Are you interested in learning how to make money on WallStreetBets? If so, this comprehensive guide is for you. In this guide, we will walk you through the ins and outs of this unique stock market trading website. We will cover a couple strategies that some traders use, and provide tips and tricks to help increase your odds of winning. So whether you are a first-time investor or a seasoned pro, read on for all the information you need to know about WallStreetBets!

What is WallStreetBets?

WallStreetBets is a subreddit (a niche forum on Reddit) where investors can discuss stocks and make bets on the direction of the market. The forum was created in 2007 by a group of friends who were interested in stock trading. WallStreetBets has grown in popularity over the years and now has over 12 million members.

Members of WallStreetBets can post their thoughts about stocks, make predictions about the market, and bet on the direction of the market. There is a section of the forum where members can post their “bets”, which are essentially predictions about the direction of a particular stock or the market as a whole. Members can also track their bets to see how they are doing.

WallStreetBets is not just for experienced investors – it is also a great place for beginners to learn about investing and stock trading.

What is the Difference Between WallStreetBets and Other Stock Trading Platforms?

WallStreetBets is a subreddit, or online forum, where participants discuss stock and options trading. The community is known for its colorful and profane jargon, aggressive trading strategies, harassment, and for playing a major role in the GameStop short squeeze that caused losses for some US firms and short sellers in a few days in early 2021.

Other stock trading platforms are typically more formal and do not allow for the same level of discussion or banter between users.

How Do You Make Money on WallStreetBets?

How Do You Make Money on WallStreetBets?

For the uninitiated, WallStreetBets (WSB) is a subreddit where members trade stocks and options with a high degree of risk in pursuit of high returns. These traders are often referred to as “degenerates” because of their willingness to take on huge risks in hopes of earning a big payday. Many members of WSB pride themselves on being “gamblers” rather than “investors,” and they tend to gravitate towards very volatile assets and use options to further leverage their trades.

So how do you make money on WallStreetBets? Well, there are a few different ways. The most popular method is simply buying and selling stocks or options in a company that the majority of these Redditors believe will go up or down in value. You can also earn profits by taking on leveraged positions or by selling “puts” and “calls.” Of course, with such high risks comes the potential for large losses, so it’s important to only invest money that you can afford to lose.

If you’re thinking about joining the ranks of the degenerates on WallStreetBets, just remember that it takes a lot of luck, skill, and guts to succeed. But if you’re willing to put in the work, you just might be able to walk away with some serious profits.

Some traders copy the trades that others are placing on WallStreetBets, while others try to get a general sense of where these Redditors feel certain stocks will go and then will use that as another indicator they use to find an entry point for a trade.

Others feel that the traders on WallStreetBets are just terrible, and if they see a big recommendation on WSB, they do the exact opposite (“inversing” the WSB recommendation).

To gauge the sentiment of WSB you’ll need to look through the most recent threads on the forum in order to figure out what the general consensus is. Or you could use a social sentiment tool that does it for you.

One of the best tools you can have in your arsenal is a social sentiment tool that tracks what stocks the members of Wallstreeet bets think will increase or decrease in value – like the one found at The Empirical Collective.

What is a Social Sentiment Tool?

A social sentiment tool is a piece of software that helps you to understand the overall mood of social media conversations. It does this by analyzing the text of posts and comments to look for positive, negative, or neutral sentiments. This can be useful for businesses who want to keep track of how their brand is being talked about online, or in this case, gauging what direction people think a stock will move. It can also be used to monitor large-scale events or trends to see how people are feeling about them.

In short, it’s a way to measure the social media buzz around a certain stock. And this can be extremely helpful in making buy or sell decisions on WallStreetBets.

There are many different social sentiment tools available, each with its own set of features and capabilities.

Most of them will just track Wallstreetbets and come up with the general sentiment of the subreddit.

The Empirical Collective, however, tracks a number of different subreddits and returns a list of stocks that the subreddit members think will increase or decrease in value.

