The WallStreetBets subreddit is a community of individual investors who share stock trading tips and strategies. The subreddit has been in the news and is most well known for its role in the GameStop short squeeze and it’s infamous for huge wallstreetbets losses as well as huge wins on their subreddit.

The WallStreetBets subreddit is a community of individual investors who share stock trading tips and strategies. The subreddit has been in the news and is most well known for its role in the GameStop short squeeze and it’s infamous for huge wallstreetbets losses as well as huge wins on their subreddit.

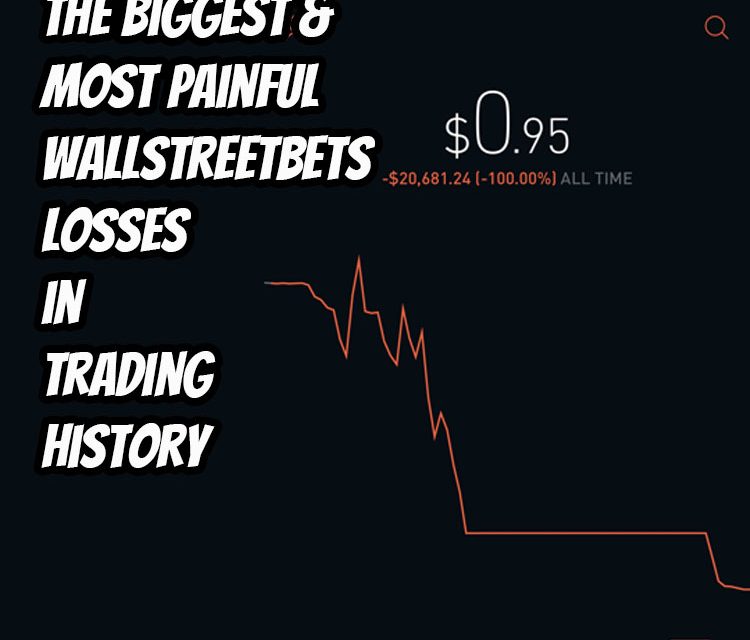

As mentioned, while the subreddit has been responsible for some big wins, it has also been responsible for some painful losses. In this article, we will take a look at some of the biggest and most painful WallStreetBets losses in trading history.

Of course, losses like these are to be expected, as the people on WSB are not professional traders & so they are not providing the best option trade alerts, like a company like The Empirical Collective is.

Of course, if you want to see what stock Wallstreetbets thinks will increase or decrease next, I recommend checking out WSBcheck.com because they keep track of the latest WSB predictions every hour.

Some people have even joked recently that the answer to the question how to make money on wallstreetbets is to do exactly the opposite (inverse) the recommendations they make.

The Wallstreetbets Losses – The Biggest & Funniest Trading Losses of the Community

#01 – User “HateMyDarnJob” Loses $45,398 of His Savings

It’s a tough pill to swallow when you realize you’ve lost a large sum of money. But for one user on an online forum WallStreetBets, it was an even tougher realization when he found out that he lost $45,398 of his savings trading wallstreetbets options.

His advice to other new traders, “This is for all the newbies who think it’s a get rich quick scheme from seeing the recent gains. Those people are literally 5-10 people out of 9 million of us. Not saying don’t trade options, just be careful. Also, I’m a full-on degenerate bastard. I bet 20-30-40k on combat sports at a time. Play with sh** you can lose, please. I hate to see posts with Lost my life savings and don’t know what to do.”

#02 – A Newbie Loses $59,905 On His First-day Trading Gamestop Options

If you’re thinking about investing in GameStop stock options or other types of options, it’s important to do your research and understand the risks involved.

A newbie trader lost $59,905 on his first-day trading GameStop options. On March 11 he posted, right at the peak of the second GameStop rally that he had $90 thousand worth of options that expire the next day. A rally this size raises the stock’s implied volatility. It indicates that the market has already factored in price changes of 100% for shares. It basically makes trading almost 100x more risky.

This is a cautionary tale for all those considering entering the world of online trading. While there are certainly opportunities to make money, there is also a high risk of losing everything – as this newbie trader found out the hard way.

#03 – An 18-year-old Kid Makes A $140k+ And Quickly Loses It

#03 – An 18-year-old Kid Makes A $140k+ And Quickly Loses It

An 18-year-old kid from WallStreetBets posted about making a $140k profit. He quickly lost it all and some people are calling him an idiot.

But with that said, many people are surprised that he was able to make that much money in the first place. Some think that he should have been more careful with his money.

Regardless of what people think, this just goes to show how risky investing can be. Many people have made and lost a lot of money in the stock market. This teenager is just one example.

