Selling put options can be a fantastic way to generate income.

There are so many ways to trade options. You can set things up to generate income weekly, monthly or on almost any time frame that you want.

Now, option expiration dates are limited to weekly or monthly options but you can always close a trade if needed.

If you’ve been following our articles, you know the trade alerts that I give out inside “The Empirical Collective” involves buying options.

We have plans to add more strategies for our members in the future, but for now we’ve focused on only buying calls or puts because:

- They are very simple trades to place.Even if people don’t have any past experience

- It doesn’t take a large account size to trade these sorts of options. Contrast that with selling options which require a larger initial deposit and for the account to be approved by your broker. If you are looking for a broker, I’d recommend using Questrade.

Now, as “The Minister of Capitalism” I don’t rule out any method or strategy to make money.

And for the record, I like selling options. But for the reasons I’ve listed above we haven’t added it as part of our service. But in an effort to serve our members better, I’m sure that will change in the future.

So, let’s look into some of the basics as to how you can begin selling put options for income.

Selling Put Options for Income

If you’ve read about this subject before, you’ve heard the “experts” say that buying options is for losers.

If you’ve read about this subject before, you’ve heard the “experts” say that buying options is for losers.

The stat they often throw around is that option sellers have a historical average of about a 75% success rate.

And I agree with them. In order to generate income virtually “on demand” the most reliable way to do that is to sell options.

But this is the advantage selling options has over buying options. You’re able to make more money as the option get closer to the expiration date. But if you buy options the stock has to move in the direction of your trade before you make money.

Selling puts flips this around. Rather than saying stocks will increase or decrease by a certain amount, you’re saying a stock won’t fall below a certain level.

Essentially you’re setting yourself up as the bank and renting out options to other traders when you sell options.

But beyond just collecting this rental income, there’s a really cool upside. This happens if the trade goes against you. (IE if the stock DOES drop in price beyond the point you specified).

Selling Put Options for a Living – Here We Go!

Ok so now that you’ve got a basic idea of what’s involved, let’s look into this further. (Of course, maybe the idea of trading options is still confusing for you. If so, I HIGHLY recommend you read this book here.)

As we’ve covered, by selling a put, you think the value of a stock won’t drop below a certain price. This price is defined by the strike price of the option you sell.

But if the price of the stock does drop below that strike, at that point you’re obligated to purchase the stock at the price of the put you sold.

Let’s look at an example to try and make this super clear.

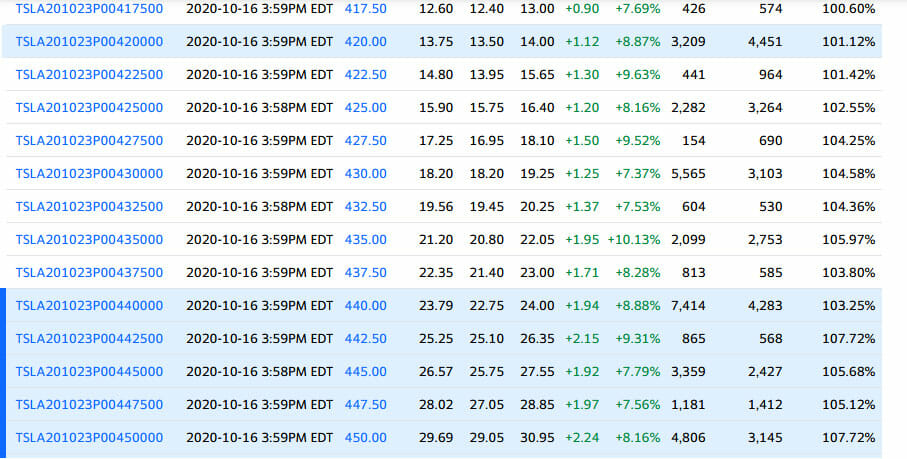

In the image below, I’ve pulled up the put options chain for Tesla. In this case, the expiration is less than 1 week away. So if you were trading this set of options you’d be trading the “weeklys”. If you don’t understand the image below, I suggest you read, “How to Read Options chains” here.

At the time of pulling this image, the price of Tesla was $439.67.

So from the above, you can see that the 440 puts and above are currently “in the money.” So if you were going to sell puts for income, you want to choose an out of the money strike.

In order to do this, you want to choose a level at which you would be happy to own the stock. That way if the trade goes against you and you have to buy the stock it’s a win-win situation.

What you want to do is look at a chart and choose a strike that’s been a level of resistance before.

With that in mind, let’s use assume the 420 strike is the place we want to place our trade.

To do this, we would sell the 420 strike puts and collect $1375 per contract in premium. (This is before brokerage fees and all that, of course).

The math is just $13.75 (I just used the “last” fill price shown between the Bid and Ask spread for this example) x 100 shares.

So if we sold 1 contract we would collect the $1375 in premium and if, at the end of the trading week (when the option expires as this is a weekly option expiration) the price of Tesla is above $420, we get to keep all the premium.