So you have a specific list that tracks the sentiment of over 19 million other traders and lets you know what they think will happen.

Needless to say, this is a huge time saver.

What are the Risks of Trading on WallStreetBets?

The risks of trading on WallStreetBets are pretty clear. First and foremost, it’s important to remember that they make very volatile and risky trades. In other words, there’s a lot of speculation and guesswork going on, and it’s very easy to get caught up in the hype and make impulsive irrational decisions. This can lead to big losses, especially if you don’t have experience trading in this kind of environment.

Additionally, there’s also the risk that the stock prices being discussed on WallStreetBets are not accurate or representative of the real market conditions. This means that you could end up buying or selling stocks at prices that are vastly different from their actual value.

As with any kind of trading, it’s important to be aware of the risks before you get started. But if you’re prepared for the volatility and you have a solid strategy in place, trading on WallStreetBets can be a great way to make some quick profits.

What are Some Tips for Successful Trading on WallStreetBets?

What are Some Tips for Successful Trading on WallStreetBets?

WallStreetBets (WSB) is a website that offers users the opportunity to bet on the stock market. For those new to WSB, or stock market betting in general, here are a few tips to help you become successful and make money.

- Do your own research: This is perhaps the most important piece of advice. Before you make any trade, be sure to do your own due diligence. Read up on the company, the sector, and the overall market conditions.

- Be patient: Don’t try to make a quick buck. Trading is a marathon, not a sprint. patiently wait for the right opportunity to present itself.

- Have a plan: Before you enter any trade, know exactly what you want to achieve and how you plan on achieving it. Having a clear plan will help you to avoid impulsive decisions.

- Cut your losses: One of the most important rules in trading is to cut your losses short. If a trade isn’t going your way, don’t be afraid to exit early and take the loss. It’s better to lose a little bit of money than to lose everything.

- Protect your profits: Once you’ve made a profit, don’t let it all vanish by holding on to the trade for too long. Use stop-loss orders to protect your profits and take some money off the table.

By following these tips, you can greatly improve your chances of success in the stock market.

What Fees are Associated with Trading on WallStreetBets?

There are no trading fees associated with WallStreetBets, as you can sign up to be a member for free.

The only fees that you will incur trading are the ones you end up paying through your broker.

Are There Any Restrictions on Who can Trade on WallStreetBets?

There are no restrictions on who can trade on WallStreetBets. Anyone can join the community and start trading. All you need is an account with a broker that offers access to the stock market and the free account on WallStreetBets. There are no requirements or qualifications; anyone can join and start trading. So, if you’re interested in making some money and don’t mind taking on high risk, then WallStreetBets could be a great place for you.

Frequently Asked Questions

What does FD mean in Wall Street Bets?

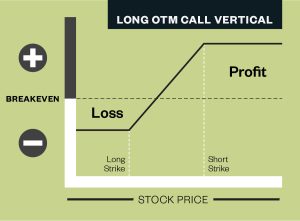

Wall Street slang for out-of-the-money options expiring within a week is FD. Their value is extremely low and they carry a high degree of risk for failure, but the small potential of a high return potential can cause the failure risk to be justified. A financial option that expires within the week gives the option to acquire 100 shares of stock.

Why do most retail investors who trade the stock market in the reddit community WallStreetBets lose money on this investing forum?

Is a new options trader better to start with robinhood or a different trading app?

In your experience, what is the best trading advice you can offer to limit a loss when trading?

There are a few things you can do to limit your losses when trading in the stock market. One is to only invest what you can afford to lose, and to have a plan for how you will respond if your investment loses value. You should also make sure you are well-informed about the stock you are investing in, and be aware of the risks involved. Finally, use stop losses to automatically sell a stock if it falls below a certain price.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  WallStreetBets Next Target : How to Find The Most Popular Stock They’re Talking About Today

WallStreetBets Next Target : How to Find The Most Popular Stock They’re Talking About Today  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market