#04 – Jack Loses $228,734 In A Month And Receives A Painful Letter From Fidelity Bank

Jack shared his story of how he lost over $200,000 in a single month of trading. In a post on the WallStreetBets subreddit, Jack detailed how he made a series of bad trades that resulted in him losing nearly all of his life savings. He even share in the post “Fidelity sent me a letter to let me know I’m retarded.“

#05 – A Trader Loses $400k+ In A Year And Blames Robinhood

This trader experienced his loss in November 2020, which means the S&P 500 rose over 50% over a six-month period before he lost almost half a million dollars.

He thought his trading application Robinhood was at fault.

But when you place losing trades over & over…. it’s ultimately your fault.

#06 – Funny Trader Loses $500k And Goes Bankrupt

#06 – Funny Trader Loses $500k And Goes Bankrupt

This trader bet his entire fortune on American Airlines, which was not a terrible choice if he had invested in actual stock instead of stock options, and waited until after the pandemic had passed.

Warren Buffett once mentioned that diversification may preserve wealth, but concentration builds wealth.

Evidently, this beginner trader was trying to build his wealth in a very short amount of time and ended up getting burned.

#07 – Trader Makes $5 Million From $35k And Then Loses 93% Of It After

This trader’s $35k mortgage invested in the GameStop option becomes $5.3 million, however, he didn’t cash it out!

And this is where it all went wrong wrong for him, as he kept trading and began losing until he only had $300k left from his $5 million winnings.

#08 – Trader Burns $1.1 Million In One Week Trade

A young trader with the username “MingBearPig27” burnt $1.1 million in just one week. The young man’s story is a cautionary tale for anyone thinking of trying their hand at day trading. While it is possible to make big profits in a short space of time, it is also very easy to lose everything just as quickly.

#09 – Trader Vows To Cut Off His D**k If Gamestop Closes Below $450 And It Does (Did He Do It??)

A trader has vowed to cut off his own D**k if Gamestop’s stock price falls below $450 that day. However after his post that day Gamestop’s stock price dropped below $450.

His post made a whole community laugh as they think losing $1 million in a week is not that painful at all.

#10 – 410k of losses over 8 months

#10 – 410k of losses over 8 months

This particular trader says his losses wiped out over 95% of his net worth and could very well cost him his marriage.

He outlines a series of trades that he made that went poorly, and ends it by cautioning others to never trade with money that they can’t afford to lose.

Good advice indeed.

Of course, if you want to see what stock the degenerates over at WallStreetBets think will go up or down, be sure to visit WSBcheck.com for their picks that are updated every hour.

Because while there have been some terrible wallstreetbets losses, they can also post huge gains!

Frequently Asked Questions

How can you identify the newbie trader?

In the investment world, there are certain telltale signs that indicate someone is new to trading. Here are a few ways you can identify the newbie trader: They tend to make emotionally-driven decisions rather than basing their trades on sound analysis and research. They may not be familiar with all the different types of orders available, and may only use market orders. They may not have a solid plan or strategy in place, and instead just wing it. New traders often don’t know how to manage risk correctly and as a result, they may take on too much risk. They may also be inclined to chase after hot stocks or follow the herd mentality instead of thinking for themselves.

What is meme stock?

A meme stock is a term used to describe a company that has seen a sudden and sustained increase in value due to the attention of online communities. The most notable recent example is GameStop, which saw its share price increase by more than 1,700% in January 2021 after being heavily discussed on Reddit forums.

What is the difference between trading stocks and put options?

The average person on the street probably doesn’t know the difference between trading stocks and put options. For the most part, they are two different things. When you trade stocks, you are buying a piece of a company that will be worth more or less in the future. When you trade put options, you are betting on the price of a stock going down. Put options are contracts that give the buyer the right to sell 100 shares of an underlying stock at a fixed price by a certain date. If the stock price falls below the strike price before expiration, then the option is in the money and it will be exercised. Stock trading is much more straightforward. You buy shares of a stock that you think will go up in value and sell them when it does. However, when the stock price drops, you can still lose money if you don't sell it before the stock price goes to zero.

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms

How to Paper Trade Options – Plus The 5 Best Free and Paid Trading Platforms  The Options Trading Mentor: Here’s How to Find the Best One for You

The Options Trading Mentor: Here’s How to Find the Best One for You  The Best Option Trading Success Stories from Average Traders Who Made Millions

The Best Option Trading Success Stories from Average Traders Who Made Millions  The Best Way to Learn Options Trading: A Guide for Beginners

The Best Way to Learn Options Trading: A Guide for Beginners  WallStreetBets Next Target : How to Find The Most Popular Stock They’re Talking About Today

WallStreetBets Next Target : How to Find The Most Popular Stock They’re Talking About Today  Here’s The Top WallStreetBets Sentiment Tool on The Market

Here’s The Top WallStreetBets Sentiment Tool on The Market