re probably already comfortable trading with larger trade sizes and have the ability to manage your trades and money properly (IE you’ve already got strict money management rules in place to where you can cut a losing trade fast and cash in a winning trade at the proper time).

On the other hand, if you’re not comfortable using that sort of style, I suggest that you either learn more about day trading (see this book here for a great primer) or hone your skills using a trading practice account first… or do both.

But those are about your only two, well, options when it comes to day trading options.

If you don’t scale your trades up enough and try to trade option contracts that don’t move much (IE have a low level of volatility or the expiration date is too far away for a change in the stock price to make a difference in the price of the option) then the value of the option contract won’t be able to change enough in one trading day for you to make any money.

So there’s that.

Moving on….

What Options Should You Trade?

To get started, I recommend that you trade the most liquid options that you can find.

This means that you’ll need to stick with either some very well known and commonly traded companies – or my favorite – indexes and ETF’s.

If you don’t you run the risk of trying to trade an option contract that isn’t liquid.

And if you’re trading anything that isn’t liquid -whether it be penny stocks, stocks, or options – it can be hard to enter and exit a trade at the price you want as the spreads will often be pretty wide.

“What’s a spread?”, you might be asking? It’s just the price difference between the Bid and Ask prices.

I’ve found the quickest way to determine a security’s level of liquidity is to look at the Bid/Ask spread.

Securities having a small bid/ask spread are more liquid than ones having a wide one.

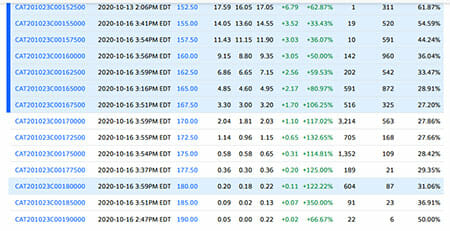

Let’s look at an example of an options chain I pulled up for CAT:

Look at the blue column where it says 180 (this is the 180 strike), you can see the difference between the bid/ask is about $0.04 (0.22-0.18).

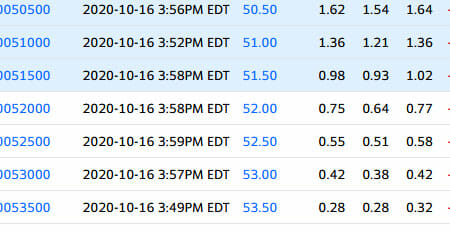

Compare that with an options chain for an options chain I pulled up for MU:

Let’s look at the 52 strike – you can see the spread is about 0.13 (0.77-0.64).

So between the two of them, the CAT options would be more liquid – meaning that at any given point of time there are more buyers and sellers willing to trade these CAT options.

And I can’t stress how important this is – because in my experience you can almost always buy, but if something is not liquid it can be really hard to sell (IE you can get stuck holding it).

So once you’ve found a liquid option to trade, we can move onto the next step.

How to Choose The Right Options

If you’re not taking the traditional day trading route of trading large position sizes to capitalize on small price movements, you’ll have to choose options that have the ability to move a lot – which makes them volatile.

If you’re not taking the traditional day trading route of trading large position sizes to capitalize on small price movements, you’ll have to choose options that have the ability to move a lot – which makes them volatile.

And more volatility means more risk, which in turn means that you will be paid more for taking this risk.

In order to determine how volatile the stock is, you need to either use an online stock screener, calculate it manually or look at a chart showing it’s daily trading range for a week or a month. If it has a wide trading range with large swings, the stock is volatile.

After that, you need to choose your expiration date of when your option expires.

Now if a stock is volatile and you choose an expiration date that’s really close (IE ends at the end of the trading week) your options values will generally increase or decrease in response to these swings and the shorter time frame that the trade has to reverse and go in the opposite direction.

The key thing to keep in mind is to look at the value of the options Delta, which gives you a rough idea as to the odds of the option ending up “in the money” at the time of the options expiration date. (If this all seems “Greek” to you – sorry bad pun – then I suggest you read this book to get up to speed on the basics of trading options).

Once you’ve chosen a liquid security to trade, have decided on just how volatile it is in relation to how close the option expiration date and have considered the odds of the option ending in the money at expiration (checking the option’s Delta value), you’re ready to apply your trade strategy.

Now you can buy or sell your calls or puts!

Please note: that this is a lot of investigative leg work just to get to where you have a list of stocks, indexes or ETF’s that you can consider trading. But once you’ve done this a few times and have placed a few trades, you’ll come up with a list of securities that you like to trade. And then you won’t have to worry about doing this over and over, as most traders will gravitate towards a handful of stocks that they check for certain trade set ups and have a couple favorite strategies that they deploy based on what they feel will happen.

Don’t forget in all of this, that you need to have an idea of what direction the stock will take (if at all) so you can call the direction of the trade and set up the proper option trade. So you’ll have to be able to spot profitable stock trade setups, or use a scanner to do it automatically for you.

There are a few important things to know before trading options. And as you can see, there are a couple more things to consider than when compared to day trading stocks.

When you trade options, you’re employing more leverage to risk a little less and potentially win a lot more.

I’ve got to say that the effort’s worth the rewards.

For the options alert service I offer, I don’t do any sort of day trading. My team and I focus exclusively on swing trading. So if day trading is your thing, I would recommend you don’t sign up.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History