If it drops below $420, we would have to buy 100 shares of Tesla for $42000. (Of course, your broker may only require you to put up a percentage of that cost in your margin account. Good brokers like Questrade may only require 30-50% in order to cover your trade.)

But if you’re happy owning the stock at that level anyways, this can be a great way of generating income.

Before we wrap this up though, let me share with you a few things to keep in mind before placing the trade.

Trading Weekly Options for a Living

-

Choose stocks you think will increase or stay the same in value.

If you’re using the sale of weekly puts for income, you ultimately aren’t wanting to end up having to buy the stock. And if this is the case, you need to choose stocks that you think will increase in value so that your trade will be safe and you can keep all of the premium you collected when you placed the trade. If you don’t know how to find stocks that can increase in value, you can sign up for my email list above for a quick method to do that, or you can pick up this book on being able to spot positive stock patterns that indicate a stock will go higher.

-

Watch out for big announcements.

Have a quick look before you place the trade and see if there is any big news on the horizon that may negatively affect the stock. Some of these things can be earnings announcements, a huge downturn in the economy or industry (watch for different announcements by the FED) and so on.

-

Choose a strike you’d fine with owning the stock at. This is your worst case scenario – getting assigned the stock – if you’re just wanting to generate some income, but it’s a good idea to plan for it. So choose a strike that is a good trade-off between generating a good amount of income and a price you’d be happy owning the stock at.

-

Trade the weeklys.

Sure, you can choose virtually any combination of timeframe you choose, but as an option seller the closer the option you sell gets to its expiration date, the greater your odds will be of you being able to keep all of the premium you collected when you placed the trade. And this is a huge reason why if you’re selling put options for income, you choose to trade options that expire within a week.

-

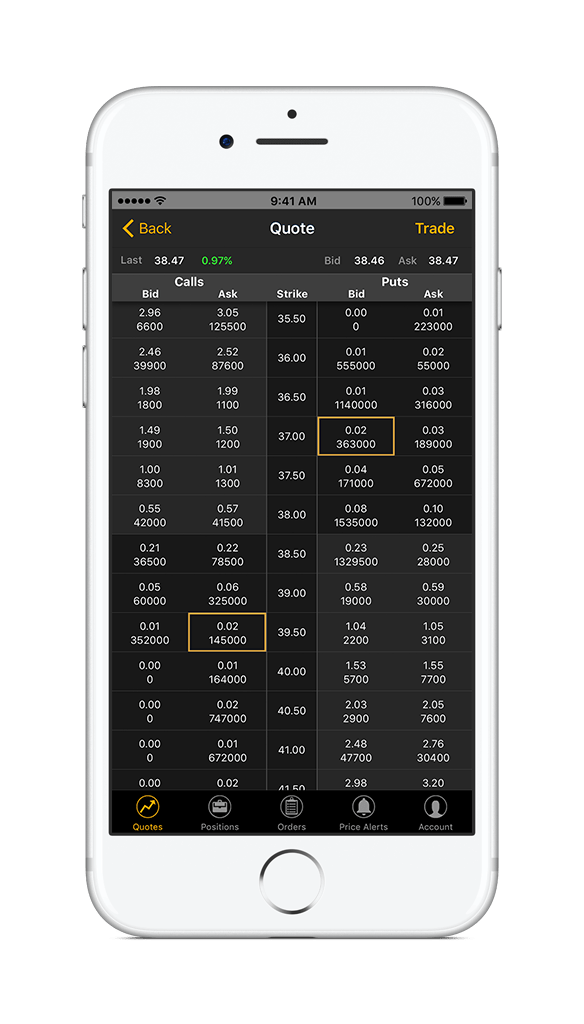

Only trade liquid stocks.

Don’t try to trade options on some weird, obscure stock that has a huge bid/ask spread in it’s stock price. You want to ensure that you have a large pool of both buyers and sellers to facilitate easy trading of the stock and options, and looking for stocks with a small bid/ask spread is a great indicator of that.

For me personally, I typically look to trade large blue-chip companies that issue dividends. And for the most part, this is because I generally want these sorts of companies added to my retirement portfolio account, so if I choose a good company I’m fine with holding for the long term and I get assigned the stock at my defined price, it’s not the end of the world because I’ve got a longer-term timeframe for that account.

Now, I wouldn’t be super happy if I was assigned stock and had a huge chunk of my active trading account tied up if a trade went against me.

So there you have it – a quick primer on selling put options for income.

If your head is spinning and you can’t figure this out (or if you can’t afford to open an account large enough to sell puts), you can always get involved and sign up for a membership in “The Empirical Collective” and trade along with our simple options buying alerts. You can get discounted access here.

If you’d like to do a little more research into finding the best options trading alert service please click to read our article – we’ve narrowed it down from quite a list of services that are currently on the market!

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market  The Biggest and Most Painful WallStreetBets Losses in Trading History

The Biggest and Most Painful WallStreetBets Losses in Trading History